COVID-19 is expected to have a significant impact on the growth of the market. The demand for RNA interference is expected to increase as it is effectively used for the development of COVID-19 disease therapeutics. According to the article titled 'Prospects for RNAi therapy of COVID-19' published in July 2020, RNAi against COVID-19 disease can potentially be directed against two different categories of targets such as viral proteins essential in survival and replication of SARS-CoV-2 and Host factors involved in cellular entry and trafficking of the virus. Such potential benefits of RNA interference for the development of COVID-19 therapy is expected to drive the growth of the market.

Certain factors that are driving the market growth include the increasing number of applications in molecular diagnostics, particularly in cancer, and improving synthetic delivery carriers and chemical modifications to RNA.

Cancer diagnosis and treatment are currently undergoing a shift with the incorporation of RNAi techniques in personalized medicine and molecular diagnostics. The availability of high throughput techniques for the identification of altered cellular molecules and metabolites allows the use of RNAi techniques in various cancer diagnosis and targeting approaches. According to the article titled ' Insight into the prospects for RNAi Therapy of Cancer' published in March 2021 the expression of terget genes is knocked by RNAi, locating these nodes which are insipensable to tumor maintenance, with low side effects and low risk, blocking the inherent immunosuppression and triggering immune attacks on tumors. Moreover one of the advantages of RNAi technology is the rapid development of efficacious and targeted drugs for controlling tumor growth. For diagnostic purposes, small interfering RNAs (siRNA) or microRNAs (miRNA) can be utilized. The commercial availability of siRNAs to silence virtually any gene in the human genome is dramatically accelerating the pace of molecular diagnosis and biomedical research. For instance in December 2020 expanded its existing cooperation scope, including the development and commercialization of RNAi therapeutic drugs. the company used its latest progress in targeted delivery of siRNA drugs and its established capabilities to deepen the development of RNAi drugs for tumors and neurological diseases. Thus, increasing the application of RNAi in molecular diagnosis and its viability as a therapeutic technique may boost the growth of the RNAi market.

Thus the above mentioned factors are expected to fuel the growth of the market during the forecast period.

RNAi Technology Market Trends

Oncology is Expected to Hold Significant Market Share in the Therapeutics Type

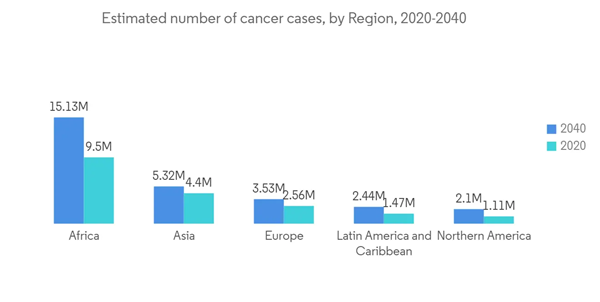

The oncology segment is expected to hold a significant market share during the forecast period.The increasing incidence of cancer among the global population leading to the rise in demand for effective therapeutics is expected to drive the growth of the studied segment. As per the report of the International Agency for Research on Cancer published GLOBOCAN 2020 report, there were an estimated 19,292,789 new cases of cancer diagnosed in 2020 and about 9,958,133 people died due to cancer, all over the world. As per the same source, of the total diagnosed cancer cases, 10,065,305 cases were reported in males and 9,227,484 cases were reported in females. the incidence of cancer cases in males was expected to reach 15,585,096 by 2040 and 13,302,846 in females by 2040. Such an increasing incidence of cancer among the global population is expected to drive the growth of the market.

Recent advancements, such as the development of small interfering RNA (siRNA) tolerant to nucleases and the development of non-viral vectors, such as cationic liposomes and nanoparticles, can overcome this obstacle and facilitate the clinical use of RNAi-based therapeutics in the treatment of cancer. Substantial pipeline for cancer therapies by companies and institutes such as Enzon Pharmaceuticals (Santaris Pharma), University of Texas, OncoGenex, Isarna Therapeutics, Astrazeneca (Ionis Pharmaceuticals), and INSYS Therapeutics, Inc. are expected to drive the market. For instance, In December 2021, Novartis received United States Food and Drug Administration approval for Leqvio, the small interfering RNA (siRNA) therapy for low-density lipoprotein with two doses a year, after an initial dose and one at three months. In addition, many companies have invested in R&D for nanocarriers to deliver oligonucleotides for cancer treatment, which is expected to contribute to the oncology verticle.

Thus the above mentioned factors are expected to drive the growth of the studied segment during the forecast period.

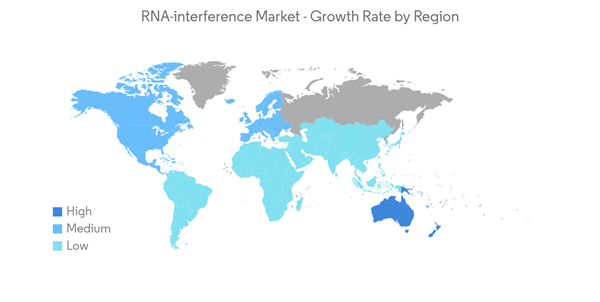

North America Dominates the Market and Expected to do the Same in the Forecast Period

North America is expected to provide lucrative opportunities for the growth of the market owing to the rising incidence of target diseases and growing demand for advanced therapeutics and diagnostics. For instance, according to the American Cancer Society's report in 2022 over 1.9 million new cancer cases are expected to be diagnosed in the United States 2022. and additionally, 80% of the people diagnosed with cancer in the United States are 55 years of age or older and 57% are 65 or older Thus, due to the high prevalence of cancer, and the rising affected geriatric population, the demand for diagnostics and treatment is also high in the country which is expected to drive the growth in the studied market in the United States.The United States has a number of RNAi therapeutics that are in developmental pipelines. A number of biotechnology companies have made considerably high investments for RNAi therapeutic development. key pharmaceutical developers have entered into collaboration agreements or licensing deals with a number of smaller firms in an attempt to capitalize on the expected growth in revenue that this market can have over the forecast period. For instance, in Dember 2021, AstraZeneca's agreement with Ionis pharmaceuticals is one of the big deals that are investing heavily into RNA-interference technology. The increasing approvals for the RNAi therapy is expected to drive the growth of the market during the forecast period. For instance in December 2021 , Novartis received United States Food and Drug Administration approval for Leqvio, the first and only small interfering RNA (SiRNA) therapy to low- density lipoprotein with two doses a year, after an initial dose and one at three months.

Thus the above mentioned factors are expected to drive the growth of the market in the studied region.

RNAi Technology Industry Overview

The RNA-interference (RNAi) market is highly competitive and consists of a few major players. Companies like Alnylam Pharmaceuticals, Arrowhead, Dicerna Pharmaceuticals (Novo Nordisk A/S), Thermofisher Scientific, Silence Therapeutics PLC, among others, hold a substantial market share in the RNA-interference (RNAi) market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alnylam Pharmaceuticals

- Arcturus Therapeutics

- Arrowhead Pharmaceuticals, Inc.

- Dicerna Pharmaceuticals (Novo Nordisk A/S)

- Ionis Pharmaceuticals Inc.

- Merck & Co. Inc. (Sigma Aldrich)

- Silence Therapeutics PLC

- Qiagen NV

- Phio Pharmaceuticals Corp.

- Thermo Fisher Scientific Inc.