The COVID-19 pandemic had a slight impact on the Defense Aircraft Materials Market. For a minor part of 2020, the global lockdown and social distancing norms have led to supply chain constraints and a shortage of raw materials across the world. With the gradual relaxation of lockdown and the reduced impact of the pandemic, the supply chain of the materials was restored, and production rates started coming back to normal.

On the other hand, the defense spending and the budgets allocated towards aircraft procurement continued to increase in 2020 and 2021, despite the impact of the pandemic. The growing military conflicts between different countries and the rising demand for military aircraft among major countries are driving the demand for aircraft materials used in various aircraft across the world.

Emerging fabrication technologies and manufacturing processes are envisioned to improve the current properties of the military aircraft materials and foster the impetus for developing new alloys for manufacturing high-performing aircraft parts and airframe structures.

Key Market Trends

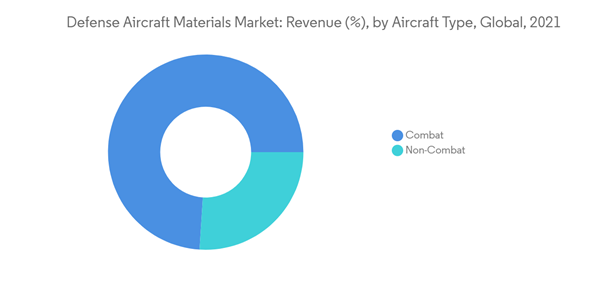

Combat Aircraft Segment to Dominate the Market During the Forecast Period

Combat aircraft are vital for protection against aerial threats, as they can engage in aerial warfare and ground-support missions. Global military powerhouses, such as the United States, the United Kingdom, China, France, and Japan, are vying to achieve a profound reconceptualization of modern aerial warfare techniques by fostering the indigenous development of the fifth generation and the envisioned sixth-generation combat aircraft. The F-35 Joint Strike Fighter (JSF) is one of the most advanced combat aircraft currently in service. Lockheed Martin delivered 134 F-35 jets in 2019, which was reduced to 123 jets in 2020 due to the pandemic. In 2021, the company delivered 142 F-35 fighter jets to the United States and its allies, three more than previously planned. Constellium SE supplies the corrosion-resistant 7050 and 7140 alloys used in the F-35 airframe. It is also a major supplier of the Airware 2297 and 2098 alloys used in the bulkheads, skins, and other key structural components of the Boeing F-18 and Lockheed Martin F-16 aircraft programs. UAE, Japan, Qatar, the UK, Singapore, and Germany are some of the countries that have either placed orders or are planning to procure combat aircraft during the forecast period. With the growing demand for various materials that could be used in developing and building next generation aircraft, major countries have been investing in testing new materials to be used for implementation in aircraft. Also, with the growing emphasis on stealth, several sophisticated materials are being used in combat aircraft, contributing to the increase in revenues. Furthermore, on a global scale, the demand for combat aircraft greatly outnumbers the demand for non-combat aircraft, hence the segment is envisioned to dominate the market in focus during the forecast period.

North America to Continue its Dominance in the Market

North America region currently dominates the market and is anticipated to continue its dominance over the market majorly due to the robust military aircraft procurement plans of the United States. The country is currently the largest military spender in the world. According to the Stockholm International Peace Research Institute (SIPRI), the US spent USD 801 billion on its military in 2021, valued at approximately 3.5% of its GDP, which accounted for about 38% of the global military expenditure. Furthermore, the revised budget estimates for 2022 amounted to USD 782 billion, a 5.6% increase over the 2021 budget estimates. The budget earmarks about USD 15.7 billion for the Air Force’s aircraft procurements. Furthermore, the FY 2023 budget request of the Air Force is approximately USD 169.5 billion dollars, of which USD 18.5 billion is sought for aircraft procurements. On the other hand, Canada spent a relatively low 1.3% of its GDP on its defense as of 2021. In line with the advancing technologies, the region’s defense equipment companies have been expanding to cater to the potential need for lighter aircraft. For instance, in April 2022, Raytheon Technologies’ Collins Aerospace created a new business unit that will allow the company to build critical parts for next-generation military aircraft and hypersonic weapons. The unit will work towards developing new types of composite materials that could be used to make futuristic aircraft and missiles lighter and make them able to resist extreme forces and temperatures. Canada has also been known to use lighter composite materials to manufacture aircrafts for different purposes. For instance, the country’s Diamond Aircraft Canada has been using major composite materials to create, stronger, lighter, and corrosion-resistant structures to embed them into the new aircraft. Such factors are expected to drive the growth of the market in North America during the forecast period.

Competitive Landscape

AMG Advanced Metallurgical Group N.V., Solvay SA, Constellium SE, Hexcel Corporation, and Toray Industries Inc., are some of the major players offering aircraft materials to defense aircraft manufacturers across the world. The rapidly evolving aerospace industry calls for a solid supply chain, where transparency and traceability are of paramount importance, especially since the aircraft OEMs face mounting market pressures to increase production rates through continuous improvement and automation while keeping an eye on sustainability and energy/cost efficiency. Thus, a reliable, standardized production process and consistent data capture throughout the production cycle are crucial to ensure repeatability, while ensuring the quality of the finished materials. However, the regional market is consolidated, as strategic collaborations have become frequent. The stringent safety and regulatory policies in the defense sector are expected to restrict the entry of new players. Nevertheless, the growth in the focus on indigenous production of aircraft and localization of supply chains is expected to increase the number of players in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Hexcel Corporation

- Allegheny Technologies Incorporated

- AMG Advanced Metallurgical Group N.V.

- Arconic Corp.

- Constellium SE

- Henkel Singapore Pte. Ltd

- Solvay SA

- DuPont de Nemours, Inc.

- Toray Industries, Inc.

Methodology

LOADING...