Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Smart Lighting Market refers to the industry focused on advanced lighting solutions that integrate digital technologies, sensors, wireless connectivity, and automation to enhance efficiency, user experience, and energy management across residential, commercial, industrial, and urban applications. Unlike conventional lighting systems, smart lighting enables remote control, customization of brightness and color, automation through motion or occupancy sensors, and integration with broader smart home or smart city ecosystems. The market is driven by the growing global emphasis on energy conservation, sustainability goals, and government initiatives promoting efficient lighting solutions as part of carbon reduction strategies.

The integration of Internet of Things, artificial intelligence, and cloud-based platforms is enabling enhanced functionalities such as predictive maintenance, real-time energy consumption monitoring, and personalized lighting environments, further boosting adoption. Urbanization and the rapid rise of smart city projects are creating significant demand for intelligent lighting infrastructure, particularly in outdoor and public spaces, where smart street lighting is becoming a cornerstone of sustainable urban development. Additionally, rising consumer awareness of energy costs, coupled with the increasing penetration of connected devices, is encouraging adoption in households and commercial establishments.

The market is also witnessing advancements in wireless communication protocols such as Zigbee, Bluetooth Low Energy, and Wi-Fi, which are making installations more seamless and cost-effective. Furthermore, leading companies are investing in research and development to enhance features like voice control integration, adaptive lighting, and compatibility with digital assistants, making smart lighting more user-friendly and accessible.

Key Market Drivers

Proliferation of Energy-Efficient Technologies

In the dynamic landscape of the Smart Lighting Market, the proliferation of energy-efficient technologies emerges as a cornerstone driver, propelling telecommunications and building operators to integrate advanced LED and sensor-based systems that optimize energy consumption while enhancing operational performance across residential, commercial, and industrial sectors. As global energy demands escalate, smart lighting solutions equipped with intelligent controls, such as occupancy sensors and daylight harvesting, enable significant reductions in electricity usage, aligning with corporate sustainability goals and regulatory compliance frameworks that emphasize carbon footprint minimization.This driver is amplified by the transition from traditional incandescent and fluorescent lighting to LED-based smart systems, which offer superior longevity and lower heat emission, thereby reducing maintenance costs and extending asset lifespans for businesses seeking long-term financial advantages. Enterprises are increasingly adopting these technologies to achieve energy management certifications, fostering a competitive edge through data-driven insights derived from integrated lighting platforms that monitor and adjust illumination in real-time. The economic incentives, including rebates and tax credits for energy-efficient upgrades, further accelerate market adoption, encouraging investments in scalable smart lighting infrastructures that support broader smart building ecosystems.

Moreover, the integration of artificial intelligence in smart lighting allows for predictive analytics, anticipating usage patterns to preemptively optimize energy flows, thus contributing to grid stability and reducing peak load demands on utilities. This technological evolution not only addresses environmental concerns but also unlocks new revenue streams for manufacturers and service providers through subscription-based lighting-as-a-service models that guarantee performance metrics. Regulatory bodies worldwide are mandating higher efficiency standards, compelling market players to innovate with adaptive lighting solutions that dynamically respond to environmental variables, enhancing user comfort while conserving resources.

The driver also influences supply chain dynamics, as component suppliers focus on eco-friendly materials and modular designs that facilitate easy upgrades, ensuring future-proof investments for end-users. In essence, the proliferation of energy-efficient technologies in the Smart Lighting Market reshapes industry paradigms, shifting from static illumination to intelligent, responsive systems that drive sustainable growth and economic resilience. This transformation is evident in how smart lighting contributes to net-zero ambitions, with deployments in large-scale projects demonstrating measurable ROI through energy audits and performance benchmarking. Furthermore, collaborations between technology firms and energy providers are fostering hybrid solutions that blend smart lighting with renewable energy sources, amplifying efficiency gains.

The market's trajectory is thus defined by a virtuous cycle where technological advancements spur regulatory support, which in turn accelerates adoption, solidifying the Smart Lighting Market's role in global energy transitions

The International Energy Agency indicates that global electricity consumption for lighting has declined by about 5% since peaking in 2010, despite expanded services, primarily due to LED adoption which is 75% more efficient than incandescent bulbs. The US Department of Energy projects continued improvements in LED efficacy through 2050, with current installations saving approximately 1.5 quadrillion BTUs annually, equating to USD15 billion in energy cost reductions. These statistics from international and government bodies underscore the push for smart lighting to further curtail energy use in buildings and infrastructure.

