The pandemic affected the market growth. As per the article published in the National Library of Medicine in August 2021, in comparison to the rest of the world, Europe experienced a higher decline in total procedure volumes, with almost all modalities experiencing the highest drops in Southern Europe. Moreover, the global and regional players in the studied market focused more on product development during the pandemic. For instance, BioSig Technologies, Inc. presented data after completing a blinded trial in 2021 for its PURE EP System.

In August 2022, the company extended product commercialization, a computerized system for collecting, digitizing, amplifying, filtering, measuring, and calculating electrocardiographic and intracardiac signals. It also records and stores the signals. Hence, development activities by the major players during the pandemic period fueled the studied market growth during the pandemic phase. Therefore, even though the market growth was hindered during the initial pandemic phase, the market witnessed growth.

The major factors driving the market growth include:

Key Highlights

- The increasing use of teleradiology.

- Ease of use.

- Portability of cardiac arrhythmia monitoring devices.

Additionally, government assistance in the form of grants fosters industry expansion over time. For instance, the development of the CUOREMA project by the UK-based health technology business my mhealth and partners received a USD 2.6 million (EUR 2.5 million) Eurostars Grant in May 2021. Creating a novel, patient-centered cardiac rehabilitation support system is the primary goal of the CUOREMA project. Thus, such initiatives are expected to increase market growth. Additionally, the number of smokers in Spain is on the rise.

World Population Review 2022 data indicates that around 27.90% of Spanish people smoke daily. An increasing number of smokers also leads to increased heart disease, accelerating the demand for cardiovascular monitoring devices, which will boost market growth during the forecast period. A report from the European Society of Cardiology 2021 has indicated that 95% of all COVID-19 deaths in the Europe region had at least one underlying condition, with cardiovascular disease being the leading comorbidity (65%). As a result of COVID-19, people with cardiovascular symptoms were reluctant to call an ambulance or go to the hospital. The pandemic has seen a 50% decrease in people presenting at hospitals and other healthcare facilities with heart attacks or stroke symptoms. Thus, such scenarios will increase the demand for monitoring devices to augment market growth.

However, a lack of awareness will hinder the market growth during the forecast period.

Europe Cardiac Arrhythmia Monitoring Devices Market Trends

Holter Monitoring Devices Segment is Expected to Hold a Significant Market Share Over the Forecast Period

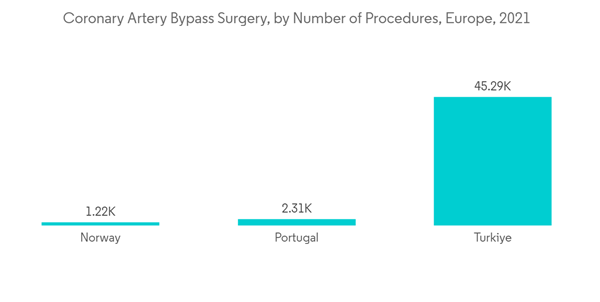

A Holter monitor is a small, wearable device that records the heart's rhythm. The Holter monitoring devices segment will have a significant share in the market as suffering patients can use these devices for longer durations to diagnose sporadic symptoms. They also offer faster and more convenient monitoring to increase patient compliance and are likely to enhance the treatment outcome. Furthermore, several advancements are taking place in the cardiac arrhythmia monitoring devices market. It is a rapidly growing and driving cardiac arrhythmia monitoring devices market. For instance, the German Heart Surgery Report published a report in June 2021 by the National Library of Medicine. The report states there were 843 assist device implantations, including left/right/biventricular assist devices, total artificial devices, 29,444 isolated coronary artery bypass grafting procedures, 35,469 isolated heart valve procedures, and 35,469 isolated heart valve procedures registered in Germany. Since patients undergoing such treatment require constant monitoring thus, increasing surgeries will increase the market growth of Holter monitoring. Hence, the market will grow due to increasing demand for these devices and rising cardiovascular disorders.France is Expected to Hold a Significant Market Share Over the Forecast Period

The cardiac arrhythmia monitoring devices in France are growing due to the increased alcohol consumption in the country and factors such as initiatives by crucial market players entering the country. As per the data from Organization for Economic Co-operation and Development (OECD), in 2022, in France, over 40% of people and almost one in ten are overweight (including obese), and the rate of overweight people will rise by an additional 10% in the following ten years. Obesity is one of the significant risk factors for heart disease, and the market studied will witness growth due to increasing obesity in the country. Similarly, according to World Population Review data, as of 2022, around 11.10% of men and 3.10% of women in France are alcoholics. As alcoholism increases heart disease chances, it significantly impacts the market for intracardiac echocardiography. Additionally, according to the United Nations Population Fund's World Population Dashboard's Statistics 2021, in France, there are about 21.1% of people aged 65 years and above. As the older population is most likely to get affected by cardiac diseases, the need for heart failure treatment devices will increase over the forecast period in the country, thus driving the market.The collaborations among the market players to strengthen their position are also boosting growth. For instance, in June 2021, eDevice SA, a health technology company focused on telemedicine, and remote patient monitoring solutions have taken over the commercialization of TwoCan Pulse from Boston Scientific in France. eDevice has developed this innovative telecardiology monitoring system in the French market. TwoCan Pulse was explicitly designed to allow cardiologists to remotely monitor patients who exhibit symptoms of potential congestive heart failure. Such launches and collaboration is propelling the growth of the market segment.

Thus, the factors mentioned above contribute to France's studied market growth.

Europe Cardiac Arrhythmia Monitoring Devices Industry Overview

The European cardiac arrhythmia monitoring devices market consists of several major players. The companies are implementing specific strategic initiatives, such as mergers and acquisitions, new product launches, and partnerships, that help them strengthen their market position. For instance, in February 2021, CardiacSense received the CE mark to market and sell a medical grade watch which can detect and remotely monitor atrial fibrillation (AF) and heart rate variability (HRV). Some key market players are ZOLL Medical Corporation, Koninklijke Philips NV, GE Healthcare, iRhythm Technologies Inc., and Abbott Laboratories.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- ACS Diagnostics, Inc.

- Biotronik, Inc.

- ZOLL Medical Corporation

- GE Healthcare

- Hill-Rom Holding Inc

- iRhythm Technologies Inc.

- Koninklijke Philips NV

- Medi-Lynx Cardiac Monitoring LLC

- Medtronic PLC

- Preventice Solutions, Inc