.

Due to the COVID-19 outbreak, nationwide lockdown around the world, disruption in mining activities and supply chains, production halts, and labor unavailability have negatively impacted the antimony market. However, the increasing demand from various end users will likely drive the market during the forecast period.

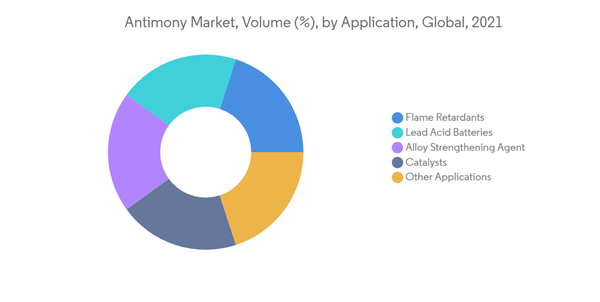

The major factors driving the market studied include the rising demand for flame retardant products and increasing demand from PET manufacturers.

Substitutes for antimony in major applications are expected to significantly hinder the growth of the market studied.

Recovery of antimony from recycled products is likely to act as an opportunity in the future.

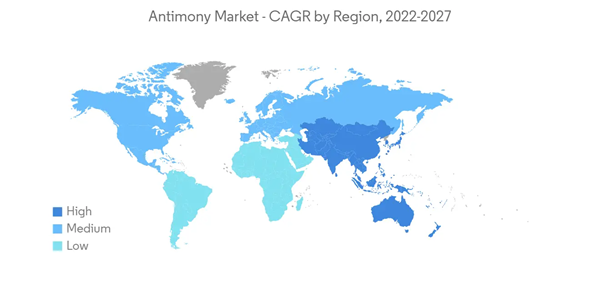

Asia-Pacific is expected to dominate the global market during the forecast period.

Antimony Market Trends

Increasing Usage in Fiberglass Composite Applications

Antimony is used as an additive in fiberglass composites. Antimony compounds are added directly to the resin, and they are dispersed using normal mixing equipment.Resin mixed with antimony is stirred frequently to keep the materials well-mixed. It is widely used due to its better heat-resistant and chemical-resistant properties.

The market for fiberglass composites is expected to grow at a fast pace. Composites are rapidly replacing all conventional materials in many applications, such as aerospace, automobiles, construction, electrical, and electronics, due to their high strength, low cost, easy processability, and availability in various forms and shapes with good aesthetics.

According to the US Census Bureau, the total construction output in the United States was estimated to be USD 1639.86 billion in December 2021, indicating a 9% increase compared to USD 1504.2 billion in the same period the previous year.

In addition to this, residential construction has also been increasing in India, as the country is likely to witness an investment of around USD 1.3 trillion in housing over the next seven years, which will boost the market studied.

According to the Federal Statistical Office (Destatis), in Germany, the turnover in the main construction industry in November 2021 was up by 6.2% compared to the corresponding month of the previous year.

Owing to the high strength of fiberglass composites, the antimony market is expected to witness tremendous growth over the forecast period.

China is Expected to Dominate the Asia-Pacific Market

China continued to be the leading global antimony producer in 2021 and accounted for 55% of the global mine production. According to the US Geological Survey (USGS), the total mine production of antimony in the country stood at 60,000 metric ton in 2021.Antimony is fused with lead, and the resulting alloy (solid solution) is used in lead-acid batteries. However, environmental regulations on lead emissions have restricted the consumption of antimony in lead batteries globally. Other alloys incorporating the element are used to make bullets, cable sheaths, solder, and even organ pipes.

The supply of antimony raw materials and downstream production of antimony products were constrained in 2021 due to raw material shortage combined with worldwide shipping delays. The antimony price reached a high of USD 6.65 per pound in October 2021 compared to the annual average price of USD 2.67 per pound in 2020.

In the semiconductor industry, it is used to manufacture diodes, hall-effect devices, and infrared detectors. Electronic products, such as smartphones, OLED TVs, tablets, etc., have the highest growth in the consumer electronics segment.

Moreover, China has the world's largest electronics production base. According to ZVEI Dia Elektroindustrie, the electronics industry of China was valued at about USD 2,430 million in 2020, and it is forecasted to grow at 11% and 8% Y-o-Y in 2021 and 2022, thus providing a huge market for antimony in the country.

Furthermore, antimony has a huge application as a flame retardant, thus leading to massive growth in the construction sector. According to the National Bureau of Statistics of China, in 2021, the construction output in China was valued at approximately CNY 29.31 trillion.

Overall, the demand for antimony is expected to increase in the country during the forecast period.

Antimony Industry Overview

The antimony market is fragmented in nature. Some of the major players (not in any particular order) in the market studied include Campine NV, Yiyang Huachang Antimony Industry Co. Ltd, Korea Zinc Co. Ltd, BASF SE, and US Antimony, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Campine

- Yiyang Huachang Antimony Industry Co. Ltd

- Hunan ChenZhou Mining Group Co. Ltd

- Korea Zinc Co. Ltd

- Lambert Metals International

- Mandalay Resources Corp.

- Nihon Seiko

- Nyacol Nano Technologies Inc.

- Suzuhiro Chemical

- Tri-Star Resources PLC

- US Antimony

- Yunnan Muli Antimony Industry Co. Ltd