Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive drivers, the market faces substantial obstacles, particularly regarding the complexity of integrating fragmented data sources while upholding rigorous security and privacy standards. Cultural resistance to new technologies and high implementation costs frequently hinder the adoption of these tools within traditional legal environments. Furthermore, the absence of standardized data formats across various jurisdictions makes aggregating data for accurate predictive modeling difficult. This lack of uniformity can restrict the scalability of analytics solutions, particularly for smaller legal practices attempting to leverage these insights.

Market Drivers

Rapid developments in Artificial Intelligence (AI) and Natural Language Processing (NLP) are transforming the Global Legal Analytics Market by evolving systems from basic keyword searches to advanced semantic analysis. These technologies empower legal professionals to detect patterns in judicial rulings and forecast litigation results with high precision, fostering the creation of sophisticated analytics platforms. This shift toward intelligent solutions is reflected in investment data; a February 2025 Crunchbase News report, 'Legal Tech Startup Investment Is Riding High,' notes that roughly 79% of legal startup funding since 2024 has gone to companies utilizing AI. This significant capital influx emphasizes the pivotal role AI plays in converting descriptive data summaries into prescriptive strategic tools.Concurrently, the drive to maximize operational efficiency and optimize legal spending is pushing law firms and corporate departments to implement analytics for resource management. In a market where clients increasingly expect value-based billing, analytics tools offer essential visibility into time allocation and case costs to minimize waste. The Law Society's December 2024 report, 'Key trends shaping the legal industry in 2025,' indicates that 43% of solicitors have seen improvements in work quality and productivity due to AI adoption. This push for optimization is further validated by financial metrics, with Artificial Lawyer reporting in 2025 that legal tech funding surpassed $5 billion in 2024, highlighting the industry's commitment to data-driven efficiency.

Market Challenges

Cultural resistance to adopting new technologies poses a major barrier to the Global Legal Analytics Market, effectively limiting entry for advanced digital solutions. The legal profession, rooted in precedent and risk aversion, maintains a traditional skepticism toward algorithmic methods that lack transparency. This ingrained caution leads to extended evaluation periods and a reluctance to replace established manual review processes with automated alternatives. Consequently, vendors face prolonged sales cycles and reduced conversion rates, as decision-makers hesitate to trust predictive models for high-stakes litigation or compliance tasks where human oversight is traditionally deemed essential.This hesitation is reinforced by quantitative data regarding trust in technology. In 2024, the American Bar Association reported that 74.7% of surveyed legal professionals cited the accuracy of technology-generated outputs as their primary concern with new analytics tools. This high degree of skepticism restricts market scalability, as firms are unlikely to deploy these solutions across broad practice areas without absolute assurance of their reliability. The gap between technological capability and user trust limits the potential revenue for analytics providers, slowing overall market growth despite the clear operational efficiencies these tools provide.

Market Trends

The incorporation of Generative AI for automated legal reasoning is reshaping the market, moving tools from passive information retrieval to active content generation and logical deduction. Beyond identifying patterns in past litigation, these advanced systems can now draft legal briefs, summarize depositions, and construct initial arguments, thereby enhancing the cognitive capacity of practitioners. This trend is rapidly gaining traction in the industry's upper tiers, particularly within large practices needing scalable solutions; the Clio '2025 Legal Trends Report' from October 2025 notes that 87% of legal professionals in large firms now utilize AI tools, highlighting a strong reliance on automated reasoning for complex mandates.At the same time, the convergence of Contract Lifecycle Management (CLM) with data analytics is treating contracts as dynamic data assets rather than static documents. This shift drives the creation of platforms that manage drafting while actively mining contract portfolios for revenue leakage, obligation tracking, and risk exposure. By embedding analytics into the lifecycle workflow, organizations can automate compliance monitoring and clause extraction, significantly easing the administrative load on legal teams. As reported by Legal Support World in their November 2025 article 'Emerging Trends in Contract Management 2025,' AI-powered contract analytics are expected to cut manual review effort by 50%, validating the impact of these integrated systems.

Key Players Profiled in the Legal Analytics Market

- Wolters Kluwer NV

- Microsoft Corporation

- Thomson Reuters Corporation

- UnitedLex Corporation

- Mindcrest Inc.

- RELX PLC

- Wipro Limited

- Abacus Data Systems, Inc.

- Clarivate Analytics PLC

- IBM Corporation

Report Scope

In this report, the Global Legal Analytics Market has been segmented into the following categories:Legal Analytics Market, by Analytics:

- Predictive

- Prescriptive

- Descriptive

Legal Analytics Market, by Deployment Type:

- On-cloud

- On-premises

Legal Analytics Market, by Case Type:

- Commercial Case Management

- Antitrust Management

- Intellectual Property Management

- Others

Legal Analytics Market, by End User:

- Legal Firms

- Corporate

- Government Entities

- Others

Legal Analytics Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Legal Analytics Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Legal Analytics market report include:- Wolters Kluwer NV

- Microsoft Corporation

- Thomson Reuters Corporation

- UnitedLex Corporation

- Mindcrest Inc.

- RELX PLC

- Wipro Limited

- Abacus Data Systems, Inc.

- Clarivate Analytics PLC

- IBM Corporation

Table Information

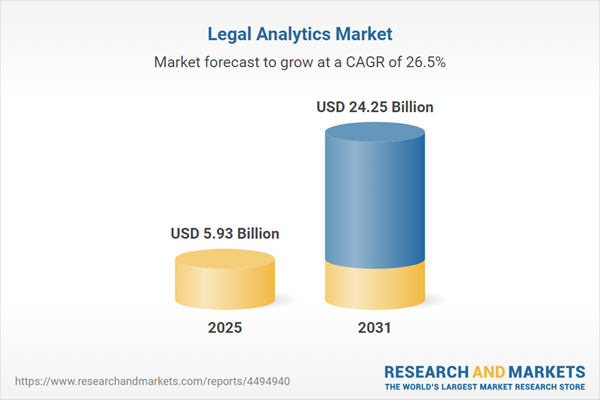

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 5.93 Billion |

| Forecasted Market Value ( USD | $ 24.25 Billion |

| Compound Annual Growth Rate | 26.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |