The COVID-19 pandemic severely impacted the market owing to the complete standstill of global transport, imports, and exports. Major manufacturing industries shut down their plant due to restrictions worldwide, and the research and production that goes into the carbon fiber market were hindered. With the majority of the world's carbon fiber production industries located in Japan, the supply chain for the automotive industry was disrupted.

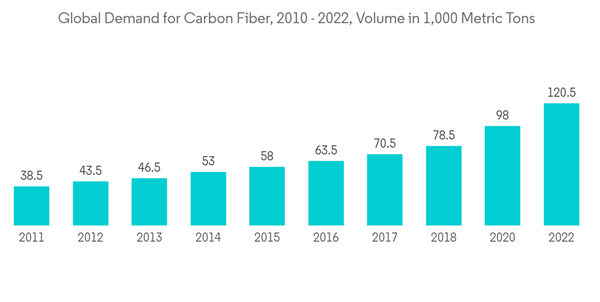

The last year remained the year for transition, where the automotive sector witnessed steady growth after revamping the automotive industry throughput. This has also elevated the demand for carbon fiber.

Carbon fiber is a lightweight material with high-strength characteristics that can be designed for enhanced performance in automotive applications. It offers improvement in structural, functional, or cosmetic properties. To make vehicles lighter, cleaner, safer, and more cost-effective, the leading carbon fiber suppliers are responding to the needs and expectations of vehicle OEMs, system suppliers, and customers. Many car companies, such as BMW, Audi, GM, Honda, and Polestar, have established agreements with carbon fiber material producers for mass production and are investing in their processes to support low-cost carbon fiber manufacturing.

Growing stringent emission norms and rising fuel prices, carbon fiber, a great alternative to conventional metals, can reduce the vehicle's weight. This can improve the fuel efficiency and performance of the engine while the fiber's physical strength limits are almost twice as high as those of conventional metals. The rise in demand for electric vehicles across the world is likely to increase the penetration of carbon fiber to enhance the range of electric vehicles.

Key Highlights

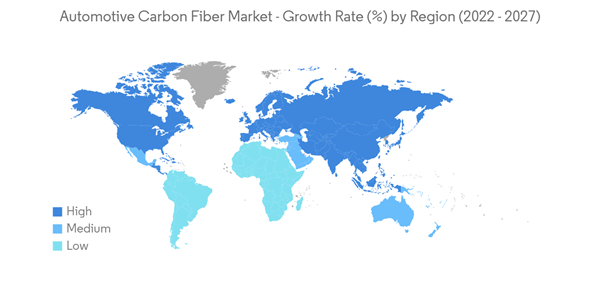

- Europe is expected to be the market leader due to the presence of many car manufacturers, such as Ferrari, Lamborghini, Koenigsegg, Pagani, etc., who use a lot of carbon fiber in manufacturing their cars. Europe is closely followed by North America and Asia-Pacific, with growing demand for performance vehicles. Within the Asia-Pacific, China and Japan are poised to be the two largest markets.

Automotive Carbon Fiber Composites Market Trends

Increasing Adoption of Carbon Fiber in Automobiles

The automotive industry has started using carbon fiber for strong, lightweight parts that increase speed and improve aerodynamics and fuel efficiency. Currently, most carbon fiber automotive parts are used in high-end sports cars and European supercars; however, some carbon fiber composite parts are available in the aftermarket. Vehicle parts such as body components, wheels and rims, and interior finishes utilize carbon fiber for their unique properties and sleek appearance.Advanced materials such as carbon fiber are essential for boosting the fuel economy of modern cars for maintaining performance and safety. Since it takes lesser energy to accelerate a lighter object than a heavier one, lightweight materials offer great potential for increasing vehicle efficiency and fuel economy. A 10% reduction in the vehicle’s weight can transpire to a 6-8% increase in fuel economy.

Major players are investing in the research and development of carbon fiber components to enhance vehicle efficiency. For instance,

- In November 2022, Ahera, an ultra-premium electric automotive brand, revealed the exterior design of the first model of its SUV. The vehicle is made up of highly sustainable composite material, including forged carbon fiber.

- In October 2022, Nissan Motors showcased its Frontier pickup truck powered by a 5.6-liter V-8 engine and integrated with a wide-body kit featuring carbon-fiber front fenders and bedsides, along with a carbon hood.

- In May 2022, Hexcel developed a new product range that combines Hexcel resin systems made with bio-derived resin content with natural fiber reinforcements to create material solutions for Automotive, Winter Sports, Marine, and Wind Energy applications.

BMW uses carbon fiber components in the upper portions of its 7-series Sedan, such as roof elements and supporting pillars, with the intention of lowering the car’s center of gravity. The Alfa Romeo 4C, on the other hand, has a complete carbon fiber chassis, which cuts the weight of the vehicle down to just 2,500 lbs. Other cars of similar styles and sizes generally weigh 3,000 lbs or more, making the 4C a lightweight luxury in its class. BMW and its carbon fiber producing partner, the SGL Group, spent close to USD 1 billion for establishing the supply chain for the CFRP used in the i3 and i8. Audi is also using carbon fiber to produce the rear wall of the space frame for its A8 sedan. Even from the supply side, carbon fiber manufacturers have been ramping up their production capacities, which will further help in the adoption of carbon fiber in automobiles.

Considering these aforementioned factors and developments, the demand for highly efficient carbon fiber is anticipated to hold high potential during the forecast period.

Europe is Dominating the Market

The luxury car and sports car market is anticipated to hold high potential for the usage of carbon fiber. Europe anticipates itself as the leading region to portray strong demand for luxury cars and sports cars.The European luxury car market is expected to be driven by SUVs. Traditional passenger cars are losing their hold in the market. It is a global trend that started in the US and then spread to Europe and Asia. Some of the brands whose best-seller SUVs are in Europe include Nissan, Hyundai, Kia, Mazda, Mitsubishi, Jaguar, Lexus, Porsche, Maserati, and Volvo. These vehicle sales would drive the demand for automotive air suspension in the long run.

The automotive industry in the United Kingdom is now best known for premium and sports car manufacturers, including Aston Martin, Bentley, Daimler, Jaguar, Lagonda, Land Rover, Lotus, McLaren, MG, Mini, Morgan, and Rolls-Royce. The country's passenger car sales increased from 1,631,064 units in 2021 to 1,647,181 units, an increase of 1.0%. This growth is backed by the launch of the latest models by these OEMs embedding the advanced body material in the vehicle.

With the enactment of stringent emission norms and fuel economy standards in the European region, automobile manufacturers in Germany, Italy, and France, such as BMW, Volkswagen, Audi, etc., have started using carbon fiber composites in manufacturing their vehicles.

Companies are trying to invent new parts made of carbon fiber that can reduce a vehicle's total weight to a great extent. The application of carbon-fiber-reinforced plastic (CFRP) has been widely adopted for the production of automotive bodies, particularly in hyper-car manufacturers such as Ferrari, Lamborghini, and Porsche.

Considering these factors, the demand for carbon fiber for automotive parts is anticipated to portray a high growth rate in the European region due to luxury and sports car sales.

Automotive Carbon Fiber Composites Market Competitor Analysis

The automotive carbon fiber market is a consolidated market. The top 10 players account for most of the market share. Major companies in the carbon fiber market include Hexcel Corporation, Mitsubishi Chemical Carbon Fiber and Composites Inc., SGL Carbon SE, Teijin Limited, and Toray Industries Inc.The demand is on the positive side, attributed to strong expansion and growth strategies adopted by the carbon fiber manufacturers. For instance, in March 2021, Teijin Limited and Applied Electric Vehicle (Applied EV) jointly developed a polycarbonate solar roof for future mobility applications.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Toray Industries

- Hexcel Corporation

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- SGL Carbon SE

- Solvay

- Teijin Ltd

- DowAksa USA LLC

- A&P Technology Inc.

- Zoltek Corp.

- Toho Tenax Europe GmbH