The plastic additives market is estimated to reach over USD 6,200 million by the end of this year and is projected to register a CAGR of around 3.5% during the forecasted period.

Due to the COVID-19 outbreak, nationwide lockdowns around the globe disrupted manufacturing activities and supply chains, and production halts impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period. An increase in house sales, new project launches, and increasing demand for automotive and packaging have been leading the market recovery over the last two years.

This product will be delivered within 2 business days.

Due to the COVID-19 outbreak, nationwide lockdowns around the globe disrupted manufacturing activities and supply chains, and production halts impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period. An increase in house sales, new project launches, and increasing demand for automotive and packaging have been leading the market recovery over the last two years.

Key Highlights

- The replacement of conventional materials with plastics in several applications and increasing demand for plastics due to rapid urbanization and rising purchasing power among consumers are expected to drive the market's growth.

- On the flip side, stringent governmental regulations on plastic usage are restraining the plastics industry's growth globally, which is directly affecting the plastic additives demand on the global front.

- Nevertheless, the rising research activities to develop bio-based plastics and innovative product applications will likely create lucrative growth opportunities for the global market soon.

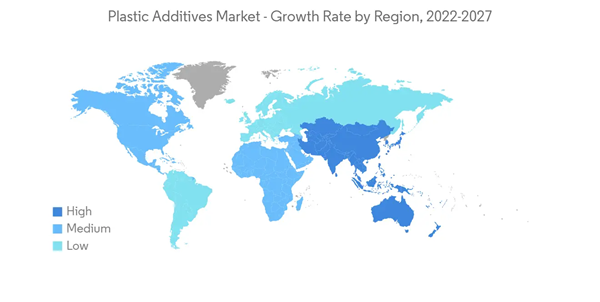

- Asia-Pacific emerged as the largest market and is expected to witness the highest CAGR during the forecast period. This dominance of Asia-Pacific is attributed to the high demand in countries such as China, Japan, and India.

Plastic Additives Market Trends

Packaging to Dominate the Market

- The packaging industry is the most extensive application for the plastic additives market globally. Factors leading to the increased application of polymers in the packaging industry are specific polymer properties, including lightweight, availability in different colours, low reactivity, chemical and moisture resistance, etc. A wide range of plastic additives is used in many types of packaging, from food and beverage to personal care and healthcare sectors.

- Significant forms of plastics used in the packaging industry are polyethene terephthalate (PET/PETE), high-density polyethene (HDPE), polyvinyl chloride (PVC), low-density polyethene (LDPE), polypropylene, polystyrene, etc.

- Polymer additives play an essential role in food and beverage packaging. A wide range of additives is available for enhancing the performance and appearance of food packaging, where polymer additives are crucial areas of innovation for packaging materials. Some major plastic additives used in food packaging are oxygen scavengers, antimicrobials, antioxidants/stabilizers, colorants, lubricants, and blowing agents.

- The global seafood market reached a value of USD 253 billion in 2021, and it is projected to reach USD 336 billion by 2025. As a result, the demand for plastic additives used for seafood packaging is anticipated to grow throughout the forecast period.

- Germany's food and beverage industry are characterized by its small and medium-sized enterprise sector of over 6,000 companies. The revenue in the food and beverage market was estimated at USD 3,222 million in 2021. The market is expected to grow annually by 6.83% during the forecast period, driving the packaging industry and the consumption of plastic additives in the country.

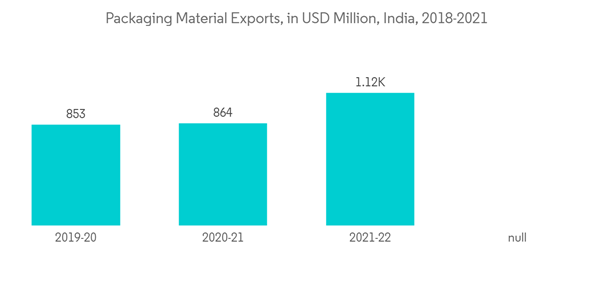

- The export of packaging materials from India grew to USD 1,119 million in 2021-22 from USD 844 million in 2018-19. The United States remains the major export destination for the packaging industry, followed by the United Kingdom, the United Arab Emirates, the Netherlands, and Germany.

- Due to the factors above, the market for plastic additives in the packaging segment is likely to grow substantially during the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. China is one of the lucrative markets for plastic additives due to low-cost raw materials and labour availability. China is one of the largest producers of plastic materials in the world.

- Packaging is the largest end-user for the plastics industry. With the rise in demand for lighter, cheaper, and more convenient packaging from consumers, the packaging sector in China is set to experience rapid growth during the forecast period, which, in turn, is expected to boost the plastic additives market.

- Food packaging is a significant player in the packaging industry, accounting for a major market share in China. According to Interpak, in China, total packaging is expected to reach 447 billion units in the foodstuff packaging category in 2023.

- Plastic additives usage is also growing in the construction industry as more engineering plastic is used in construction applications. The preference shifted from conventional to polymer-based materials. Using plastics in building and construction products saves energy compared to alternative construction materials.

- The Government of India is pushing notable projects in the next few years. The government’s ‘Housing for All’ initiative aimed to build more than 20 million affordable homes for the urban poor by 2022. In the 2021-22 budget, the smart cities mission is given INR 6,450 crore (~USD 778.78 million) as against INR 3,400 crore (~USD 410.52 million) in the 2020-21 revised estimates.

- The use of plastic additives is rising in the automotive industry in conjunction with the growing usage of engineering plastic in automotive parts. Various plastics have replaced conventional metals and wood, used for many under-the-hood parts of automobiles. These parts consume plastic additives in their production.

- According to the Society of Indian Automobile Association, the auto industry produced 22,933,230 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles from April 2021 to March 2022, as against 22,655,609 units from April 2020 to March 2021.

- As per reports by the Japan Automobile Manufacturers Association (JAMA), the country produced 7,846,955 units of passenger cars and light vehicles in 2021. However, the industry witnessed a 3% decline compared to the production numbers in 2020.

- All the factors above are expected to drive the demand for plastic additives from various applications in the consumer goods, construction, and automotive industries over the forecast period.

Plastic Additives Market Competitor Analysis

The plastic additives market is fragmented in nature. Some of the major players in the market (in no particular order) include BASF SE, Adeka Corporation, Lanxess, EVONIK INDUSTRIES AG, and Exxon Mobil Corporation, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Replacement of Conventional Materials by Plastics in Several Applications

4.1.2 Increasing Demand for Plastics Due to Rapid Urbanization and Rising Purchasing Power Among Consumers

4.2 Restraints

4.2.1 Stringent Governmental Regulations on Plastic Usage

4.2.2 Other Restraints

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Buyers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Type

5.1.1 Lubricants

5.1.2 Processing Aids (Fluoro-polymer Based)

5.1.3 Flow Improvers

5.1.4 Slip Additives

5.1.5 Antistatic Additives

5.1.6 Pigment Wetting Agents

5.1.7 Filler Dispersants

5.1.8 Antifog Additives

5.1.9 Plasticizers

5.1.10 Other Types

5.2 Plastic Type

5.2.1 Polyethylene (PE)

5.2.2 Polystyrene (PS)

5.2.3 Polypropylene (PP)

5.2.4 Polyamides (PA)

5.2.5 Polyethylene Terephthalate (PET)

5.2.6 Polyvinyl Chloride (PVC)

5.2.7 Polycarbonate (PC)

5.2.8 Other Plastic Types

5.3 Application

5.3.1 Packaging

5.3.2 Consumer Goods

5.3.3 Construction

5.3.4 Automotive

5.3.5 Other Applications

5.4 Geography

5.4.1 Asia-Pacific

5.4.1.1 China

5.4.1.2 India

5.4.1.3 Japan

5.4.1.4 South Korea

5.4.1.5 ASEAN Countries

5.4.1.6 Rest of Asia-Pacific

5.4.2 North America

5.4.2.1 United States

5.4.2.2 Canada

5.4.2.3 Mexico

5.4.3 Europe

5.4.3.1 Germany

5.4.3.2 United Kingdom

5.4.3.3 France

5.4.3.4 Italy

5.4.3.5 Spain

5.4.3.6 Russia

5.4.3.7 Rest of Europe

5.4.4 South America

5.4.4.1 Brazil

5.4.4.2 Argentina

5.4.4.3 Rest of South America

5.4.5 Middle-East and Africa

5.4.5.1 Saudi Arabia

5.4.5.2 United Arab Emirates

5.4.5.3 South Africa

5.4.5.4 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 ADEKA CORPORATION

6.4.2 Arkema

6.4.3 Baerlocher GmbH

6.4.4 BASF SE

6.4.5 Clariant

6.4.6 Croda International PLC

6.4.7 Dow

6.4.8 Emery Oleochemicals

6.4.9 Evonik Industries AG

6.4.10 Exxon Mobil Corporation

6.4.11 KANEKA CORPORATION

6.4.12 Kemipex

6.4.13 LANXESS

6.4.14 Mitsui & Co. Plastics Ltd

6.4.15 Nouryon

6.4.16 Peter Greven GmbH & Co. KG

6.4.17 SABO SpA

6.4.18 Solvay

6.4.19 SONGWON

6.4.20 Struktol Company of America LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Rising Research Activities to Develop Bio-based Plastics

7.2 Innovative Product Applications

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADEKA CORPORATION

- Arkema

- Baerlocher GmbH

- BASF SE

- Clariant

- Croda International PLC

- Dow

- Emery Oleochemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- KANEKA CORPORATION

- Kemipex

- LANXESS

- Mitsui & Co. Plastics Ltd

- Nouryon

- Peter Greven GmbH & Co. KG

- SABO SpA

- Solvay

- SONGWON

- Struktol Company of America LLC