COVID-19 impacted the global pipe coatings industry in 2020. However, the rise in the water treatment industry post-pandemic has propelled the demand for pipe coatings globally.

Key Highlights

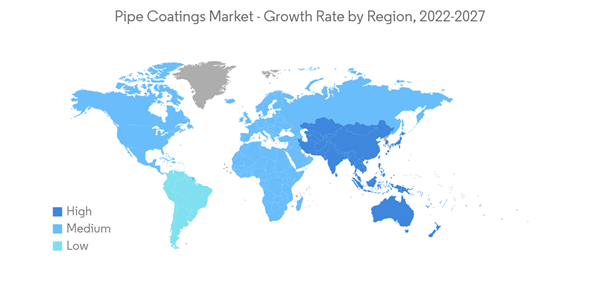

- The major factors driving the growth of the market studied are the upsurge in shale oil and gas production in North America, growing infrastructure and industrialization in Asia-Pacific, rise in irrigation and agricultural activities in Southeast Asia, and rising demand for energy in Europe.

- On the flip side, plunging oil prices due to oversupply, operational challenges in newly discovered energy reserves, and competition from renewable energy substitutes are the restraints hampering the growth of the studied market.

- The growth in deep-water exploration and production activities and industrial growth in the Middle East & Africa are likely to provide opportunities for the market studied during the forecast period.

- Asia-Pacific dominated the market across the globe, where the demand is driven by the growing demand for applications in the irrigation sector, construction, oil and gas, and other industries.

Pipe Coatings Market Trends

Oil and Gas Segment to Dominate the Market Demand

- In the oil and gas industry, pipes are required in petroleum offshore and onshore production and refineries.

- In the petroleum industry, pipes are required upstream, midstream, and downstream. Hence, it generates higher demand for pipe coatings.

- In the oil and gas industry, epoxy pipe coating is used extensively, as it is resistant to high temperatures, chemicals, and corrosion.

- Without pipeline corrosion protection, damages occur, which leads to equipment failure and loses of production time. Tubing, pipes, fasteners, and equipment are subjected to the punishing effects of chemicals, water, and sea salt spray.

- Industry-standard hot-dip galvanized, cadmium and zinc-plated coatings lack durability and deteriorate in tough offshore environments. However, metal coatings' proprietary gas pipe coating products minimize the effects of corrosion and abrasion and improve the longevity of costly equipment.

- With recovery prices in the oil and gas industry, exploration and production have started increasing globally. The major increase in oil & gas offshore exploration and production activities is noticed in the North Sea, North America, and Middle Eastern regions.

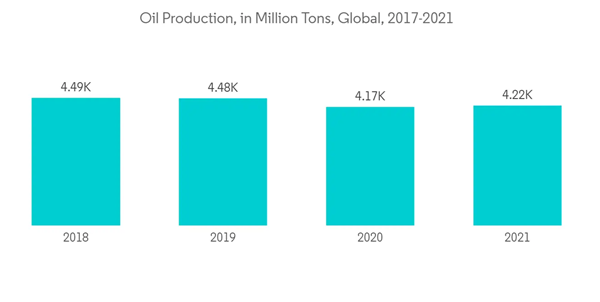

- According to BP, globally, oil production in 2021 increased by about 1.6% from the previous year and is expected to increase over the forecast period. In 2021, global oil production stood at 4,221 million tons, up from 4,171 million tons in 2020.

- The United States is the largest oil producer across the globe. In 2021, the country accounted for 16.8% (711.1 million tons) of the market share globally. Additionally, Saudi Arabia is also one of the largest producers of oil, which produced 515.0 million tons (12.2%) of oil in 2021.

- With this, the pipeline projects are also increasing to supply oil and gas output from fields to the refineries.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region dominated the global market share. The demand for the market studied is driven by the increasing demand for pipeline infrastructure from oil and gas, chemical, mining, water and wastewater, agriculture, and construction industries.

- In Asia-Pacific, the construction sector has been witnessing strong growth in countries such as India, Indonesia, China, Vietnam, and Singapore, owing to which the demand for construction pipes has been increasing in the region.

- The oil and gas exploration and production activities rebounded in 2021 compared to the pandemic-hobbled 2020. China's oil production observed a growth rate of 2.4%, accounting for 198.9 million tons in 2021, as compared to 194.8 million tons in 2020.

- Besides, gas projects are likely to be developed in Indonesia and Malaysia, which is expected to increase pipeline projects in these countries. In Malaysia, natural gas production observed a growth rate of 8.3%, accounting for 74.2 billion cubic meters in 2021.

- In addition to this, water treatment facilities have also been increasing in the region due to several factors, such as the growing environmental regulations, increasing shortage of fresh water supply, and rising water demand for industrial use.