Key Market Challenges

High Initial Investment and Installation Costs

One of the most significant challenges faced by the smart lighting market is the high initial investment and installation costs, which continue to act as a barrier for widespread adoption. Smart lighting systems, which consist of sensors, connected bulbs, wireless communication modules, gateways, and integrated control platforms, require substantial upfront capital. In addition, the cost of replacing conventional lighting infrastructure with connected lighting fixtures often involves extensive retrofitting, cabling, and integration expenses. For many small- and medium-sized businesses, as well as residential customers in developing regions, these costs outweigh the long-term benefits of reduced electricity consumption and improved energy efficiency.Furthermore, professional installation is often necessary, which adds another layer of expenditure in terms of labor costs, maintenance contracts, and specialized technical services. Even though smart lighting solutions can provide cost savings over time through energy optimization and reduced operational costs, the payback period can be relatively long, which discourages budget-conscious consumers and businesses. Additionally, government subsidies and incentive programs are not uniformly available across global markets, further widening the affordability gap.

This makes adoption more concentrated in advanced economies while slowing penetration in price-sensitive regions. To overcome this challenge, companies must innovate to reduce manufacturing costs, create modular systems for phased upgrades, and encourage financing models such as leasing or energy savings-based contracts. Without addressing the cost barrier, the market risks limiting its reach primarily to premium segments, hindering the pace of overall growth.

Key Market Trends

Increasing Integration of Smart Lighting with Internet of Things Ecosystems

The smart lighting market is experiencing a significant trend in the increasing integration of smart lighting systems with Internet of Things ecosystems, reshaping how residential, commercial, and industrial environments function. As businesses and consumers adopt connected devices at an accelerated pace, the demand for seamless interaction between smart lighting systems and broader Internet of Things platforms is growing rapidly. This integration allows lighting solutions to go beyond simple illumination and instead function as intelligent components within connected ecosystems, enabling real-time monitoring, automation, and enhanced energy management.For instance, smart lighting systems connected with Internet of Things-enabled sensors can automatically adjust brightness and color temperature in response to occupancy levels, daylight availability, and even user behavior patterns. In commercial settings, this creates not only energy efficiency but also productivity gains by optimizing lighting environments to improve comfort and employee performance. Additionally, municipalities worldwide are adopting Internet of Things-enabled smart street lighting to improve energy savings, enhance public safety, and facilitate smart city initiatives by integrating lighting infrastructure with traffic, weather, and environmental sensors.

The ongoing trend of interoperability is further driving this integration, as manufacturers are increasingly ensuring compatibility with leading Internet of Things platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit. This convergence of technologies is encouraging widespread adoption, as consumers and enterprises seek unified systems that are easy to operate, scalable, and capable of providing value-added services. As Internet of Things ecosystems evolve, the role of smart lighting as a foundational element of connected environments is expected to expand, establishing it as a key enabler of smart homes, smart offices, and smart cities, thereby contributing significantly to the future growth of the smart lighting market.

Key Market Players

- Signify N.V. (formerly Philips Lighting)

- Acuity Brands, Inc.

- Osram Licht AG (now part of ams OSRAM)

- Hubbell Incorporated

- Cree Lighting (a brand of IDEAL Industries, Inc.)

- Eaton Corporation plc

- Zumtobel Group AG

- General Electric Company (GE Lighting, now part of Savant Systems Inc.)

- Lutron Electronics Co., Inc.

- Honeywell International Inc.

Report Scope:

In this report, the Global Smart Lighting Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Smart Lighting Market, By Offering:

- Hardware

- Software

- Services

Smart Lighting Market, By Installation Type:

- New Installation

- Retrofit Installation

Smart Lighting Market, By End-User:

- Residential

- Commercial

- Industrial

- Public Infrastructure

Smart Lighting Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Smart Lighting Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Signify N.V. (formerly Philips Lighting)

- Acuity Brands, Inc.

- Osram Licht AG (now part of ams OSRAM)

- Hubbell Incorporated

- Cree Lighting (a brand of IDEAL Industries, Inc.)

- Eaton Corporation plc

- Zumtobel Group AG

- General Electric Company (GE Lighting, now part of Savant Systems Inc.)

- Lutron Electronics Co., Inc.

- Honeywell International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

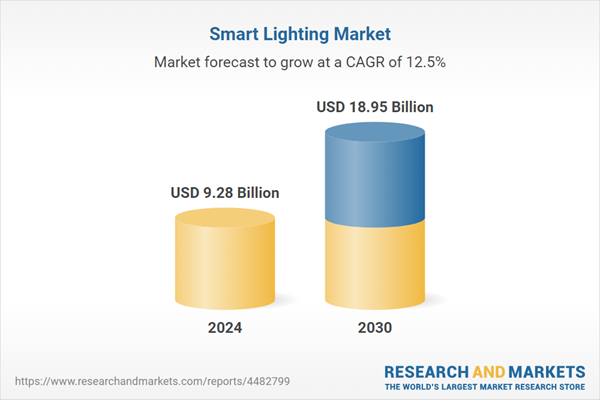

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.28 Billion |

| Forecasted Market Value ( USD | $ 18.95 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |