Key Participants in the Market Include AkzoNobel, Sherwin Williams, Asian Paints Ltd, Kansai Paints, and Nippon Paints

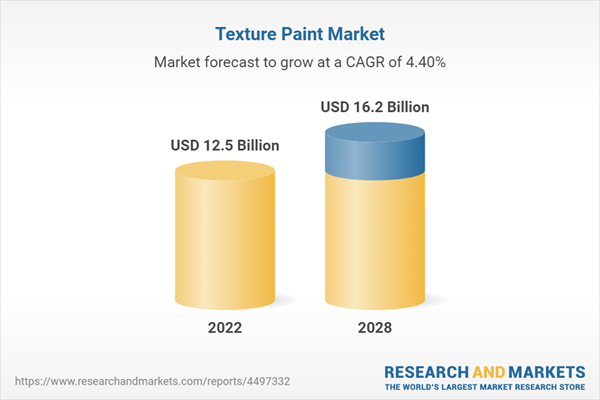

The texture paint market size is projected to reach USD 16.2 billion by 2028 at a CAGR of 4.4% from USD 12.5 billion in 2022. The water-based, by technology type segment is estimated to account for the largest share of the texture paint market in 2022.

Water-based technology is estimated to register the highest CAGR during the forecast period.

Stringent environmental regulations and increased awareness of the harmful effects of volatile organic compounds (VOCs) have driven the demand for water-based texture paint. Water-based formulations have lower VOC content compared to solvent-based alternatives, making them a more sustainable and environmentally friendly choice. Water-based texture paint offers ease of application and cleanup compared to solvent-based alternatives. It can be applied using standard painting tools and techniques, and it can be cleaned with water, eliminating the need for harsh chemicals or solvents. This convenience attracts both professionals and DIY enthusiasts, contributing to the market growth.

The North American texture paint market is expected to account for the second largest share in 2022.

North America has seen a steady demand for texture paint, driven by residential and commercial construction, as well as the renovation and remodeling sectors. The market has been influenced by factors such as the growing preference for textured finishes, the need for surface protection, and the desire to hide imperfections. Additionally, the increasing focus on sustainable and eco-friendly products has also played a role in shaping the texture paint market in North America.

China's texture paint market is projected to account for the largest share in 2022.

China's growing construction sector, urbanization, and rising disposable income have all contributed to the country's texture paint market's expansion. The need for aesthetically pleasing and unique finishes in both residential and commercial environments drives the market for texture paint. Furthermore, the Chinese government's efforts to improve environmental regulations and encourage sustainable building practises have had an impact on the industry, with a greater emphasis on eco-friendly texture paint compositions.

The break-up of the profile of primary participants in the texture paint market:

- By Company Type: Tier 1 - 39%, Tier 2 - 34%, and Tier 3 - 27%

- By Designation: C Level - 30%, D Level - 30%, and Others - 40%

- By Region: North America - 20%, Asia Pacific- 40%, Europe - 20%, Middle East & Africa - 10%, and South America - 10%

Prominent companies include The Sherwin-Williams Company (US), PPG Industries, Inc (US), AkzoNobel N.V. (The Netherlands), Asian Paints Limited (India), Kansai Paint Co., Ltd (Japan), Nippon Paint Holding Co., Ltd (Japan), Axalta Coating Systems LLC (US), and others.

Research Coverage:

This research report provides detailed segmentation of the texture paint market by resin type (acrylic, and epoxy), by technology (water based, and solvent based), by product type (Interior, and Exterior), by application (residential, and non-residential) and region (North America, Europe, Asia Pacific, the Middle East & Africa, and South America). The report covers detailed information about the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the texture paint market. A thorough analysis of the major industry players has been conducted to provide insights into their business overview, products, finances; key strategies;. new product launches, mergers and acquisitions, and significant changes affecting the texture paint market. In order to better position their companies and develop effective go to market strategies, stakeholder will benefit from the competitive landscape and gain additional insight from this report.

The report provides insights on the following pointers:

- Analysis of key drivers (Booming construction industry), restraints (High price of texture paint as compared to that of conventional paint), opportunity (Superior properties of texture paints) and challenges (Texture paint increases the thickness of the wall).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the texture paint market

- Market Development: Comprehensive information about lucrative markets - the report analyses the texture paint market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the texture paint market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like The Sherwin-Williams Company (US), PPG Industries, Inc (US), AkzoNobel N.V. (The Netherlands), Asian Paints Limited (India), Kansai Paint Co., Ltd (Japan), Nippon Paint Holding Co., Ltd (Japan), Axalta Coating Systems LLC (US), and others. The report also helps stakeholders understand the pulse of the texture paint market and provides them information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

Companies Mentioned

- Akzonobel N.V.

- Andura Coatings

- Anvil Paints & Coatings

- Asian Paints Limited

- Axalta Coating Systems

- Berger Paints

- Crown Paints Limited.

- Dunn-Edwards

- Haymes Paints

- Hempel Group

- Jiangmen City Crystone Paint Co., Ltd.

- Jotun A/S

- Kansai Paint Company Limited

- Kelly Moore Paints

- Nippon Paints Holdings Co., Ltd.

- PPG Industries, Inc

- Retina Paints Pvt. Ltd.

- Saekyung Jolypate Co Ltd

- Sirca Paints India Limited

- SK Kaken Co., Ltd.

- Spectrum Paints Limited

- The Sherwin-Williams Company

- Tikkurila OYJ

- Tnemec Co. Inc.

- Ultratech Texture Paints Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | May 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 12.5 Billion |

| Forecasted Market Value ( USD | $ 16.2 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Asia Pacific, Europe, Global, North America |

| No. of Companies Mentioned | 25 |