Naphtha refers to a broad range of volatile and flammable liquid hydrocarbons that are derived from crude oil or coal tar. This liquid fraction, commonly obtained from petroleum refining, displays properties that are intermediate between gasoline and kerosene. It has the ability to dissolve and mix with various organic compounds, facilitating chemical reactions or acting as a carrier for desired materials. Its unique composition ensures its utility as a solvent, diluent, or raw material in various industrial processes, including the production of high-quality gasoline and as a feedstock for the production of chemicals. Furthermore, it finds applications in the cleaning of metals and the extraction of valuable substances.

The global market is primarily driven by the escalating demand for high-octane fuel using olefin-rich materials. This trend, together with the ongoing expansion in the petrochemical sector and the growing application of this material for the creation of aromatics and olefins is propelling the market. Moreover, the growing demand for budget-friendly fuel has amplified consumption in both developing and industrialized regions, which in turn is creating a positive market outlook.

In line with this, the rising construction and infrastructure development activities in both residential and commercial areas are further stimulating the demand for paints and cleaning agents, thereby stimulating the market. Furthermore, the accelerating need to achieve higher fuel efficiency and reduced emissions in alignment with international regulations leading to the formulation of specialized fuel mixtures is fueling the market.

Naphtha Market Trends/Drivers:

Augmenting demand in the energy sector

The persistent need for naphtha within the energy sector embodies a core element in the market's dynamics. As an essential component in various fuels, including gasoline and kerosene, it provides the means to power everything from vehicles to heating systems. As urbanization and industrialization continue to advance across various regions, the demand for energy in various forms is on the rise.Developing nations, in particular, require increasing energy supplies to fuel their growth, and this particular hydrocarbon mixture is often at the forefront of meeting this need. Whether through direct combustion or as a raw material for more complex energy products, it holds a central place in the global energy landscape. Its versatility and compatibility with other energy forms further enhance its attractiveness.

Rising need for compliance with regulatory requirements

Governments, industry bodies, and international organizations enforce rules that dictate the extraction, refining, transportation, and utilization of this complex hydrocarbon mixture. Environmental concerns, public health, and safety are often at the forefront of these regulations, pushing the industry towards cleaner and more responsible practices. Compliance with varying regulatory landscapes requires flexibility and innovation. It pushes organizations to invest in technologies that reduce emissions, enhance safety, and improve overall efficiency.Whether these regulations pertain to environmental stewardship, consumer protection, or fair trade, they compel the market participants to align their operations with broader societal goals. The ever-evolving nature of these rules ensures that the market remains dynamic, adapting to new challenges and opportunities that arise from changing legal and social landscapes.

Continual technological innovations and research and development (R&D) activities

The naphtha market is considerably influenced by the ongoing technological innovations and research and development (R&D) activities in the petrochemical industry. These advancements encompass improvements in extraction methods, refining processes, and the development of new applications for this hydrocarbon mixture. Innovative technologies not only enhance the efficiency of current practices but also pave the way for entirely new uses and markets.For example, breakthroughs in catalytic processes have enabled the more efficient production of vital chemicals, while advances in environmental technologies have allowed for cleaner and more sustainable operations. Research and development (R&D) efforts often focus on finding new ways to utilize this valuable compound, expanding its role within various industries. Furthermore, strategic collaborations among academic institutions, research organizations, and industry leaders are also acting as a significant growth-inducing factor for the market.

Naphtha Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global naphtha market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on application.Breakup by Application:

- Petrochemical Feedstock

- Gasoline Blending

- Other.

Petrochemical feedstock represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes petrochemical feedstock, gasoline blending, and others. According to the report, petrochemical feedstock represented the largest segment.The growing demand for plastics and synthetic materials, which require petrochemical feedstock in their production process, fuels this market segment. Also, technological advancements in refining processes enable more efficient extraction and processing of petrochemical feedstock, supporting the market growth. Moreover, the shift towards cleaner and more sustainable chemicals is pushing manufacturers to utilize specific feedstock that aligns with environmental standards.

