The increasing electrification of vehicles, including hybrid and electric vehicles, drives the demand for relays to control and manage various electrical systems. Also, the growth of ADAS features such as adaptive cruise control and lane departure warning systems relies on relays to control sensors and acuators.

The demand for advanced relays with lightweight and high-performance characteristics is compelling manufacturers to invest in producing more solid-state relays compared to traditional heavy electromechanical relays. It is owing to the growing demand for hybrid and electric vehicles in the region.

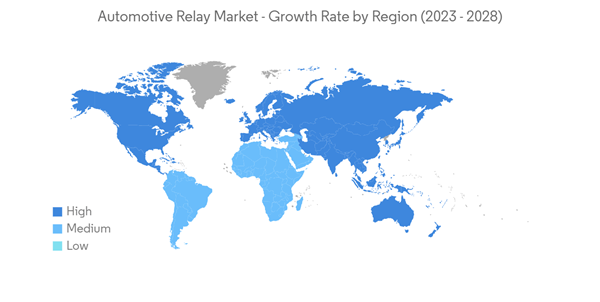

Among regions, Asia-Pacific is anticipated to dominate the automotive relay market. The Asia-Pacific relay market is primarily driven by growing vehicle production and sales, rapid electrification of vehicles, rising stringency of emission norms, and increasing disposable income of consumers. It, in turn, is increasing the demand for vehicles, owing to the growing preference for safety and comfort.

Automotive Relay Market Trends

Increasing Penetration of Automated Systems Driving the Adoption of Electronics.

The automotive industry is transitioning from hardware to software-enabled vehicles, and the average software and electronics content per vehicle is increasing rapidly. Electronics often enable the integration of new functions and features into the car. Thus, there is increasing penetration of electronics into major application fields, including powertrain, safety management, body, and convenience or infotainment.Both government involvement and consumers' demand for greater automatic control of systems resulted in the increased usage of electronics in vehicles. Electronics are offering new opportunities to improve energy efficiency and emission reduction as several functions can be consolidated into fewer and smaller electronic control super units, thereby reducing the weight. The high penetration rate of automobile electronics across all vehicle classes is being influenced by three major aspects, namely, productivity, quality, and innovation.

Efforts are being deployed in the automobile industry to transform consumers driving experience. Cars are becoming smarter and capable of conducting self-diagnostics. In the coming years, cars can connect effectively.

In addition, passenger safety is another factor driving the adoption of automated systems in automobiles. The installation of safety features and systems in vehicles greatly aided in reducing the number of accidents and fatalities on the road over the past few decades.

With the increasing focus on autonomous vehicles and smart cars (with the ability to connect with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications) that can ensure safety and convenience to consumers, the demand for electronic systems in new cars is increasing rapidly.

Newer generation automotive electronics that enhance the driver experience are witnessing mass adoption in mid-range and entry-level car segments and ease of availability through the aftermarket.

The rapidly growing use of electric components in current and upcoming vehicles is consistently propelling the need for manufacturing reliable and standardized components for efficient, safe, and secure switching of electric loads. These factors are currently driving the market growth.

Asia-Pacific Dominating The Automotive Relay Market

Asia-Pacific is the world's largest automotive production hub, with several countries in the region, including China, Japan, South Korea, and India being major automobile manufacturers. Also, rising income levels, urbanization, and improved living standards led to an increase in vehicle ownership across Asia-Pacific. This surge in vehicle ownership directly impacts the demand for automotive relays used in various vehicle systems.Many countries in Asia-Pacific implemented strict emission regulations to reduce pollution and greenhouse gas emissions. These regulations drive the adoption of advanced engine management and emission control systems that use relays for efficient operation.

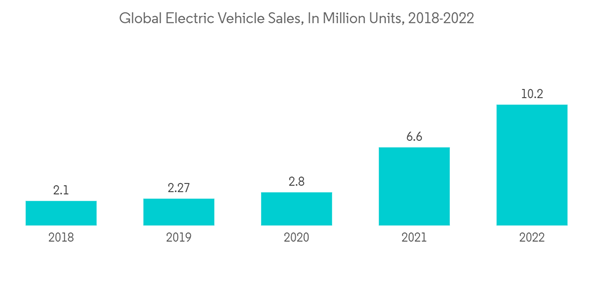

The shift towards EVs and hybrid vehicles is a significant trend in the automotive industry. EVs and hybrids use more relays compared to traditional internal combustion engine vehicles, contributing to the market growth. Relays are becoming more compact and integrated, saving space in vehicles and reducing weight. This trend aligns with the automotive industry's focus on lightweighting and space optimization.

Asia-Pacific region leads in the automotive relay market due to its position as a major automotive production hub, growing vehicle ownership, the electrification of vehicles, stringent regulations, and the adoption of advanced automotive technologies.

Automotive Relay Industry Overview

The automotive relay market is dominated by companies such as DENSO Corporation (ANDEN Co. Ltd), Panasonic Corporation, TE Connectivity, and Nidec Corporation.The market for automotive relays is highly competitive due to the presence of both international and domestic relay suppliers in the region. The companies are investing heavily in R&D projects and launching new products. For instance,

- In April 2022, LG Magna e-Powertrain announced its latest manufacturing facility located in Ramos Arizpe, Mexico. This newly established plant is dedicated to the production of inverters, motors, and onboard chargers with the primary objective of bolstering General Motors Electric Vehicle (EV) manufacturing operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Robert Bosch GmbH

- DENSO Corporation

- Fujitsu Ltd

- Panasonic Corporation

- MITSUBA Corporation

- TE Connectivity

- Omron Corporation

- Hella KGaA Hueck & Co.

- Nidec Corporation