Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

With strong support from schemes like the Ministry of New and Renewable Energy’s (MNRE) subsidies and state-level initiatives, residential and commercial sectors are increasingly shifting toward solar water heating systems. Rapid urbanization, coupled with growing environmental concerns, is further driving demand in tier-1 and tier-2 cities. Technological advancements, such as improved vacuum tube collectors and better storage tanks, are enhancing efficiency and reliability. Southern states like Tamil Nadu and Karnataka are major contributors due to favorable climate and policy support.

Key Market Drivers

Government Incentives and Supportive Policies

One of the most significant drivers of the solar water heater market in India is the extensive support from government policies and financial incentives aimed at promoting renewable energy usage. The Ministry of New and Renewable Energy (MNRE) has been instrumental in encouraging the adoption of solar water heating systems by offering capital subsidies, particularly for domestic and institutional users. The Haryana Renewable Energy Development Agency (HAREDA) lists 2024-25 benchmark costs for solar water heaters as USD 287 for 100 LPD flat plate collectors and USD 204 for 100 LPD evacuated tube systems. These systems can save up to 70-80% on energy bills and reduce around 1.5 tonnes of CO₂ annually.Several state governments, including those of Maharashtra, Karnataka, and Tamil Nadu, offer additional incentives such as interest-free loans, rebates on electricity bills, and exemptions from electricity duty for those adopting solar water heaters. These incentives lower the upfront cost barrier for consumers and accelerate market penetration. Furthermore, solar water heaters have been mandated in certain regions for use in residential buildings, hotels, hospitals, and hostels, helping to drive demand. The inclusion of solar water heating systems under sustainable building certifications like GRIHA and LEED also promotes adoption in the commercial real estate sector. As India works toward achieving its renewable energy targets and reducing carbon emissions under international climate agreements, policies supporting decentralized and clean energy technologies like solar water heaters will remain a key market stimulant.

Key Market Challenges

High Initial Investment and Affordability Concerns

One of the primary challenges facing the India solar water heater market is the high upfront cost associated with installation, which continues to deter many potential users, especially in the lower and middle-income segments. Although solar water heaters offer significant long-term savings, the initial cost of purchasing and installing a quality system - including the solar collector, storage tank, mounting structure, and plumbing - can be relatively high compared to conventional electric or gas geysers. For many households and small businesses, especially in rural or economically weaker sections, this initial capital outlay can be unaffordable or perceived as risky.Despite government subsidies and incentives, lack of awareness about financial schemes or bureaucratic delays in subsidy disbursement often make them inaccessible or ineffective. In addition, financing options such as loans for solar water heating systems are limited or underutilized due to lack of partnerships between manufacturers and banks. While commercial and institutional users may see quicker returns on investment, the price sensitivity in the residential market remains a major roadblock. Until more cost-effective solutions or widespread financing models are introduced, affordability will continue to be a significant barrier to widespread adoption.

Key Market Trends

Shift Toward Evacuated Tube Collector (ETC) Technology

A major trend in the India solar water heater market is the increasing preference for Evacuated Tube Collector (ETC) systems over traditional Flat Plate Collector (FPC) models. ETC systems are gaining popularity due to their superior efficiency, especially in regions with colder climates and limited sunlight during parts of the year. Unlike FPCs, ETCs use vacuum tubes that reduce heat loss, ensuring better performance in diffused or low solar radiation conditions. They are also lighter in weight, easier to install, and often more cost-effective, making them highly attractive for both residential and commercial users.The growing demand for ETCs is also driven by advancements in manufacturing that have reduced costs and improved durability. Manufacturers are increasingly focusing on product innovation in ETC systems, offering designs with anti-freeze features and better insulation. Urban consumers, builders, and even institutions are now favoring ETCs for their space-saving design and faster heat retention. As consumer awareness grows and installation techniques become more refined, ETC systems are gradually becoming the standard in India’s solar water heater market, especially in northern and eastern states that face seasonal climate variations.

Key Market Players

- V-Guard Industries

- Racold Thermo Private Limited

- EMMVEE Solar System Private Limited

- Sudarshan Saur Shakti Pvt. Ltd

- Jain Irrigations Systems Ltd

- Bosch Limited

- Supreme Solar Systems Private Limited

- Nuetech Solar Systems Private Limited

- Akson’s Solar Equipments Pvt Ltd.

- Anu Solar Power Private Limited

Report Scope:

In this report, the India Solar Water Heater Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Solar Water Heater Market, By Product Type:

- Active Solar Water Heating Systems

- Passive Solar Water Heating Systems

India Solar Water Heater Market, By Collector Type:

- Glazed

- Unglazed

India Solar Water Heater Market, By End-Use:

- Residential

- Commercial

India Solar Water Heater Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Solar Water Heater Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- V-Guard Industries

- Racold Thermo Private Limited

- EMMVEE Solar System Private Limited

- Sudarshan Saur Shakti Pvt. Ltd

- Jain Irrigations Systems Ltd

- Bosch Limited

- Supreme Solar Systems Private Limited

- Nuetech Solar Systems Private Limited

- Akson’s Solar Equipments Pvt Ltd.

- Anu Solar Power Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | August 2025 |

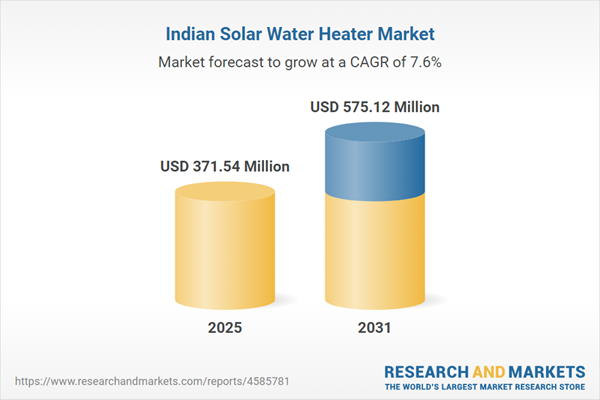

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 371.54 Million |

| Forecasted Market Value ( USD | $ 575.12 Million |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |