In North America diabetes incidence for type 2 diabetes as well as other diabetes, forms were numerically higher in individuals with Covid-19. Insulin resistance and impaired insulin secretion have been described in individuals without diabetes history who recovered from SARS-CoV-2 infections. It has been suggested that diagnosis and treatment of post-Covid syndrome require integrated rather than disease-specific approaches.

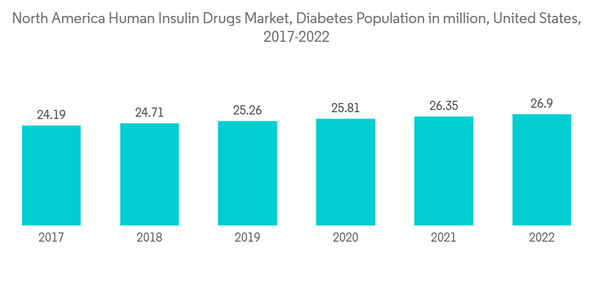

North America dominates the global insulin therapeutics market, owing to the high prevalence of diabetes in the region because of the sedentary lifestyle and the launch of new drugs in the region. The United States is expected to grow tremendously during the forecast period, owing to factors, such as the high prevalence of obesity and increasing awareness regarding diabetes care in the region.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

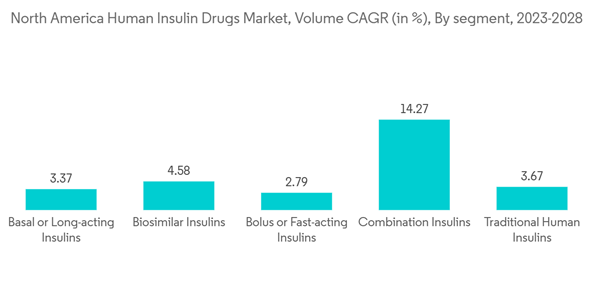

North America Insulin Market Trends

Basal/Long Acting Insulins Holds The Highest Market Share in Current Year

The US Food and Drug Administration (FDA) approved Lantus in April 2000. Lantus is a man-made form of the hormone insulin that is produced in the body. Insulin is a hormone that works by lowering levels of glucose (sugar) in the blood. Insulin glargine is a long-acting insulin that starts to work several hours after injection and keeps working evenly for 24 hours. Lantus is for use in adults with type-1 or type-2 diabetes and in children at least 6 years old with type-1 diabetes. For type-1 diabetes, Lantus is used together with short-acting insulin given before meals. Lantus and Januvia, two treatments for diabetes, are some of the highest-selling drugs of all time and represent some of the greatest breakthroughs in diabetes control.In 2021, the United States was the largest market for Lantus, accounting for more than 58% of market revenues. However, the biosimilars for Lantus may not present it with competitive challenges currently. The loss of exclusivity for Lantus may not result in a near-term disruption of the market for it. However, there will be additional pricing pressure and some loss of market share that will continue and may increase over time.

United States Holds Highest Market Share in Current Year

Among North American countries, the United States dominates around 94% of the total North American human insulin drug market. This is mainly due to the high diabetes prevalence in the country. The United States records the highest healthcare expenditure globally, and it also has a higher adoption of advanced therapeutics. The United States accounts for the highest sales of long-acting insulin, Lantus, across the North American region. Most diabetic drug manufacturing companies consider the country a critical market for improving overall global sales. Lantus is the most commonly administered basal insulin across the world, accounting for a dominant share in the United States market. Together, Eli Lilly and Boehringer Ingelheim are working to develop and market Basaglar (Insulin Glargine). Insulin Tregopil, an oral prandial insulin tablet, is being developed by Biocon to treat type-1 and type-2 diabetes mellitus. Fast-acting oral insulin holds the potential to revolutionize T1D care by enhancing post-prandial glucose control with fewer side effects and higher adherence. In order to provide a more practical, efficient, and secure way to administer insulin therapy, Oramed Pharmaceuticals Inc., a clinical-stage pharmaceutical company focused on the development of oral drug delivery systems, is attempting to bring the first oral insulin product to market.The United States accounts for the highest sales of Humalog across the world, with over 56% of the market share. The majority of diabetes drug manufacturing companies consider the country a critical market for improving overall global sales. In the United States, Humalog is available in different varieties under names like Humalog Mix 75/25, Humalog U-100, Humalog U-200, and Humalog Mix 50/50 for the treatment of diabetes.

Therefore, owing to the aforesaid factors, the growth of the studied market is anticipated in the North American region.

North America Insulin Industry Overview

The North American human insulin market is highly fragmented, with three major manufacturers having a large market share. In the United States, there are no other players except Novo Nordisk, Sanofi, and Eli Lilly. In the remaining countries, the manufacturers confine themselves to other local or region-specific manufacturers. Mergers and acquisitions that happened between the players in the recent past helped the companies strengthen their market presence. Eli Lilly and Boehringer Ingelheim have an alliance to develop and commercialize Basaglar (insulin glargine).Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Novo Nordisk A/S

- Sanofi S.A.

- Eli Lilly and Company

- Biocon Limited

- Pfizer Inc.

- Wockhardt

- Julphar

- Exir

- Sedico