Key Highlights

- Despite the significant impact of the COVID-19 pandemic on the global economy, the market for armored fighting vehicles remained unaffected, as the procurement projects were on track and the sales and revenues of armored vehicles increased steadily for the manufacturing companies. However, there were some supply chain disruptions pocketed for certain vehicle models owing to the complexity and critical component requirements of the integrated subsystems.

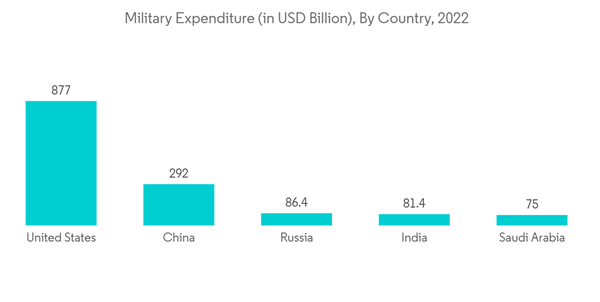

- The widening of geopolitical rifts and rising instances of cross-border conflicts in regions such as Asia-Pacific, Europe, the Middle East, and Africa has been the primary demand driver for the procurement of new armored vehicles to enhance the combat capabilities of the ground forces. Currently, the majority of the armed forces globally are operating old and aging armored vehicles. To replace the aging armored vehicles fleet, the armed forces are investing in the procurement of new-generation armed vehicle programs with enhanced efficiency, lethality, and surveillance capabilities. There is a growing emphasis on developing local manufacturing capabilities in the Asia-Pacific and the Middle East and African regions. The development of new armored vehicle models by local armored vehicle manufacturers is anticipated to increase their presence in the regional market.

Armored Fighting Vehicles Market Trends

Infantry Fighting Vehicle (IFV) to Dominate Market Share

- The infantry fighting vehicle segment is expected to show its domination during the forecast period. Increasing procurement of IFVs and rising defense expenditure are driving the segment's growth. Infantry fighting vehicles effectively carry mechanized infantry units into battle and provide direct-fire support. These IFVs can be fitted with modular add-on armor and composite or spaced laminated armor for protection against various munitions or rounds.

- According to the US Congressional Budget Office (CBO), the total acquisition costs for the US Army's ground combat vehicles are forecasted to average about USD 5 billion per year through 2050, of which USD 4.5 billion for procurement and USD 0.5 billion for RDT&E. The projected acquisition costs are mainly for remanufactured and upgraded versions of existing vehicles.

- Also, the US Army plans to procure an optionally manned fighting vehicle, which will replace the Bradley armored personnel carrier, a new mobile protected firepower tank, which will be lighter than an Abrams tank, and an armored multi-purpose vehicle, which will replace the M113 armored personnel carrier.

- Also, the Australian Army is currently in talks with armored vehicles for the acquisition of about 450 tracked IFVs under Project LAND 400 Phase 3, which will replace M113AS4 armored personnel carriers in service of the Army. The total acquisition cost of the vehicles is estimated to be worth up to USD 27 billion. Such large-scale procurements and growing expenditure on the upgradation of the current fleet may further propel the growth of this segment during the forecast period.

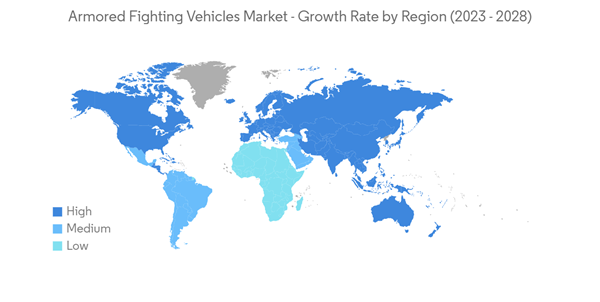

Asia-Pacific Region is Expected to Witness the Highest Growth During the Forecast Period

- The Asia-Pacific region is expected to witness the highest growth during the forecast period due to the robustly growing military spending of the countries in the region. Due to the increasing geopolitical tensions in the region, countries like China, India, Australia, South Korea, Singapore, and Japan are significantly investing in the procurement of new armored vehicles to replace their aging fleets that have been in operation for over 30 years. Earlier in March 2021, the Acquisition, Technology & Logistics Agency (ATLA) of Japan announced its plan to replace the light armored vehicles (LAV) due to their issue of lower cabin space and high emissions from engines.

- In December 2022, the Indian Army revealed that an acceptance of necessity was granted for the procurement of new Futuristic Infantry Combat Vehicles (Tracked). As of February 2023, the United States government may allow the Transfer of Technology (ToT) for the Stryker armored personnel carrier (APC) to India. Although it is not yet clear whether the Indian Army is willing to go for a domestically produced APC over imported ones, the deal for the Stryker armored personnel carrier (APC) is expected to provide a boost to India's defense manufacturing industry.

- Likewise, the Indian Ministry of Defense awarded Mahindra Defence Systems (MDS) a contract worth USD 146 million (INR 1,056 crore) to supply light specialist vehicles (LSVs). Under the contract, the company is expected to deliver 1,300 LSVs from 2021 through 2025. The countries in the region are robustly developing their local manufacturing capabilities to support their regional armed forces. For instance, China's NORINCO has been focusing on increasing the production and sales of domestically manufactured armored vehicles for the past few years. Such developments are anticipated to accelerate the growth of the market in this region.

Armored Fighting Vehicles Industry Overview

The armored fighting vehicles market is moderately fragmented, with many international and regional players in the market. Some of the prominent players in the market are General Dynamics Corporation, Oshkosh Corporation, BAE Systems plc, Rheinmetall AG, and Nexter Group. For decades, the market for armored fighting vehicles was highly consolidated, with few international players accounting for the majority share of the market.However, over the past few years, due to the global trend of indigenous manufacturing, many new local players have entered the market in the Asia-Pacific and Middle Eastern regions. Saudi Arabian Military Industries (SAMI), STREIT Group, Nurol Makina, BMC Otomotiv Sanayi ve Ticarest AS (BMC), and Katmerciler HIZIR, among others, are some of the local players based out of the Middle Eastern region.

To further enhance their footprint in the market, the local players are signing long-term contracts to meet the requirements of the regional armed forces. In this regard, companies in Turkey have been rapidly expanding their presence in Middle Eastern and North African countries through strategic partnerships with the local defense authorities. Due to high competitiveness in the market, the international players are investing in the development of next-generation armored vehicle models with autonomous capabilities as well as advanced weapons and electro-optic infrared sensor suites, which will enhance situational awareness and survivability of the military personnel on the battlefield.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- General Dynamics Corporation

- Rheinmetall AG

- BAE Systems plc

- Textron Inc.

- Elbit Systems Ltd.

- Oshkosh Corporation

- Nexter Group

- Denel SOC Ltd.

- FNSS Savunma Sistemleri A.Ş.

- BMC Otomotiv Sanayi ve Ticarest AS

- Saudi Arabian Military Industries (SAMI)

- Patria Group

- Hanwha Corporation

- Mitsubishi Heavy Industries Ltd.