The syrup market is witnessing an upsurge in demand due to the wide usage of syrups in different food items. The market is largely driven by the increasing demand for syrups to be consumed with food products, especially convenience and ready-to-eat food. The flexibility in syrup formulation is an important factor that helps in boosting the use of the product as a taste enhancer and sweetener. Apart from sweet-flavored syrups, the market also has savory-flavored syrups, thus catering to the changing consumer preferences.

Syrups can be used with food and beverage items, further expanding their scope in the market. They can be used in diluted forms in different beverages like mocktails, cocktails, drinkable yogurt, and others. Among all the syrups, fruit syrup accounts for the largest share due to its wide usage in beverages. The market is driven by the demand for new flavors in beverages. However, one of the major challenges restraining the market is the presence of readily available substitutes, such as spreads.

Syrup Market Trends

Increasing Inclination Toward Organic/Natural Syrups

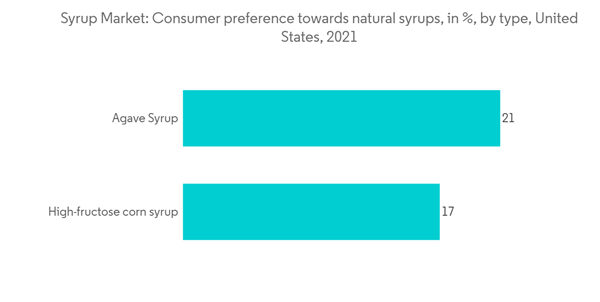

Increasingly, consumers are placing more value on food with functional benefits apart from taste, thereby increasing the demand for healthy, natural, and organic syrups. These organic food alternatives are positively impacting the market's growth.Due to increasing health awareness and concerns regarding food sources, consumers are continuously focusing on food labels and preferring products with healthy and clean-labeled ingredients. This increasing label-conscious population has paved the way for natural and organic syrup manufacturers to enter the market, especially in developed markets.

The demand for organic and flavored syrups is increasing among consumers, encouraging manufacturers to introduce new flavored organic syrups. For instance, in August 2022, Singing Dog Vanilla launched an organic vanilla syrup in the US market. The company claims that the vanilla organic syrup will add pure and complex flavor to tea, lattes, iced coffee, and other beverage products.

North America Holds a Prominent Share in the Market

North America leads the overall market for syrups of all kinds, with the United States and Canada holding the largest market share in the region. This high share is due to the high rate of production and consumption in the region and the export of syrups worldwide. The consumers in the region prefer to have a variety of breakfast options, supporting the high demand for flavored syrups.Consumers in the region prefer syrups with breakfast items and hot and cold beverages. Moreover, the increasing trend of using syrups as toppings in readily available snacking items has led to an upsurge in demand for syrups in the region.

Organic produce has been witnessing support among American consumers due to increasing concerns for well-being, health, and the environment. Thus, the North American market is leading innovation in organic syrups and natural sweeteners, with the United States and Canada at the forefront. Although organic products have fully entered mainstream channels and continue to gain traction with shoppers, the organic segment offers innovative opportunities across the market, which may drive growth during the forecast period. For instance, in May 2021, Nickel Dime Cocktail Syrups launched four new flavors of syrups in the US market. These syrups are prepared from natural ingredients and are alcohol- and gluten-free.

Syrup Industry Overview

The syrup market is highly competitive in nature, with a large number of domestic and multinational players competing for a sizeable market share. The market is fragmented with global players like Nestle SA, Conagra Brands Inc., The Hershey Company, The J.M. Smucker Company, and The Kraft Heinz Company.Additionally, companies are implementing common strategies like mergers, expansions, acquisitions, and partnerships with other companies to enhance their presence and boost the market. The key players in the market are extending their product lines, along with expanding their global presence and catering to different customer needs in different regions. For instance, in December 2021, Mrs. Butterworth, a company that prepares pancake syrups, collaborated with Post, a food manufacturer and distributor, and launched cereal-flavored pancake syrup. This Fruity Pebbles Flavored Pancake Syrup has the taste of Fruity Pebbles cereal, specially formulated to be consumed with waffles, porridge, and pancakes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Conagra Brands Inc.

- The Hershey Company

- The Kraft Heinz Company

- Sonoma Syrup Co.

- The Quaker Oats Company

- The J.M. Smucker Company

- Nestle SA

- Dr. Willmar Schwabe GmbH & Co. KG

- MONIN

- Amoretti