The market is majorly driven by the robust demand for health-based products, like probiotics, among consumers, especially the younger generations. Probiotics are part of functional foods and beverages and are known for improving gut functionality, along with other benefits, including immunity boost. Various health benefits of probiotic foods are driving consumers in the region toward the consumption of such foods and beverages. Probiotics are made of good live bacteria and/or yeasts that naturally live in your body which help in digesting food, creating vitamins, and the breakdown and absorbing medications, among many others. Additionally, increasing acidity, stomach and gut issues, and indigestion problems among people in the region are increasing the demand for such probiotics-incorporated foods. For instance, according to GOQii, a large-scale survey conducted across India in 2021 resulted that about 30% of female respondents reported acidity and indigestion problems, whereas about 29% of male respondents had gut-related problems that year.

Moreover, a growing number of customers in the region are turning to beverages that do more than just satisfy their thirst, and this is creating a strong need for functional beverages to meet their demands, in addition to naturally sourced, balanced, and nutritious meals. This growing trend of healthier, enhanced drinks has created a new opportunity for brands or start-ups to develop products that nourish as well as refresh and hydrate. For instance, a new start-up in India called Ginger Rage offers probiotic products like Kombucha, which claims to be low in calories, a cocktail mixer, and is gut-friendly and an immunity booster. The company is also offering all of its products through its online retail store and other social media platforms. Such innovations and diversity in the products being offered in the region are expected to further boost the market’s growth during the forecast period.

Asia Pacific Probiotics Market Trends

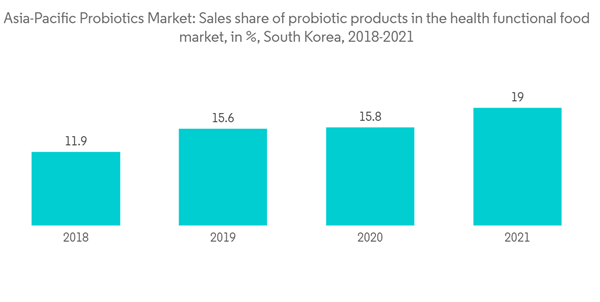

Increasing Health Consciousness

Probiotics are a key ingredient in the thriving digestive health supplement market, and consumers of all ages are consuming more of them. Due to their increased awareness of health and wellness owing to multi-channel publicity campaigns, which significantly affect their consumption habits, the majority of consumption is seen among millennials. With the rising health concerns and early occurring gastric and gut-related problems, consumers in the region have become more conscious about their gut health and maintaining gut flora. Probiotics being the perfect solution to overcome or prevent such undesired issues, demand for such beverages and foods is highly increasing. For instance, according to the Ministry of Food and Drug Safety of South Korea, in 2021, probiotic products took up about 19% of the South Korean health functional food market, considerably up from around 15.8% in the previous year. Similarly, Hy Co. Ltd, formerly known as Korea Yakult, was the leading probiotics company in South Korea in 2021. It generated around KRW 275 billion in sales of probiotics products. Hence, rising consumption and demand for probiotic products in the region are expected to fill the market with innovative products, thus driving the market for probiotics in the near future.Japan Holds a Prominent Share in the Market

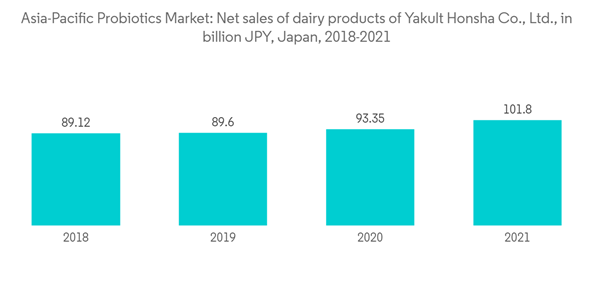

In Japan, probiotic ingredients and finished products are developed based on scientific proof and supported by health requirements. Additionally, the probiotics market in Japan is primarily driven by Japanese customers, who have been particularly concerned about regularly replacing their gut flora and believe probiotic bacteria to be the best way to do so. In line with this, different new technologies being developed in the country to produce more effective and sustainable products are also supporting the market's growth by increasing the consumer base. For instance, in June 2021, after 20 years of research and development, SCIENCE OF PROBIOTICS by TCI JAPAN announced that it finally broke through the existing limitations and found new ways to create innovative probiotic beverages. TCI JAPAN's SCIENCE OF PROBIOTICS is the first in the industry to announce its development of a new patented process where high-efficiency fermentation technology is used to infuse into each tiny glass bottle of drink with 100 billion live probiotics, roughly equal to the total probiotic count in 10 bottles of common lactic acid bacteria drinks.In addition, using such cutting-edge technologies, high counts of live bacteria can be maintained in the drinks, which is expected to attract consumers owing to the high-potency, quick-acting, and long-acting probiotic beverages in the country. Notably, the Japanese-based brand, Yakult, is so prevalent in the country with higher revenues and its products are served as part of school lunches and delivered to homes by its employees, thus augmenting its growth in the country. For instance, according to Yakult Honsha, in the fiscal year 2021, the company generated almost JPY 102 billion in net sales through its dairy product segment in Japan, continuing the upward trend of recent years.

Asia Pacific Probiotics Industry Overview

The Asia-Pacific probiotics market is fragmented, with the presence of various players in the market. Probiotic foods in the region are currently dominated by dairy products, such as fermented milk drinks, probiotic yogurts, and probiotic yogurt drinks. The major players in the market are Yakult, Danone, Morinaga, and Nestlé. These players have further consolidated their positions in recent years. The launch of new innovative products in the market is one of the major strategies adopted by the players in the market in order to expand their product portfolios and consumer bases.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Nestle SA

- Groupe Danone

- Danone SA

- PepsiCo Inc.

- Yakult Honsha Co. Ltd

- Cell Biotech

- Bio-K Plus International

- Now Foods

- Amway Corp.

- Anand Milk Union Limited