Key Highlights

- The sudden eruption of the COVID-19 pandemic had a major impact on Asian supply chains, which grew into global production centers. Due to reduced demand, supply capacity, and transport capacity, the supply chains became difficult to maintain. However, Cambodia's freight and logistics sector remained surprisingly strong, returning to near pre-pandemic levels after a series of COVID-19 slowdowns effectively brought market activity to a halt.

- Located in South-East Asia, Cambodia is one of the fastest developing countries in Asia, with an average GDP growth rate of around 7% over the past decade. The economic boom, combined with a growing population, has resulted in increased pressure on the country’s transport infrastructure.

- In order to facilitate the development of transport infrastructure, the Government of Cambodia and its development partners prepared a “Logistics System Improvement Master Plan” in 2018 to improve the logistics system and implement priority projects identified for realizing sustainable economic growth.

- Cambodia currently has four drivers of growth: agriculture, tourism, manufacturing (mainly garments for export), and commercial and residential construction. Expansion and diversification of Cambodia’s drivers of growth, especially agriculture, are important development objectives for the government.

- Efficient transport is critical for the growth of those sectors. The agriculture sector relies on road and maritime transport for exports, the tourism sector relies on international air carriers and road transport, manufacturing relies on road and water transport to deliver the materials needed and to export finished products, and the construction sector relies on water and road transport to deliver materials. So, to maintain economic growth, the transportation sector needs to be developed and maintained.

- Shipping costs, especially to remote markets such as Europe and the United States, remain high, fueled by a constant shortage of containers that have proven particularly troublesome for farmers.

- According to the Cambodian Logistics Association, shipping costs from Cambodia to international markets range from 10% to 20% of the set price. Congestion at some international ports further reduced shipments.

- Shipping costs to the US and Europe per container rose from about USD 2,000 to USD 5,000 before the outbreak and from USD 8,000 to USD 10,000 during the COVID-19 crisis and rising fuel prices. Special shipping prices can go as high as USD 15,000 for a single container.

- Rail freight and passenger transport is recognized as a potential driver of economic growth and employment opportunities, as well as attracting inbound foreign investment. Export-oriented companies have driven Cambodia's strong economic growth.

- The regional and Global value logistics sector is at the center of the country's development strategy as it is increasingly integrated into the chain. The World Bank estimates that by 2030, Cambodian businesses are expected to transport four times as many goods via highways, ports, airports, and warehouses.

Cambodia Freight & Logistics Market Trends

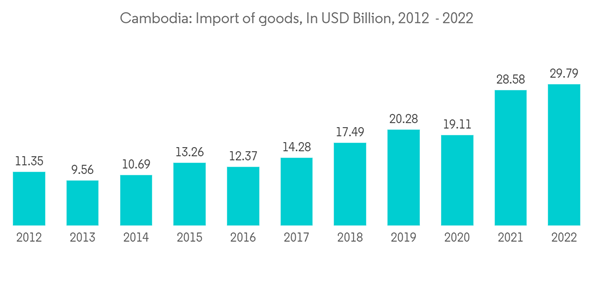

Surge in import and exports boosting the logistics market

In 2021, Cambodia was the number 101 economy in the world in terms of GDP, 69 in total exports, 61 in total imports, 149 in the economy in terms of GDP per capita, and 92 in the list of most complex economies according to the Economic Complexity Index (ECI).Textile industries play an important role in the growth of Cambodia’s economy. It is easier for Cambodia to produce good quality and cheaper textiles compared to some other countries due to the abundance of cheap labor, natural resources, and government support.

Cambodia largely imports the raw materials for finished textiles from China and exports the final products to many other countries.

The top exports of Cambodia were Knit Sweaters (USD 2.47 Bn), Trunks and Cases (USD 2.04 Bn), Knit Women's Suits (USD 1.84 Bn), Non-Knit Women's Suits (USD 1.52 Bn), and Leather Footwear (USD 933 Mn), exporting mostly to United States (USD 9.59 Bn), China (USD 1.94 Bn), Germany (USD 1.89 Bn), Vietnam (USD 1.88 Bn), and Japan (USD 1.74 Bn). In 2021, Cambodia was the world's biggest exporter of Tanned Furskins (USD 471 Mn).

The top imports of Cambodia are Gold (USD 10.9 Bn), Refined Petroleum (USD 2.71 Bn), Light Rubberized Knitted Fabric (USD 2.66 Bn), Bi-Wheel Vehicle Parts (USD 611 Mn), and Cars (USD 578 Mn), importing mostly from China (USD 11.3 Bn), Singapore (USD 11.2 Bn), Thailand (USD 6.69 Bn), Vietnam (USD 4.91 Bn), and Hong Kong (USD 955 Mn).

In 2021, Cambodia was the world's biggest importer of Raw Furskins (USD 377 Mn), Military Weapons (USD 139 Mn), and Leather Sheets (USD 80.4 Mn).

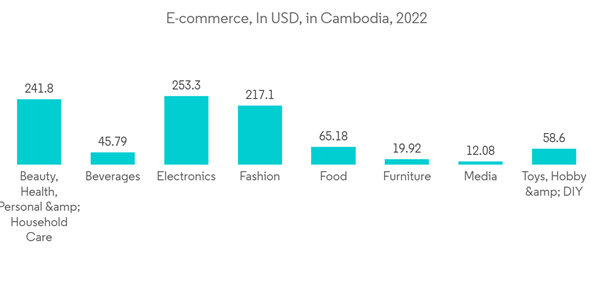

Growth in e-commerce

The rapidly developing e-commerce movement in Cambodia is shaping up to be an exhilarating game-changer. Online shopping has quickly become a significant part of life in the Kingdom, creating an array of opportunities for small to medium-sized businesses.The swift rise of e-commerce has introduced a new lifestyle for many in Cambodia, altering their shopping habits. Once primarily a trend in the capital, it’s anticipated to spread across the nation.

One of the most significant advantages of online shopping is the convenience it offers – from comparing prices and product features to a diverse range of products often available at better prices than physical stores. The diversity of payment options, including credit cards, debit cards, money transfers, and digital wallets, combined with convenient and cost-effective delivery options, have significantly boosted the appeal of online shopping.

The rise of digital platforms is dramatically altering the way Cambodia’s small and medium-sized enterprises (SMEs) interact with customers. With a virtual presence, these businesses can attract customers far beyond their local neighborhoods.

The government’s role in bolstering e-commerce has been notable, with the Ministry of Commerce undertaking key initiatives to enhance knowledge and capacity. The government is trying to enrich the local e-commerce ecosystem and assist local SMEs in leveraging e-commerce and digital trade with the help of the Go4eCAM project.

Cambodia Freight & Logistics Industry Overview

The competition in the logistics industry in Cambodia is highly fragmented with the presence of both domestic as well as international logistics companies in the country. Cambodia's local logistics providers offer domestic services, with a limited service range and low-to-average quality of service, barring a few providers who are market leaders.With the economic boom and transport infrastructure development, the business opportunities for Logistics providers are also improving. Some of the existing major players in the market include – Sihanoukville Autonomous Port, Phnom Penh Autonomous Port, Damco Ltd, CBG Logistics, Nippon Express, DB Schenker, UPS, DHL, CEVA Logistics, Yusen Logistics, XPO Logistics, Naniwa Transport, Sinotrans, Bright Star Logistics Service Providers, Kuehne + Nagel Ltd., FedEx and VTS (Cambodia) Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.