On the other hand, the increasing vehicle usage and a growing automotive industry worldwide contribute to higher demand for gasoline, thus driving the gasoline blending market. Also, regulatory mandates to ensure cleaner combustion and reduced emissions necessitate specific gasoline blending techniques, thereby supporting this market segment. Volatile crude oil prices influence gasoline blending strategies, as refiners aim to achieve cost-effective production without sacrificing quality.

Breakup by Region:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin Americ.

Asia Pacific exhibits a clear dominance, accounting for the largest naphtha market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific; North America; Europe; Middle East and Africa; and Latin America.Rapid industrialization and urbanization in the Asia Pacific region lead to an increase in energy and petrochemical consumption, propelling market growth. The emergence of Asia Pacific as a manufacturing hub for various industries including automotive, electronics, and textiles requires extensive energy and raw materials, driving market segments.

In addition to this, strategic policies and investments by governments in this region to promote energy security and sustainable development further fuel market growth. Also, an increasing focus on environmental conservation, adherence to international emissions standards, and the development of eco-friendly technologies are influencing market trends in the Asia Pacific region.

Furthermore, the presence of several key market players and the region's strategic location, facilitating export and import activities, make the Asia Pacific a vital segment in the global market landscape.

Competitive Landscape:

The leading companies are focusing on research and development to create more efficient and environmentally friendly naphtha products. Innovations in refining processes and the development of new applications for naphtha are part of this strategy. The top players are also expanding their presence into emerging markets, where the demand for naphtha in various industries such as petrochemicals and solvents is growing.By forming alliances with other industry players and investing in joint ventures, leading companies can share knowledge, technology, and resources. The key players are integrating modern technologies, such as artificial intelligence and analytics, to optimize inventory management and logistics. Additionally, they are adopting green chemistry practices and investing in cleaner technologies to reduce emissions and waste.

The report has provided a comprehensive analysis of the competitive landscape in the naphtha market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- BP plc

- Chevron Corporation

- Exxon Mobil Corporation

- Lotte Chemical Corporation

- Mangalore Refinery and Petrochemicals Limited

- OAO Novatek

- Saudi Basic Industries Corporation (SABIC)

- Shell International B.V.

- Sinopec Group

- Total S.A.

- Vitol SA

- Mitsubishi Chemical

- Reliance Industries Limited

- Indian Oil Corporatio.

Key Questions Answered in This Report:

- How has the global naphtha market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global naphtha market?

- What is the impact of each driver, restraint, and opportunity on the global naphtha market?

- What are the key regional markets?

- Which countries represent the most attractive naphtha market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the naphtha market?

- What is the competitive structure of the global naphtha market?

- Who are the key players/companies in the global naphtha market?

Table of Contents

Companies Mentioned

- BP plc

- Chevron Corporation

- Exxon Mobil Corporation

- Lotte Chemical Corporation

- Mangalore Refinery and Petrochemicals Limited

- OAO Novatek

- Saudi Basic Industries Corporation (SABIC)

- Shell International B.V.

- Sinopec Group

- Total S.A.

- Vitol SA

- Mitsubishi Chemical

- Reliance Industries Limited

- Indian Oil Corporation

Table Information

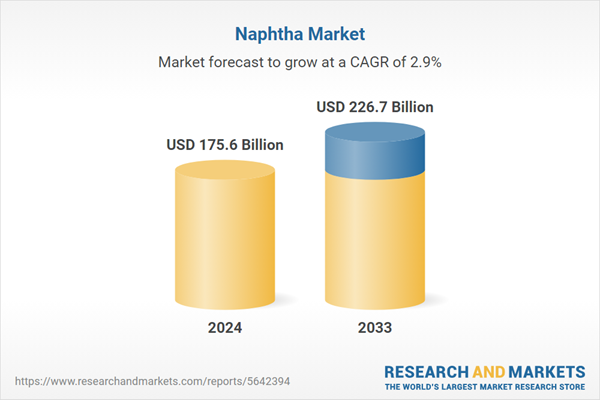

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 175.6 Billion |

| Forecasted Market Value ( USD | $ 226.7 Billion |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |