The melanoma diagnostics and therapeutics market is estimated to show good growth due to the increasing incidences of melanoma cases, rising governments initiatives for early detection and skin cancer treatment and rising technological advancements. Furthermore, the launch of advanced diagnostics and therapeutics for Melanoma treatment is also projected to boost the market growth. For instance, in March 2022, Bristol Myers Squibb announced that it has received United States Food and Drug Administration approval for OpdualagTM (nivolumab and relatlimab-rmbw), a new, first-in-class, fixed-dose combination of nivolumab and relatlimab, administered as a single intravenous infusion, for the treatment of adult and pediatric patients 12 years of age or older with unresectable or metastatic melanoma.

According to an article published in May 2019, skin cancer is the most frequent type of cancer, with one in every three malignancies diagnosed being skin cancer, according to the World Health Organization (WHO). Every year, around two million people are diagnosed with non-melanoma skin cancers and 132,000 with melanoma, and the frequency of the disease continues to rise. The main cause of increased skin cancer rates is ozone depletion, which means more harmful UV radiation reaches the Earth's surface; the WHO estimates that a 10% decline in ozone levels leads to an additional 300,000 instances of skin cancer. Also, as per the American Society of Clinical Oncology (ASCO), an estimated 324,635 people were diagnosed with melanoma globally in 2020 and an estimated 57,043 people worldwide died from melanoma in the same year.

Key Market Trends

Immune Therapy is Anticipated to be the Dominant in Therapeutics Segment during the Forecast Period

Immunotherapy is the use of medicines to stimulate a person immune system to recognize and destroy cancer cells effectively. There are several types of immunotherapies available that can be used to treat melanoma cancer.

Immunotherapy is found to hold the largest share that can be attributed to the effectiveness of drugs used in immunotherapy and an increase in their approvals. There are currently many FDA-approved immunotherapy options for melanoma that helps in the growth of the market. For instance, In February 2021, the United States Food and Drug Administration has approved the PD-1 inhibitor Libtayo (cemiplimab-rwlc) as the first immunotherapy indicated for patients with advanced basal cell carcinoma (BCC) previously treated with a hedgehog pathway inhibitor (HHI) or for whom an HHI is not appropriate. Libtayo is now approved for patients with advanced stages of the two most common skin cancers in the United States. Also, in June 2020, the United States Food and Drug Administration approved pembrolizumab (KEYTRUDA, Merck & Co., Inc.) for patients with recurrent or metastatic cutaneous squamous cell carcinoma (cSCC) that is not curable by surgery or radiation. There have also many advances in using immunotherapy drugs known as checkpoint inhibitors to treat melanoma. Thus the strong emerging pipeline for melanoma treatment is expected to drive the immunotherapy segment over the forecast period.

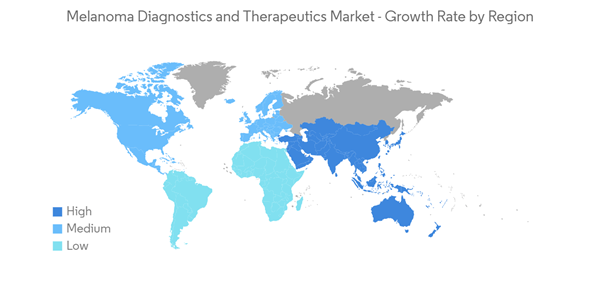

North America Dominates the Melanoma Diagnostics and Therapeutics Market

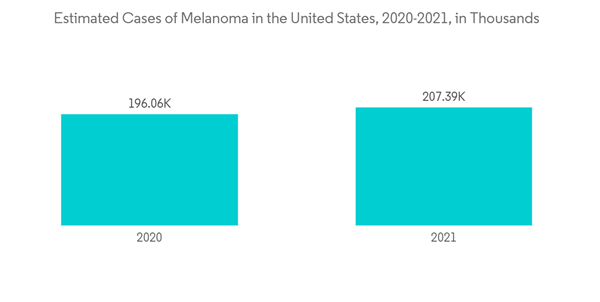

Over the previous decade, the incidence of skin cancer has increased in North America, as has the number of skin cancer biopsies. The COVID-19 epidemic was unprecedented, and it resulted in a significant drop in non-urgent medical visits. Early in the COVID-19 epidemic, there was a significant decrease in skin biopsies. With the commencement of COVID-19 cases, a precipitous decline in total skin biopsies, biopsies for KC, and melanoma was found, according to an Ontario-based research study titled "Impact of the COVID-19 pandemic on skin cancer diagnosis: A population-based analysis" released in March 2021. Over the next 10 weeks, there was a significant improvement in biopsy rates. However, a considerable backlog of predicted cases remained 28 weeks after lockdown, compared to 2019.

North America holds a dominant share of the market owing to the rising incidence of melanoma and other skin cancers cases in the region. According to the American Academy of Dermatology Association (AAD) 2022, Skin cancer is the most common cancer in the United States. AAD also estimated that one in five Americans will develop skin cancer in their lifetime. Also, approximately 9,500 people in the United States are diagnosed with skin cancer every day. Also, according to the American Cancer Society, about 99,780 new melanomas will be diagnosed in the United States in 2022, and around 7,650 people are expected to die of melanoma in the same year. These statistics highlight the need for drugs that help in the management of melanoma over the coming years.

The United States government has also developed favorable reimbursement policies for treatment of melanoma diseases that is an attempt to fulfil unmet patient needs. This is expected to provide a healthy platform for growth to the North American market. Furthermore, the presence of numerous new players is expected to drive the overall market.

Competitive Landscape

The market is highly competitive in nature, with many key players involved in market expansion, partnerships, new product development, and R&D to increase market penetration. There are also several products are under clinical trials which are expected to receive approval and thus the market is likely to continue witnessing high competitive rivalry over the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Diagnostics

- Amgen, Inc.

- Bristol-Myers Squibb

- F. Hoffman-La Roche Ltd.

- GlaxoSmithKline PLC

- Merck & Co., Inc

- Novartis AG

- Pfizer, Inc.

- DermTech

- bioMérieux SA

- Dermlite

- Canfield Scientific, Inc.

- Caliber Imaging & Diagnostics, Inc.