The construction of new airports, expansion of existing airports to increase passenger and cargo handling capacities, and privatization of airports are expected to drive the growth of the airport ground handling services market during the forecast period.

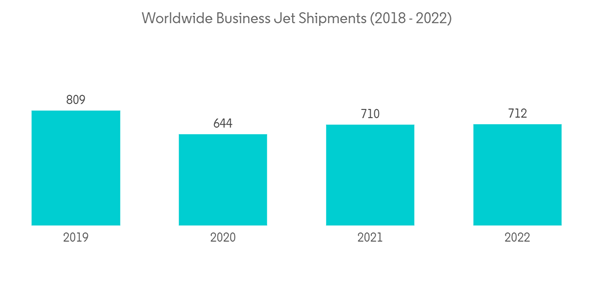

Globally, charter activities are increasing and gaining momentum. The industry is flying high due to growth in the demand from the downstream markets. The growth in purchasing private and charter aircraft is expected to increase the demand for ground-handling services in the coming years. With the rise in fuel prices, FBOs face difficulty in offering discounts. Smaller players suffer the most during such instances and can incur huge losses. This may challenge the growth of the market studied in the coming years.

Business Jet Ground Handling Services Market Trends

Aircraft Handling Services to Dominate the Market During the Forecasted Period

The aircraft handling segment dominates the market during the forecast period due to the increasing technological advances in aircraft handling systems. Aircraft handling is a service that takes care of aircraft's movement, positioning, and parking. These services include turnaround services (refueling, storage, cleaning,) pushback services, car parking services (catering, lavatory services, water services,) and flight line services (safety checks, inspections, and repairs). The US Federal Aviation Administration (FAA) has allocated a budget to various airports in the United States for the procurement of ground power units (GPUs), pre-conditioned air (PCA) units, and de-icing equipment during the forecast period.For instance, in June 2022, Charles M. Schulz-Sonoma Airport was allocated USD 220,411 to procure two mobile GPUs.Similarly, Boise Air Terminal/Gowen Field, Philadelphia International Airport, and Pittsburgh International Airport were awarded USD 1 million, USD 2.8 million, and USD 4.6 million, respectively. Such development of new equipment, as well as investments into procurement of aircraft handling equipment, is anticipated to propel the growth of the market during the forecast period.

North America Held the Highest Shares in the Market

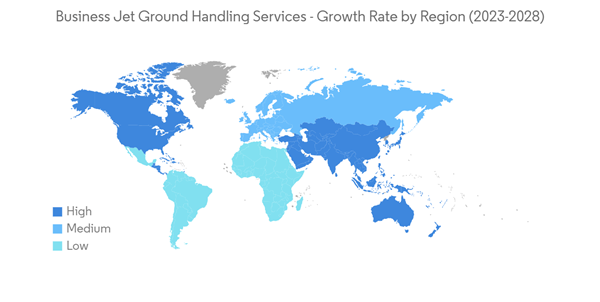

The North American region is expected to grow most during the forecast period. This is due to the rapid recovery of the aviation industry from the COVID-19 pandemic impact, along with investments of the civil aviation authority and airport operators in the region in expanding airports and developing ground handling equipment modernization. The increasing demand for business jets in the region and the growing number of airports and airfields is also a driving factor for the growth of this market. The region is also home to many affluent individuals and businesses, which drive the demand for private jet services. The increasing number of business jet operators in the region also drives the market. These operators seek efficient, cost-effective ground-handling services to ensure their operations run smoothly. Factors such as these drive the market's growth during the forecasted period.Business Jet Ground Handling Services Industry Overview

The business jet ground handling services market is semi-consolidated due to numerous local players providing a wide range of ground handling services. The key players in the market include Signature Aviation Limited, Jet Aviation AG, TAG Aviation, ExecuJet Aviation Group AG, and Aviation Services Management (ASM). However, mergers and acquisitions are expected to consolidate the market. In addition, partnerships with dealers and outsourcing activities are being done by companies to expand their global footprint. The Middle East and Asia-Pacific are projected to undergo numerous developments in the market studied. Hence, extending to the regions either by partnerships or through mergers and acquisitions may help the existing players to increase their revenues further.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- IGS Ground Services

- Signature Aviation Limited

- Jet Aviation AG

- TAG Aviation

- Aviation Services Management (ASM)

- Atlantic Aviation

- World Fuel Services Corporation

- Dnata

- Dassault Falcon Service

- RoyalJet LLC

- Universal Weather and Aviation, LLC

- ExecuJet Aviation Group AG