The Olive Market size is estimated at USD 14.89 billion in 2024, and is expected to reach USD 18.86 billion by 2029, growing at a CAGR of 4.85% during the forecast period (2024-2029).

Key Highlights

- The olive market has increased in recent years, majorly driven by a shift in the consumption pattern toward the inclusion of olive oil in regular diet and the usage of table olives from Mediterranean cuisine in non-European countries. The demand for olives is not just rising from the food industry; the need for olives and olive trees is also rapidly growing from the Cosmetic industry to make products from the olive oils and biological fuel sector, where bilo fuel is derived from the cultivation of olive trees and the production of olive oil.

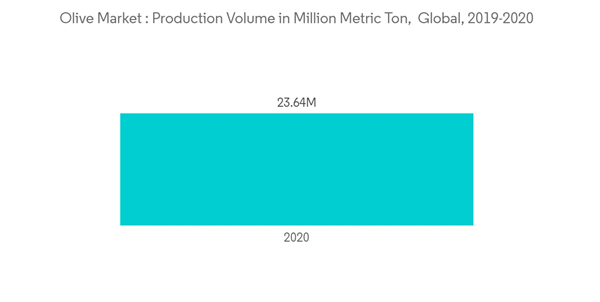

- In terms of production, Spain is the largest producer of olives in the world, and Italy holds the second-largest share. Though olive is also produced in various new regions, it is concentrated in the Mediterranean. According to the FAO, the global harvested area of olives was recorded at 9.7 million ha in 2017, which will grow to 12.7 million ha by 2020. Global olive production also grew by 12.3% from 2017 and reached 23.6 million tons in 2020. Though the show has been increasing, the yield has been going down significantly in recent years; from 2017, the work has dropped by 14.5% and reached 18,522 hectograms per hectare in 2020.

- Although the processing of olives into edible oil has dominated the trend of olive production for many years, the demand for table olives for various purposes, such as freshly fermented fruits, olive pickles, and food toppings, is on the rise across the country. This trend is anticipated to affect the market in the long term positively.

Olive Market Trends

Dietary Revolution Leading to an Upsurge in Demand for Olive Oil

As the general population is becoming more educated about health, the trend is shifting with the rising demand for oil and olive products, mainly because of their health benefits. Olive oil improves heart health; it contains antioxidants and omega-6 and omega-3 fatty acids. Although olive oil consumption has been traditionally based in the Mediterranean countries, such as Spain, Italy, Morocco, Tunisia, and others, the growing middle-income families and affluent consumers in China, Brazil, and India have started including refined and virgin olive oil in their regular diet. According to a report by the Italian farmer's group, Coldiretti, the world's consumption of olive oil increased by as much as 73% over the last 25 years.

According to the International Olive Council (IOC), the world olive oil production in 2021 is estimated to be 3.09 million metric tons, a 2.9% growth from the previous year. In 2021 the consumption was estimated to be 3.21 million metric tons, a 2.9% growth from 2020. The imports and export in 2020 were registered at 1.12 million metric tons and 1.10 million metric tons, respectively. The global demand for table olives also stemmed from using olives as snacks. The producers apply different fermentation methods to treat olives and offer the final assorted products for consumption.

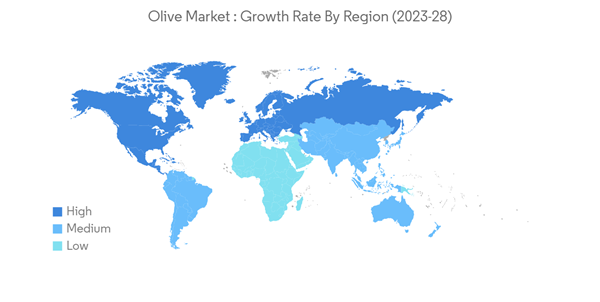

Europe Dominates the Olive Market

The European Union is the leading producer, consumer, and exporter of olives. According to the FAO, the harvested area of olives in Europe was recorded at 4.9 million hectares in 2017, which increased to 5.1 million hectares by 2020. Also, as per the International Olive Council, Europe accounted for almost 22% of the global olive consumption in 2020, estimated to be 0.6 million metric ton, which is expected to increase slightly next year.

Europe holds a major share of global consumption, with Spain, Italy, Greece, and France accounting for over 80% of the consumption. The consumption of table olives in France was recorded at 65 thousand metric ton in 2017, which grew to 70 thousand metric ton by 2020. According to IOC Spain, Greece, Portugal, and Italy are the European countries with the maximum consumption of olive oil per inhabitant. The yield of olives in Europe has also increased from 26,398 hectograms per hectare to 27,346 hectograms per hectare, supporting the demand and production.

According to UN Comtrade data, the major olive importers in Europe are Portugal, Italy, Netherlands, and Spain. In 2021 Portugal accounted for almost 23% of the total total oilve export values reaching upto USD 23.5 million. Incase of Exports the major exporters of oilve are Portugal, Spain, netherlands and Greece accounting for almost 83% of the global export value in 2021. The demand for Oilve has be increasing year on year, the import value in 2021 was accounted to be USD 90.8 million an of almost 40% from previous year, the export value also increased by almost 26% from 2020 and reached USD 79.1 million in 2021 and this is trend is expected to continue during the forecasted period with the rising demand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.