Vision care refers to a comprehensive range of practices and services aimed at maintaining and improving the health of the eyes and ensuring optimal vision. It includes preventive measures, diagnostic procedures, and treatments for various eye-related conditions. Regular eye examinations are essential in vision care, as they allow early detection of issues such as refractive errors including nearsightedness, farsightedness, astigmatism, and eye diseases such as glaucoma, cataracts, and macular degeneration. It helps determine the need for corrective eyewear or other interventions. Additionally, it promotes eye safety and hygiene, particularly in work and recreational settings where eye strain or injuries are possible.

The market is primarily driven by the prevalence of visual impairments and eye-related disorders. In addition, the growing geriatric population, the increasing screen time due to digitalization, and the changing lifestyles of individuals are contributing to the market growth. Moreover, several advancements in medical technology led to innovative treatments and solutions for numerous eye conditions, fostering a sense of optimism among individuals seeking improved visual health which represents another major growth-inducing factor. Also, the growing consumer willingness to invest in high-quality eyewear, contact lenses, and surgical interventions is propelling the market forward. Besides this, the growing awareness and proactive approach toward maintaining good vision, preventive measures, including regular eye check-ups and the adoption of protective eyewear are gaining traction, thus accelerating the sales demand. Furthermore, eyewear is evolving from being solely a corrective tool to a fashionable accessory, influencing consumer choices and driving the market growth.

Vision Care Market Trends/Drivers:

The easy access to healthcare services

The increasing improvement in healthcare services in the vision care market is influencing the market growth. In addition, governments and healthcare organizations are enhancing access to vision care services with numerous initiatives such as establishing vision care clinics in remote and underserved areas, conducting eye health awareness campaigns, and integrating eye care services into primary healthcare systems, thus contributing to the market growth. Moreover, the integration of telemedicine and online consultation platforms has made it possible for individuals to seek professional advice from ophthalmologists and optometrists without the need for physical appointments representing another major growth-inducing factor. This digital transformation in healthcare is benefitting individuals who face geographical barriers or mobility challenges. Besides this, collaborations between non-governmental organizations (NGOs), private healthcare providers, and international agencies are resulting in community-based eye care programs focusing on early detection and treatment of common vision problems, thus preventing avoidable vision impairments, which is propelling the market growth.The growing awareness regarding the importance of eye health

The importance of eye health with the rising awareness campaigns is compelling individuals to prioritize their visual well-being. These campaigns are essential in educating individuals about the significance of regular eye check-ups, early detection of eye conditions, and adopting healthy practices to maintain optimal eye health. In addition, awareness campaigns are reaching audiences through various channels, including social media, traditional media outlets, community events, and educational programs thus contributing to the market growth. Also, the educational campaigns provide information about common eye conditions such as myopia, astigmatism, and age-related macular degeneration, while highlighting the potential risks associated with prolonged screen time and inadequate protective measures thus augmenting the market growth. Moreover, individuals are now inclined to schedule regular eye examinations, and early detection of eye conditions allows for timely interventions, minimizing the risk of vision loss and preserving visual acuity which represents another major growth-inducing factor. Furthermore, these campaigns emphasize the importance of ultraviolet (UV) protection for the eyes, fostering the use of sunglasses and other protective eyewear.The emerging technological advancements

The market is witnessing a rapid influx of technological advancements that are transforming the field of eye care. These innovations include various aspects of vision correction, eyeglass frames, contact lenses, and lens materials, contributing to enhanced visual experiences and improved eye health. Moreover, the development of advanced materials that offer greater comfort, breathability, and longer wear times represents another major growth-inducing factor. For instance, silicon hydrogel lenses allow for increased oxygen permeability, reducing the risk of eye dryness and irritation. Along with this, the integration of smart technologies into contact lenses holds the potential to monitor intraocular pressure and provide real-time data for individuals with conditions such as glaucoma, thus augmenting the market growth. Besides this, eyeglass frames are undergoing remarkable advancements, combining style with functionality with lightweight and durable materials, such as titanium and memory metals, to offer comfort and longevity are propelling the market growth. Furthermore, three-dimensional (3D) printing technology allows the creation of customizable frames catering to individual preferences and facial structures, thus creating a positive market outlook.Vision Care Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global vision care market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type and distribution channel.Breakup by Product Type:

- Glass Lenses

- Contact Lenses

- Intraocular Lenses

- Contact Solutions

- LASIK Equipment

- Artificial Tears

Glass lenses represents the most popular product type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes glass lenses, contact lenses, intraocular lenses, contact solutions, LASIK equipment, and artificial tears. According to the report, glass lenses accounted for the largest market share.Glass lenses also known as eyeglasses or spectacles are driven by the traditional and widely used vision correction solution. They offer various designs and coatings to address refractive errors like myopia, hyperopia, and astigmatism due to their durability, scratch resistance, and affordability to individuals seeking reliable and cost-effective visual correction. Additionally, glass lenses offer excellent ultraviolet (UV) protection, shielding the eyes from harmful ultraviolet rays which enhances eye health, thus contributing to the market growth.

