Key Highlights

- The COVID-19 pandemic had a limited impact on the market, and the market has stabilized since then. The sea-based C4ISR market is growing with the increase in the number of security attacks, global terrorism, increasing the requirement for integrated solutions and interoperability, the rise in asymmetric warfare, and the increasing use of technologies like active electronically scanned array (AESA) and unmanned platforms.

- Moreover, the growing anti-submarine warfare operations worldwide will lead to growth in the market during the forecast period. Increasing usage of geospatial intelligence, as well as the increasing need for short mission cycle time, will also lead to growth in the market in the years to come.

- Advanced technological developments, such as SeaFLIR 240 by Teledyne FLIR, are expected to provide growth opportunities for the market in the years to come. SeaFLIR 240 has a lightweight stabilized turret, HD payload options, and inertial navigational capabilities, and it will be helpful in Intelligence, Surveillance, and Reconnaissance (ISR) missions.

Sea Based C4ISR Market Trends

Electronic Warfare Segment to Witness Rapid Growth During Forecast Period

- Currently, electronic warfare has the highest share out of all the segments. The primary reason for the growth in this sector is the rising demand from various countries that are looking to upgrade, modernize, or replace their current EW systems.

- The Brazilian navy is in plans to upgrade its NDM Bahia (G 40) multi-purpose landing dock platform (LPD) with new surface navigation and electronic warfare systems. Moreover, the Defensor Mk3 electronic support measures (ESM) system, which was developed by Brazil's Navy Research Institute (IPqM), will be installed to identify radar emitters in a given electromagnetic environment. The system will comprise an antenna, processing unit, as well as operator interface units. On the other hand, the UK Royal Navy is in plans to upgrade its electronic warfare capabilities under a UK Defense procurement program known as MEWP.

- Companies, such as THALES and BAE Systems Plc, have been contracted to provide the necessary electronic warfare upgrades to the UK Royal Navy. The three companies will deliver critical components of electronic surveillance sensors, electronic warfare command and control, and electronic warfare operational support to the UK Royal Navy. Similarly, in March 2022, the US Naval Sea Systems Command awarded a contract modification to Leidos to install the AN/SQQ-89A(V)15 undersea combat system on the US Navy's combat vessels. The contract was worth USD 81.1 million. The AN/SQQ-89A(V)15 will provide the surface vessels with the capabilities to search, detect, classify, localize, and track underwater contacts (like submarines, sea mines, torpedoes, etc.).

- In October 2022, Indian company Centum Electronics Ltd and Rafael Advanced Systems Ltd, an Israeli company, signed a memorandum of understanding (MoU) for jointly developing a new electronic warfare (EW) system for the Indian Navy and Indian Coast Guard. The MoU encompasses knowledge sharing and manufacturing in India, and also the deal includes life cycle support of the already existing EW systems. The upcoming developments being done by various countries in terms of electronic warfare will increase the focus on this segment, and this will be the reason for its expected high CAGR.

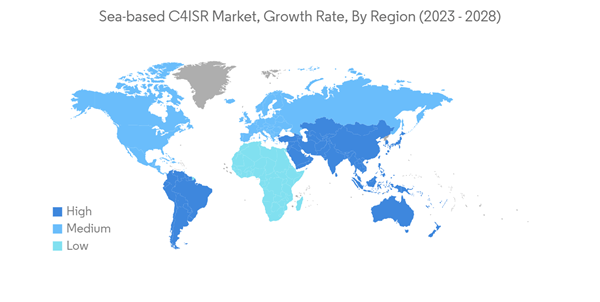

Latin America to Witness Highest Growth in Market Share

- In the sea-based C4ISR market, regionally, South America is generating the highest revenue at present. South America is witnessing an increase in the number of developments related to sea-based C4ISR. According to the latest Strategic Plan, the Plano Estratégico da Marinha2040, released by the Navy in September 2020, the Navy is planning to focus more heavily on operations in the Southern Atlantic Ocean to counter threats such as piracy, illegal fishing, organized crimes, urban conflicts, natural resources dispute, cyber warfare, terrorism, the illegal access to knowledge, pandemics, natural disasters, and environmental issues.

- Under this plan, the Navy plans to acquire anti-submarine (ASW) and reconnaissance helicopters as well as unmanned aerial vehicles (UAVs) for surveillance applications. Brazil has been upgrading its naval strength by taking delivery of offshore patrol vessels. For instance, in April 2022, the Brazilian Navy accepted the delivery of its last A-4 Skyhawk, modernized by Embraer.

- The Brazilian Navy's modernized aircraft got new power generation, navigation, weapons, tactical communication, computers, sensor systems, state-of-the-art multi-mode radar, and the latest operating system. Moreover, to the modernization, the renewal of the cell was carried out, enhancing the aircraft's useful life. Also in April 2023, at the LAAD 2023, the Brazilian Navy and EDGE, UAE-based technology and defense group, signed a joint development agreement for co-creation and business opportunities for a long-range anti-ship missile and a supersonic missile. EDGE will contribute its technological knowledge of smart weapons and electronic warfare for the development of high-performance, low-cost missiles. The Brazilian Navy will also deploy the new submarines to patrol the country's offshore deep waters that host vast oil and gas reserves. Thus, various upcoming developments in the South American region will lead to a positive impact on the growth of the market.

Sea Based C4ISR Industry Overview

The sea-based C4ISR market is moderately consolidated with the major players, like Lockheed Martin, General Dynamics Corporation, Northrop Grumman, L3Harris, and BAE Systems plc, accounting for a major market revenue share. The market leaders are trying to solidify their positions through constant R&D and signing long-term contracts with the global defense forces to modify their product offerings as per the end-user requirements. In March 2022, Leonardo was selected by the Qatari Emiri Naval Forces (QENF) to provide a Naval Operation Centre (NOC) to provide command, control, and coordination of operations at territorial water, Exclusive Economic Zone (EEZ), and adjacent waters simultaneously to enhance cooperation with various national agencies in charge of maritime security.Also, in January 2022, Elbit Systems Sweden was Awarded a Contract to Supply Combat Management Systems to the Royal Swedish Navy, following a competitive tender process with a contract from the Swedish DefenceMaterial Administration (FMV) to supply Albatross Combat Management Systems (CMS) for the Royal Swedish Navy. The majority of the companies saw an increase in the sale of C4ISR products leading to higher revenues. The sea-based C4ISR market is expected to experience a lot of activity during the forecast period, primarily due to the ongoing territorial disputes in the China Sea. The US, Japan, South Korea, India, as well as the UK are expected to be a few of the biggest spenders during the forecast period. China and India have been investing heavily in developing their sea-based warfare capability with modern ships, aircraft carriers, and submarines. This rapid military expansion of China has forced neighbors to upgrade and procure equipment to tackle the Chinese threat in the Indian and the Pacific Ocean.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- General Dynamics Corporation

- CACI International Inc.

- BAE Systems plc

- Booz Allen Hamilton Holding Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Kratos Defense & Security Solutions, Inc.

- Leidos, Inc.

- Rheinmetall AG