The COVID-19 pandemic had a minor impact on the market. Although the production of military aircraft was slowed down for a brief period in 2020, the increase in military expenditure from all the countries has driven the demand for new military aircraft and has consequently driven the demand for military aircraft collision avoidance systems.

Increasing defense expenditure, rising military aircraft procurement contracts, and growing military modernization programs drive the growth of the market. An increasing focus on military aircraft safety is the major factor driving the market growth. Military aircraft operate in hazardous conditions, hence there are high chances of mid-air collisions and fatal accidents. Thus, military forces adopt sophisticated airborne collision avoidance systems, as the systems help to improve the operational safety of aircraft and pilots or troops.

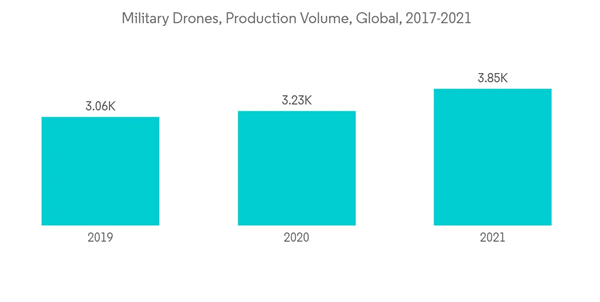

Military forces across the world are using unmanned aerial vehicles (UAVs) for long-range missions. The collision avoidance systems in UAVs use onboard sensors to generate an image of the airspace surrounding the UAV. The sensor data is used to analyze various conflicts such as collisions, TCAS violations, and airspace violations. Since the implementation of collision avoidance systems is mandatory in UAVs, an increase in the adoption of UAVs may increase the demand for these systems, as they help to improve operational safety and enhance the lifetime of UAVs.

Military ACAS Market Trends

The Unmanned Aircraft Segment is Anticipated to Growth with Highest CAGR During the Forecast Period

The unmanned aircraft segment is projected to register a high CAGR, owing to the growing UAV applications in the military and the rate at which the procurements of UAVs are growing among the militaries. The increasing usage of unmanned aircraft such as UAVs and other automated drones has been driving the demand for aircraft collision avoidance systems. Additionally, the rising defense expenditure and growing adoption of unmanned aerial vehicles for numerous applications from defense forces drive the growth of the market.For instance, in January 2022, Sagetech Avionics, the United States-based aerospace technology company, teamed up with Northeast UAS Airspace Integration Research Alliance, Inc. (NUAIR) to work together to test Detect and Avoid (DAA) solutions, and Automatic Dependent Surveillance-Broadcast (ADS-B) transponders, which were developed by Sagetech Avionics. General Electric, together with its partners, is working on drone flights integrating the next-generation airborne collision avoidance system (ACAS X), which is being developed jointly with the Federal Aviation Administration (FAA). Furthermore, in July 2022, Iris Automation, a collision avoidance technology provider enter into a partnership with Sagetech Avionics that will offer uncrewed aircraft an air risk mitigation solution. Through the partnership, Sagetech Avionics’ TSO-approved MXS ADS-B transponder will be integrated with Iris Automation’s detect-and-avoid (DAA) system, Casia via Sagetech’s ACAS X sensor fusion and collision avoidance module. This becomes a complete air risk mitigation solution for detection and avoidance. Several developments are expected to drive the unmanned aircraft segment of the market.

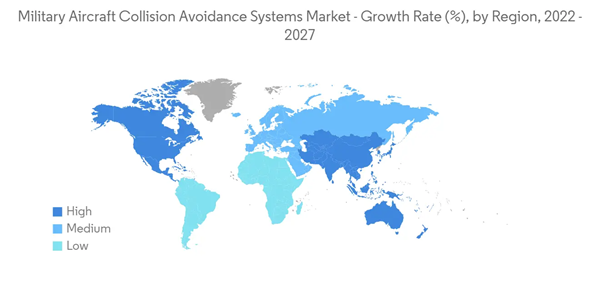

Asia Pacific is Projected to Show Remarkable Growth During the Forecast Period

The Asia Pacific region is expected to witness the highest growth rate during the forecast period, owing to the presence of countries like China and India that spend significantly on military aircraft procurement. Growing political disputes, cross-border conflicts between India and China, and rising terrorist activities lead to increasing defense expenditures from countries like China and India. For instance, in 2021, China allocated a defense budget of USD 293 billion while India spent a total of USD 76.6 billion on its defense sector.Furthermore, these countries have been developing new technologies to prevent aircraft collisions. For instance, in October 2022, Paras Aerospace, a subsidiary of Paras Defense and Space Technologies Limited showcased an unmanned combat aerial vehicle (UCAV) at DefExpo 2022 that is designed and manufactured in India. It is equipped with collision avoidance radar, electronic support and countermeasure systems, air-to-air radar, and other systems. Furthermore, several new developments and innovations for safety systems have been driving the implementation of collision avoidance systems on board aircraft. In May 2022, China developed a ground collision avoidance and air collision avoidance system that enables unmanned military drones to help in surveillance and reconnaissance. This technology is expected to gradually be employed in the existing fleet of China for better military aviation safety. Such developments are expected to drive the demand for collision avoidance systems across the Asia Pacific region.

Military ACAS Market Competitor Analysis

The military aircraft collision avoidance systems market is consolidated, with few players holding significant shares in the market. Some of the key players are Honeywell International Inc., L3Harris Technologies, Inc., Raytheon Technologies Corporation, Leonardo SpA, and Thales Group. As flight safety is one of the areas where aircraft OEMs spend more on reliability, irrespective of the pricing, companies are trying to manufacture advanced collision avoidance systems with enhanced capabilities to ensure more safety for pilots and troops. Players are also working along with the aviation authorities and government bodies as well as the military end-users to develop next-generation collision avoidance systems. Increased focus on R&D and entry into strategic partnerships are expected to help the players in the long run.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Honeywell International Inc.

- L3Harris Technologies, Inc

- Collins Aerospace (Raytheon Technologies Corporation)

- Leonardo SpA

- Thales Group

- Garmin Aerospace

- Avidyne Corporation

- Sandel Avionics Inc.

- Northrop Grumman

- Lockheed Martin Corporation