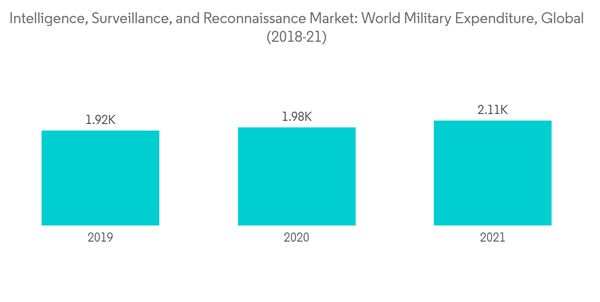

The COVID-19 pandemic had a moderate effect because of the disruption in the supply chain in 2020. However, the market became stable within a short time and has also grown in 2021 and 2022. With the increase in the defense budget by countries worldwide, the market is further expected to grow. According to the Stockholm International Peace Research Institute (SIPRI), the global military expenditure in 2021 crossed USD 2 trillion for the first time ever, which was a 0.7% increase compared to the global military expenditure in 2020. The global military budget has been increasing yearly for the past 8 years. With tensions between the nations, the military expenditure by various nations is expected to increase, which will result in a surge in investments for the development and procurement of intelligence, surveillance, and reconnaissance technologies and devices during the forecast period.

Rapid technological developments are breeding disruptive technologies in the defense industry. The impact of defense majors’ portfolio capabilities creates unexpected competition, particularly in the case of ISR. The increasing use of small unmanned systems for surveillance is further expected to generate demand for electronic components used in ISR missions.

Intelligence Surveillance and Reconnaissance Market Trends

Growth Led by the Air Segment of the Market

The air segment of the market, driven by the growing popularity of UAVs and communication systems, is expected to grow rapidly during the forecast period and control nearly one-third of the market. The space segment is anticipated to attract significant attention, and it is likely to be the most-explored segment of this market. As seen in some new projects, at present, the market is moving toward consolidation and integration of ISR systems across all platforms, which may result in high efficiency and performance. In the air segment, the demand for electronic support and countermeasures (ESM and ECM), airborne C3, and surveillance and maritime patrol aircraft is expected to increase steadily, owing to the surging need for total situational awareness, air superiority, and survivability. In June 2022, Raytheon Technologies and L3Harris partnered together to work on the second phase of the United States Army's High Accuracy Detection and Exploitation System (HADES), a multi-domain sensing system (MDSS), program. The second phase of the HADES program is improving aerial intelligence. Phase 1 of this program was awarded to Raytheon and L3Harris in June 2021, under which the companies are expected to demonstrate, develop, and build prototype electronic intelligence and communications intelligence (COMINT) sensors. The HADES program has been allocated USD 49.9 million for research and development in the fiscal year 2023.The Market is Expected to Experience the Highest Growth in Asia-Pacific

Currently, North America holds a major share of the market, as the United States is one of the leading countries in terms of defense platforms and spending. The country also spends heavily in order to foster collaboration between its naval, airborne, space, and land forces. The United States Coast Guard’s Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance Systems Acquisition Program is a multi-year effort to design, develop, and integrate the equipment used on the Coast Guard’s newest assets, including the national security cutter, offshore patrol cutter, long-range surveillance aircraft (HC-130J), and medium-range surveillance aircraft (HC-144A and C-27J). However, market dynamics are shifting toward Asia-Pacific. China and India are taking huge strides toward strengthening the capabilities of their armed forces, and they are among the top five countries, in terms of defense spending, in the world. Also, these countries have plans to enhance their unmanned aerial systems in the near future, which may propel the growth of the market in this region. In October 2022, during DefExpo 2022 in Gandhinagar, the Indian Army said that Indian defense systems would yield over INR 8 lakh crores in the next 7 years, with intelligence, surveillance, and reconnaissance expected to hold the major share. With the recent tensions between nations and missile tests done by North Korea in the region, countries like South Korea and Japan have also increased their surveillance capabilities. In December 2021, Korea Aerospace Industries (KAI) has been awarded a contract worth USD 675 million by the Defense Acquisition Program Administration of South Korea for developing and manufacturing four intelligence, surveillance, and reconnaissance (ISR) aircraft for the Republic of Korea Air Force (RoKAF).Intelligence Surveillance and Reconnaissance Market Competitor Analysis

The intelligence, surveillance, and reconnaissance market is moderately consolidated. L3Harris Technologies Inc., Elbit Systems, BAE Systems PLC, and General Dynamics Corporation are some of the major players that dominate the market in terms of market share. In October 2022, L3Harris announced that it has partnered with Mag Aerospace to work on the United States Army's Theater Level High-Altitude Expeditionary Next-Gen ISR Radar Program (ATHENA-R). The ATHENA-R aircraft, a Bombardier Global Express 6500s converted with ISR mission capabilities, is designed for enhancing the United States Army ISR capabilites at higher altitudes. The ISR market is expected to reach a mature position, wherein small regional players are expected to be either acquired or merged with the market giants to survive the competition.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- L3Harris Technologies Inc.

- General Dynamics Corporation

- The Boeing Company

- Elbit Systems Ltd

- BAE Systems PLC

- ThalesRaytheonSystems

- Rheinmetall AG

- CACI International Inc.

- Northrop Grumman Corporation

- Kratos Defense & Security Solutions Inc.