Besides this, contact lenses are available in numerous types, including soft, rigid gas permeable (RGP), and specialty lenses. It addresses numerous refractive errors and conditions, including myopia, hyperopia, astigmatism, and presbyopia. Along with this, intraocular lenses are primarily used in cataract surgery to replace the eye's natural lens which are artificial lenses implanted to restore clear vision after cataract removal. Furthermore, artificial tears are lubricating eye drops used to alleviate dryness, discomfort, and irritation in the eyes which are beneficial for individuals with dry eye syndrome, which can result from environmental conditions, aging, and prolonged screen time.

Breakup by Distribution Channel:

- Retail Stores

- Online Stores

- Clinics

- Hospitals

Retail stores presently accounts for the largest market share

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes retail stores, online stores, clinics, and hospitals. According to the report, retail stores accounted for the largest market share.Retail stores offer unparalleled accessibility to consumers seeking vision care products. In addition, these stores are strategically positioned in urban and rural locales, ensuring easy availability for a numerous clientele. It facilitates convenience and enhances the brand's visibility, fostering trust and familiarity among consumers.

Moreover, retail stores provide a tactile and immersive shopping experience, allowing customers to interact directly with products which are essential in the vision care sector. Also, consumers can examine eyewear, try on frames, and consult knowledgeable staff, thereby making informed decisions that align with their optical needs and preferences thus contributing to the market growth.

Furthermore, the comprehensive nature of retail stores engenders a one-stop solution for all vision care requirements. These establishments include various eyeglasses, contact lenses, and accessories under a single roof which simplifies the shopping journey and resonates with consumers seeking convenience and variety.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America market is driven by the growing healthcare infrastructure, characterized by advanced medical facilities and cutting-edge technologies. In addition, the increasing eye care centers, equipped with state-of-the-art diagnostic tools and treatment options are contributing to exceptional patient care.

Moreover, the growing emphasis on research and innovation is essential resulting in collaborations between renowned medical institutions, optometry schools, and pharmaceutical companies yielding groundbreaking advancements in ocular health.

Besides this, consumers are willing to invest in premium eye care services and products, and the increasing public awareness campaigns and government support for preventive eye care initiatives are fostering a culture of proactive ocular health management to ensure sustained demand for vision care services, thus accelerating market growth.

Competitive Landscape:

At present, key players in the market are strategically implementing various measures to strengthen their positions and remain competitive in a rapidly evolving industry. These efforts encompass innovation, expansion, strategic partnerships, and a focus on customer-centric approaches. Additionally, companies are investing in research and development (R&D) to introduce innovative products that address emerging trends and consumer needs including advanced contact lens materials, lens coatings, and design options to enhance comfort, visual clarity, and eye health. Moreover, they are embracing digital platforms and e-commerce channels to engage with customers directly and provide convenient purchasing options. Online platforms allow customers to order contact lenses, eyeglasses, and related products with ease. Also, digital tools are used to offer virtual try-on experiences, aiding customers in selecting frames and lenses that suit their preferences. Furthermore, key players are focusing on providing personalized solutions by offering customization options for eyewear and contact lenses which allows customers to choose frame styles, lens coatings, and prescription options that cater to their individual preferences and needs.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Johnson & Johnson Services, Inc.

- CooperVision, Inc. (Cooper Companies, Inc.)

- Bausch Health Companies, Inc.

- Essilor International

- Novartis International AG

Key Questions Answered in This Report

1. What is vision care?2. How big is the global vision care market?

3. What is the expected growth rate of the global vision care market during 2025-2033?

4. What are the key factors driving the global vision care market?

5. What is the leading segment of the global vision care market based on product type?

6. What is the leading segment of the global vision care market based on distribution channel?

7. What are the key regions in the global vision care market?

8. Who are the key players/companies in the global vision care market?

Table of Contents

Companies Mentioned

- Johnson & Johnson Services Inc.

- CooperVision Inc. (Cooper Companies Inc.)

- Bausch Health Companies Inc.

- Essilor International

- Novartis International AG

Table Information

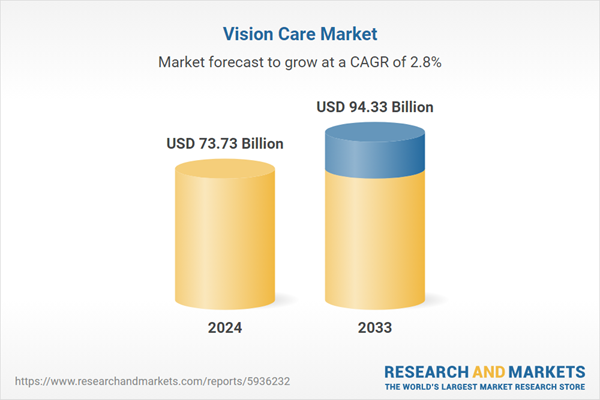

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 73.73 Billion |

| Forecasted Market Value ( USD | $ 94.33 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |