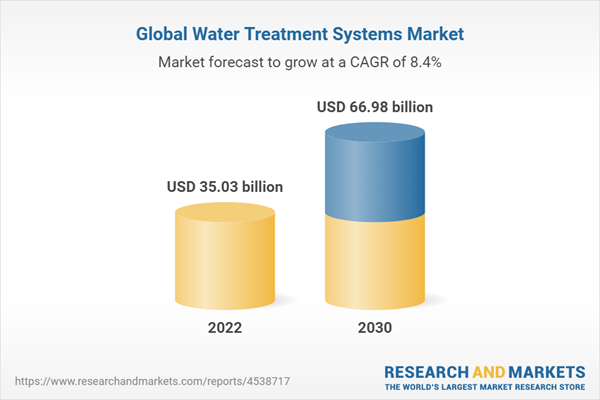

The global water treatment systems market size is anticipated to reach USD 66.98 billion by 2030. The market is expected to grow at a CAGR of 8.4% from 2023 to 2030. The rising level of contaminants in water sources worldwide is expected to drive the global demand for water treatment systems to ensure a safe water supply. As the water pollution level rises, consumers are expected to switch from traditional water purifiers to technologically advanced ones, thereby leading to the growth of the market worldwide. According to the United Nations World Water Development Report, the metropolitan population tackling water scarcity is expected to increase from 930 million in 2016 to between 1.7 and 2.4 billion people in 2050.

The growth in the urban population is rampant in emerging economies with limited capacity and other restraints on natural resources and creating water stress. Cities impact the water cycle and groundwater tables in numerous ways, mostly because they draw substantial volumes of water from groundwater and surface water sources. The growing urban population is anticipated to contribute to the increasing pollution of the water bodies, thereby driving the global demand for water treatment units. The disruptions of water distribution networks are expected to contaminate the water supply, resulting in the discharge of stormwater and untreated wastewater to consumers. This is expected to result in the spread of a variety of waterborne diseases, along with other health risks being posed to consumers.

For instance, waterborne pathogens caused 7,000 fatalities, 120,000 hospitalizations, 7 million illnesses, and USD 3 billion in healthcare expenses, according to the Centers for Disease Control and Prevention (CDC) 2022 Report. Thus, water treatment systems are becoming more popular around the world due to their capacity to produce safe water that is free of toxins, thereby fueling the market demand. Water scarcity, floods, and poor water quality affect emerging economies, such as India, Brazil, and China, disproportionately. According to the WHO, inadequate water and sanitation are held responsible for up to 80% of illnesses in these economies. Trusted water sources in a number of countries are being contaminated by pollution or rising sea levels. Water scarcity, along with the lack of proper sanitation, disproportionately affects the health, safety, and ability of humans to engage in economic activities.

All these aforementioned factors are anticipated to increase product adoption in the coming years, thereby fueling the growth of the market. Key manufacturers are focusing on collaborations, mergers, and acquisitions to expand their business and increase production capacity. They are also investing in increasing their manufacturing facilities to accommodate rising demand from the application industries, such as commercial, industrial, and residential. For instance, in March 2023, DuPont introduced PES ultrafiltration membranes and DuPont Multibore PRO. Customers who want to lower the distress of modules necessitated in water purification systems can utilize Multibore PRO as part of a multi-technology approach to municipal drinking water, desalination, or industrial water applications.

Water Treatment Systems Market Report Highlights

- The point-of-use (PoU) segment accounted for 74.4% of the global revenue share in 2022 as a result of various factors including high water contamination, increased population, and awareness about the advantages of water treatment

- The reverse osmosis (RO) systems segment accounted for a 28.2% share of the global revenue in 2022. Nitrate, phosphorus, potassium, calcium, magnesium, radium, sulfate, fluoride, and arsenic levels in water are reduced with RO

- Commercial applications are projected to witness growth at a CAGR of 8.9% from 2023 to 2030 driven by concerns about new contaminants and rising demand for high-quality drinking water coupled with the rapidly growing commercial sector

- Asia Pacific accounted for around 36.1% of the global revenue share in 2022. The ongoing industrialization & urbanization and improving public infrastructure, including healthcare, and transportation, are expected to positively affect the regional market growth during the forecast period

Table of Contents

Companies Mentioned

- 3M

- Honeywell International Inc.

- DuPont

- Panasonic

- Pentair plc

- BWT Aktiengesellschaft

- Culligan

- Watts Water Technologies Inc.

- Aquasana, Inc.

- Calgon Carbon Corp.

- Pure Aqua, Inc

- EcoWater Systems LLC

- Aquaphor

- FilterSmart

- WCC (Water Control Corp.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | July 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 35.03 billion |

| Forecasted Market Value ( USD | $ 66.98 billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |