Because most elective treatments were postponed due to the COVID-19 pandemic, treatment of hematologic malignancies was also impacted significantly.However, delayed treatment is not recommended for severe diseases, especially acute leukemia, and thus, necessary guidelines and measures were put forth recently to allow leukemia treatments during the pandemic with all protective measures. As per the study published in December 2021 by the National Library of Medicine, there were 4.1 million cancer-related encounters, 3.9 million relevant procedures, and 251,647 new cancer cases diagnosed. Compared to the annual averages in 2018 through 2019, colonoscopies in 2020 decreased by 45%, whereas prostate biopsies, chest computed tomography scans, and cystoscopies decreased by 29%, 10%, and 21%, respectively. New cancer diagnoses decreased by 13% to 23%. However, the market growth is stabilizing in the current scenario after COVID-19 as the worldwide restrictions have eased and disease screening services have been resumed.

The leukemia therapeutics market is mainly driven by a rise in the prevalence of leukemia, a surge in awareness related to early detection and treatment of leukemia, and rising investment in the healthcare sector. A significant number of the population across the globe suffers from leukemia. For instance, as per the statistics by GLOBOCAN 2020, leukemia accounted for 475,000 cases for both sexes of all ages in 2020; these cases are expected to increase and reach up to 692,000 by 2040, worldwide. In addition, as per the 2021 statistics from the Leukemia & Lymphoma Society, an estimated 397,501 people were living with or in remission from leukemia in the United States. Hence, the overall statistics show that there is a huge number of people that suffer from leukemia, which is expected to boost the growth of the market in the forecast period.

Furthermore, the increasing number of investments being made in research and development has enabled several pharmaceutical and biotechnology companies to focus on and develop novel and effective drugs. For instance, in April 2021, the Leukemia & Lymphoma Society Therapy Acceleration Program (LLS TAP) reported five new investments aimed at speeding up the development of new and improved immunotherapies for the treatment of blood cancers in the United States. Over the past few decades, the LLS has spent more than $100 million on grants and TAP investments to move forward innovative ways to use cellular immunotherapies to fight blood cancers.

Additionally, in May 2022, Servier received US FDA approval for TIBSOVO (ivosidenib tablets) in combination with azacitidine for the treatment of patients with newly diagnosed IDH1-mutated acute myeloid leukemia (AML) in adults 75 years of age or older, or who have comorbidities that preclude the use of intensive induction chemotherapy. Moreover, in March 2022, Sumitomo Dainippon Pharma Oncology, Inc. will dose patients in a Phase I/II study of DSP-5336, an inhibitor of melanin binding to mixed-lineage leukemia (MLL) proteins, in patients with relapsed or refractory acute myeloid leukemia (AML) or acute lymphoblastic leukemia (ALL). Thus, increasing clinical trials by the key players is expected to boost the growth of the market over the forecast period.

As a result of the aforementioned factors, the market is expected to grow. However, the high treatment costs and stringent regulatory environment restrained market growth over the forecast period.

Leukemia Therapeutics Market Trends

Chemotherapy is Expected to Register a Significant Growth Over the Forecast Year

Chemotherapy is a drug treatment that uses powerful chemicals to kill fast-growing cells in the body. Chemotherapy is most often used to treat cancer since cancer cells grow and multiply much more quickly than most cells in the body.The primary factor contributing to the growth of the chemotherapy segment is the rising incidence of leukemia cases. As per the 2021 statistics from Blood Cancer UK, children can develop AML. As per the same above-mentioned source, in the United Kingdom, around 100 children a year are diagnosed with the condition.

Many companies are also focusing on developing breakthrough products for the treatment of leukemia to maintain their competitive advantage and penetrate new regional markets. Furthermore, chemotherapy is considered the main treatment option for most individuals with leukemia. For instance, in December 2021, BDR Pharma launched India’s first generic, Midostaurin, under the brand name MSTARIN. Midostaurin is a single-agent maintenance therapy for adults with newly diagnosed leukemia who are FLT3 mutation-positive.