- With all such trends in the market, the demand for pipes has been increasing from these industries, which is further expected to drive the demand for the pipe coatings market in the region.

Pipe Coatings Market Competitor Analysis

The pipe coatings market is consolidated, where few players account for a significant share of the market demand. Some of the noticeable players in the market include PPG Industries, 3M, BASF SE, the Sherwin-Williams Company (Valspar), and AkzoNobel NV, among others (not in any particular order).Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Deliverables

1.2 Study Assumptions

1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Upsurge in Shale Oil and Gas Production in North America

4.1.2 Growing Infrastructure and Industrialization in the Asia-Pacific Region

4.1.3 Rise in Irrigation and Agricultural Activities in Southeast Asia

4.1.4 Rising Energy Demand in Europe

4.2 Restraints

4.2.1 Operational Challenges in Newly Discovered Energy Reserves

4.2.2 Competition from Renewable Energy Substitutes

4.3 Industry Value Chain Analysis

4.4 Porter Five Forces

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Material Type

5.1.1 Thermoplastics

5.1.2 Epoxy Layered

5.1.3 Coal Tar Enamel

5.1.4 Asphalt Enamel

5.1.5 Vinyl Ester-based

5.1.6 Other Material Types

5.2 End-user Industry

5.2.1 Oil and Gas

5.2.2 Water and Wastewater Treatment

5.2.3 Mining

5.2.4 Agriculture

5.2.5 Chemical Processing and Transport

5.2.6 Infrastructure

5.2.7 Other End-user Industries

5.3 Geography

5.3.1 Asia-Pacific

5.3.1.1 China

5.3.1.2 India

5.3.1.3 Japan

5.3.1.4 South Korea

5.3.1.5 Rest of Asia-Pacific

5.3.2 North America

5.3.2.1 United States

5.3.2.2 Canada

5.3.2.3 Mexico

5.3.3 Europe

5.3.3.1 Germany

5.3.3.2 United Kingdom

5.3.3.3 France

5.3.3.4 Italy

5.3.3.5 Rest of Europe

5.3.4 South America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.4.3 Rest of South America

5.3.5 Middle-East and Africa

5.3.5.1 Saudi Arabia

5.3.5.2 South Africa

5.3.5.3 Qatar

5.3.5.4 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%)**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 3M

6.4.2 A.W. Chesterton Co.

6.4.3 Aegion Coating Services (also operates through subsidiary Bayou Coating)

6.4.4 AkzoNobel NV

6.4.5 Al Qahtani Pipe Coating Industries

6.4.6 Allan Edwards Inc.

6.4.7 Arabian Pipe Coating Co. (APCO)

6.4.8 BASF SE

6.4.9 Bauhuis BV

6.4.10 Borusan Mannesmann

6.4.11 Bredero Shaw Ltd

6.4.12 BSR Coatings

6.4.13 Celanese Corporation

6.4.14 Corinth Pipeworks (Cenergy Holdings SA)

6.4.15 DuPont

6.4.16 Dura-Bond (DBB Acquisition LLC)

6.4.17 Mutares AG

6.4.18 GBA Products Co. Ltd

6.4.19 Hempel Coatings

6.4.20 Jotun

6.4.21 Lyondellbasell Industries Holdings BV

6.4.22 Perma-Pipe Inc.

6.4.23 PPG Industries Inc.

6.4.24 Shaic International Co.

6.4.25 Shawcor Ltd

6.4.26 The Sherwin-Williams Company (Valspar)

6.4.27 Tenaris SA

6.4.28 Wasco Energy Group of Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Industrial Growth in the Middle-East & Africa

7.2 Growth in Deepwater Exploration and Production Activities

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- A.W. Chesterton Co.

- Aegion Coating Services (also operates through subsidiary Bayou Coating)

- AkzoNobel NV

- Al Qahtani Pipe Coating Industries

- Allan Edwards Inc.

- Arabian Pipe Coating Co. (APCO)

- BASF SE

- Bauhuis BV

- Borusan Mannesmann

- Bredero Shaw Ltd

- BSR Coatings

- Celanese Corporation

- Corinth Pipeworks (Cenergy Holdings SA)

- DuPont

- Dura-Bond (DBB Acquisition LLC)

- Mutares AG

- GBA Products Co. Ltd

- Hempel Coatings

- Jotun

- Lyondellbasell Industries Holdings BV

- Perma-Pipe Inc.

- PPG Industries Inc.

- Shaic International Co.

- Shawcor Ltd

- The Sherwin-Williams Company (Valspar)

- Tenaris SA

- Wasco Energy Group of Companies