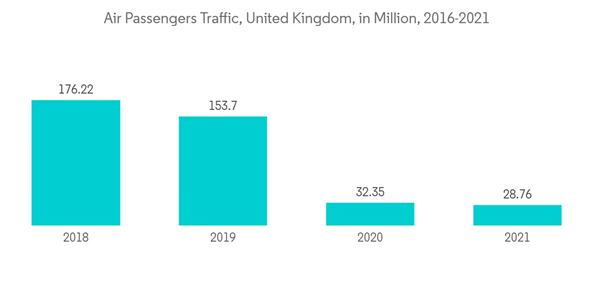

Europe was one of the world's earliest and most affected regions during the COVID-19 outbreak. The aviation industry is strategically important for several countries in the region. The decline in passenger traffic and flight activity in 2020 resulted in huge losses for regional airlines. However, the situation improved in 2021, and the recovery started during the summer of 2021. According to Eurostat, the European Union's air passengers, freight, and mail grew 25% between August 2021 and August 2022. But the aviation market across Europe was again hampered due to the Russia-Ukraine war due to flight cancellations to and from Russia.

Due to the increasing pressure from the United States on the NATO members to achieve their defense expenditure target (2% of GDP), several European countries plan to increase their military budget allocation in the coming years. It is estimated that a major share of the allocation is expected to be for the development and procurement of military combat and non-combat aircraft, as several major countries in the region are involved in the development of next-generation military aircraft, while many countries require rapid fleet modernization to maintain technological superiority over their adversaries.

Furthermore, growing air traffic, an increasing number of airports and rising spending on procuring business jets drive market growth across Europe. Airbus, an aircraft manufacturer, forecasts that there will be demand for 39,490 new passengers and freighter aircraft over the next 20 years. Out of the total aircraft demand, Europe will showcase demand for 8,140 from 2022-2041. Thus, the growing demand for commercial aircraft due to rising air traffic in the United Kingdom, Germany, France, and others drives the market growth.

Europe Aviation Market Trends

Military Segment Will Showcase Remarkable Growth Due to Increasing Defense Expenditure from European Countries

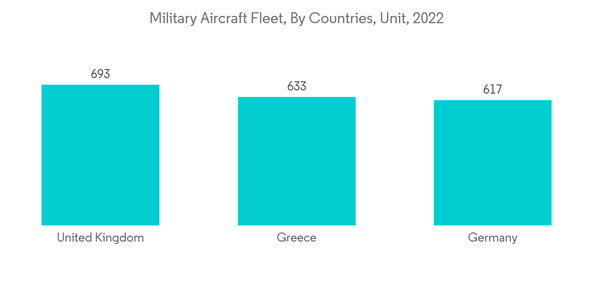

In Europe, both the commercial and general aviation segments were affected due to the border restrictions and the decline in passenger demand in 2020 and 2021. However, the order from the military segment is expected to remain relatively unaffected by the pandemic. Despite the effect of the pandemic on the economies of the countries in the region, most of the countries in Europe increased their defense expenditures in 2020. Also, the Russian invasion of Ukraine is expected to force NATO countries to increase their defense spending in the coming years.In the 2022 Multiannual Financial Framework (MFF), EUR 43.9 billion was allocated for defense and security, which showed an increase of 123% on the EUR 19.7 billion in the previous EU budget. The European Defence Fund, which supports research and development of military technologies, has soared to EUR 8 billion. For instance, in February 2022, Germany announced the creation of a special military fund of EUR 100 billion or USD 112 billion, in addition to the regular EUR 47.31 billion or USD 52.8 billion, as estimated by the SIPRI, in response to the ongoing escalation of the Russo-Ukrainian War, thereby placing them at the third largest in the world. Such factors are expected to make Europe one of the fastest-growing regions in terms of defense spending globally.

Several European countries have drafted plans to modernize and enhance their military aircraft fleets over the next decade. The United Kingdom, France, Germany, Poland, Italy, Spain, Finland, Slovakia, Romania, Bulgaria, and Croatia announced plans and orders for procuring new combat and non-combat aircraft during the forecast period. In addition, countries in the region are enhancing their local aircraft manufacturing capabilities. While France, Germany, and Spain are working together on the Future Combat Air System (FCAS), the United Kingdom's BAE System is working on the Tempest Sixth Generation Fighter Aircraft. Meanwhile, Russia is also working on several next-generation combats and non-combat aerial platforms. All these factors are expected to drive the military segment of the market during the forecast period.

The United Kingdom is Estimated to Dominate the Market During the Forecast Period

In the European aviation market, the United Kingdom currently accounts for a major share in terms of revenue. The United Kingdom has some of the busiest international airports in Europe, like London Heathrow airport, Gatwick airport, and Manchester airport. Despite a huge reduction in passenger traffic in 2020 and 2021, London Heathrow airport remained one of the busiest airports in Europe. Though the COVID-19 pandemic has drastically affected the future growth plans of carriers, like EasyJet and Virgin Atlantic, a few airlines were defying the industry's pessimism over the COVID-19 impact and have expanded their order book in the last two years.For instance, in December 2021, EasyJet announced that it had firmed up seven A320-200N options and twelve purchase rights, with deliveries scheduled between January 2025 and September 2027. Following the order, EasyJet has 106 A320-200Ns and sixteen A321-200Ns on order from Airbus, with a further six A320neo options and 53 purchase rights. British Airways' fleet of new aircraft is also growing as the airline is taking deliveries of the Airbus A350 aircraft following the retirement of its Boeing 747 in early 2020. The airline, however, pushed back the initial deliveries of the Boeing 777X aircraft from 2022 to 2024 due to delays from Boeing. Apart from commercial aviation, the UK government had invested heavily in the modernization of its fighter aircraft fleet.

In February 2022, the British Ministry of Defence announced plans to invest EUR 238 billion (USD 270 billion) in state-of-the-art military equipment and necessary support services from 2021 to 2031. The Royal air force and Royal Navy planned to procure 138 Lockheed Martin F-35B STOVL aircraft in total, out of which 21 aircraft were in service as of 2020, out of the 48 envisioned to be procured by 2025. The government has also announced to invest of GBP 2 billion in Tempest, a new fighter aircraft project (under development) by 2025.

Moreover, the United Kingdom's business aviation sector has also witnessed a huge growth rate over the years. The country has two of the top 10 busiest business aviation airports in Europe, Farnborough airport and London Luton airport. VistaJet, Ravenair, Wijet, and Luxaviation United Kingdom, are some of the main charter jet service providers in the United Kingdom. With the growing number of people opting for charter services for business travel in Europe, charter jet service providers are procuring new aircraft to increase their fleet. All these factors are expected to drive the market in the country in the years to come.

Europe Aviation Industry Overview

The Europe aviation market is consolidated as few players hold significant amounts of shares in the market. Airbus SE, Boeing, Lockheed Martin Corporation, Leonardo SpA, and Dassault Aviation SA are some of the major players in this region. Airbus dominates the market in Europe in commercial as well as military aviation.The aircraft industry is expected to see innovations getting implemented in aircraft design, which is expected to change the landscape of safety, comfort, and efficiency for both passengers and aircraft manufacturers. Companies are looking forward to grabbing the opportunities offered by the new technological innovations, increasing their respective market shares. Multiple countries are partnering to develop new military aircraft models, which is expected to bolster the prospects of the local players in those countries.

For instance, Germany, France, and Spain are involved in the development of a next-generation fighter jet named Future Combat Air System (FCAS). Such programs are expected to drive the growth of the local players in these countries during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus SE

- Saab AB

- Pilatus Aircraft Ltd

- Dassult Aviation SA

- Leonardo SpA

- Lockheed Martin Corporation

- The Boeing Company

- Bombardier Inc.

- Textron Inc.

- General Dynamics Corporation

- Daher

- Embraer SA