Thus, because of the things listed above, the market segment is likely to grow over the next few years.

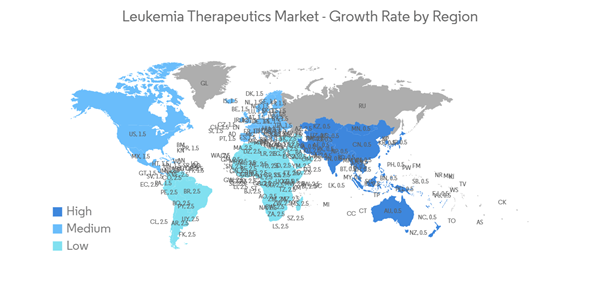

North America Holds the Large Share in the Leukemia Therapeutics Market Over the Forecast Period

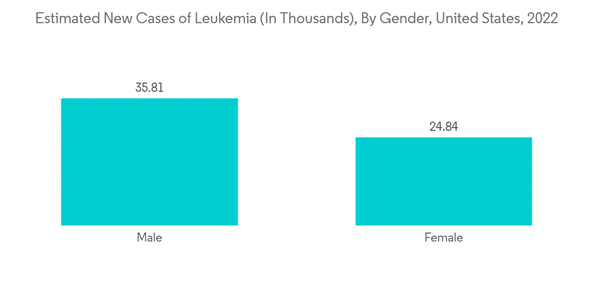

The North American region holds a large share of the leukemia therapeutics market due to the presence of high incidence rates of leukemia and advancements in the treatment of leukemia. According to American Cancer Society estimates, in January 2022, about 60,650 new cases of leukemia were diagnosed, and there were around 11,450 deaths due to acute myeloid leukemia in the United States in the year 2022. Moreover, according to the American Society of Clinical Oncology in 2021, acute myeloid leukemia is a malignancy that accounts for around 1% of all cancers. In the United States, an estimated 20,240 people of all ages (11,230 men and boys and 9,010 women and girls) were diagnosed with this disease in 2021. Statistics show that a big part of the adult population is affected, and they need good medical care to make them live longer.Furthermore, beneficial government initiatives and an increase in the number of research partnerships are some of the drivers expected to drive market growth. For instance, in November 2022, the Canadian Cancer Society (CCS) announced a partnership with the CQDM, the Cole Foundation, and Oncopole, pôle cancer du FRQS, for the creation of a new four-year grant program with a value of up to USD 5 million. The partnership shows that CCS and its partners are funding research projects in Quebec. This program will accelerate the development of platforms, tools, and treatments to support advances in the continuum of pediatric cancer care: prevention, diagnosis, and treatment.

Furthermore, in June 2021, Jazz Pharmaceuticals plc received US FDA approval for Rylaze (asparaginase Erwinia chrysanthemi) for use as a component of a multi-agent chemotherapeutic regimen for the treatment of ALL or LBL in pediatric and adult patients one month of age and older who have developed hypersensitivity to E. coli-derived asparaginase. Also, in January 2022, the US Food and Drug Administration (FDA) gave the company an orphan drug designation for OM-301, which was made by Oncolyze Inc. to treat AML.

Thus, due to the above-mentioned developments, the market is expected to see robust growth.

Leukemia Therapeutics Market Competitor Analysis

The Leukemia Therapeutics Market is competitive. Product approvals are a key strategy adopted by key players to enhance their dominance in this market. Some of the major players in the market are Amgen Inc., AstraZeneca Plc, Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd., Incyte Corp., Johnson & Johnson, Novartis, Pfizer Inc., and Sanofi, which are providing these products across the globe.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amgen Inc.

- AstraZeneca plc

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd.

- Incyte Corp

- Johnson & Johnson

- Novartis International AG

- Pfizer Inc.

- Sanofi S.A.

- Teva Pharmaceutical

- Astellas Pharma

- Otsuka Holdings Co., Ltd.

- BeiGene