Amid the COVID-19 pandemic, the health systems of countries were majorly dependent on online services. Healthcare professionals were taking up a consultation with the patients through virtual sources. This was mainly due to the strict lockdown regulations imposed by various governments during the initial stages of the pandemic. Moreover, due to the COVID-19 outbreak across the world, clinical decision support systems played a vital role in assisting patient resources and services. For instance, the Journal Plos One article published in March 2021 mentioned that the development of decision support tools for real-time clinical diagnosis of COVID-19 is of prime importance of assist patient triage and allocating resources for patients at risk. Several countries are increasingly providing online services, which is boosting the market. Additionally, various market players launched clinical decision support systems for the management of COVID-19 data and insights. For instance, in May 2022, Epocrates launched an innovative long COVID-19 tool that incorporates late-breaking updates to expand the library of clinical decision support guidelines. Thus the increased adoption and launches of clinical decision support systems boosted the growth of the market during the pandemic.

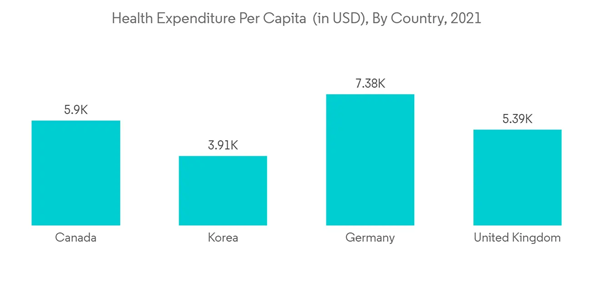

The rising demand for reducing healthcare expenditure, the need for improvement in the quality of care, and technological advancements in healthcare IT in hospitals are the major factors that are likely to boost the growth of the clinical decision support systems (CDSS) market. Furthermore, according to the Organization for Economic Co-operation and Development (OECD) Survey Report, in 2021, the average per capita health expenditure was about USD 7,382.6 in Germany, USD 7,064.8 in Norway, and USD 6,262.3 in Sweden. Thus, the high healthcare expenditure is also expected to contribute to the growth of the market.

According to the Science direct study published in November 2022, the hybrid optimization learning algorithm had accuracy, sensitivity, and specificity metrics. The results revealed that the proposed model was quite appropriate for social anxiety disorder diagnosis and in line with the findings of other studies. Such efficiency of clinical decision support systems is expected to contribute to the growth of the market.

Additionally, the rising geriatric population is also expected to contribute to the growth of the market. According to the WHO data published in October 2022, the population aged 60 years and over will increase to 1.4 billion in 2030 and is expected to reach 2.1 billion by 2050. The UN report in 2022 mentioned that the share of the population aged 65 years or over is projected to rise from 10% in 2022 to 16% in 2050. The geriatric population who are vulnerable to developing chronic diseases and needs regular health checks and treatments for the prevention of diseases is expected to drive the demand for advanced clinical decision support systems, thereby contributing to the growth of the market.

Moreover, increasing initiatives such as collaborations and partnerships to develop clinical decision support systems are expected to contribute to the growth of the market. For instance, in June 2021, Google cloud entered into a multi-year agreement with the national hospital chain HCA healthcare to create customized healthcare algorithms to improve clinical decision-making.

Thus, the increasing healthcare expenditure and increasing initiatives for the development of clinical decision support systems are expected to contribute to the growth of the market. However, lack of trust in the systems, as CDSS are in the initial stages of development, lack of skilled labor, and suggestions from CDSS for unnecessary diagnostic testing hinder the market growth.

CDSS Market Trends

The Cloud-based Segment is Expected to Hold a Major Market Share Over the Forecast Period

The increasing healthcare expenditure and adoption of cloud computing are the major drivers for the expansion of the cloud-based segment of the market. The government in various countries in the European region are taking initiatives to support the growth of information technology in healthcare. For instance, in February 2021, the UK government launched an initiative to adopt a fully connected cloud-driven health service. Under this initiative, over two million National Health Services (NHS) mailboxes were moved to Microsoft's Azure Cloud. This will enable smoother and more efficient communication between staff across NHS organizations and departments and provide improved access to information. This will increase the usage of (Healthcare Information Technology) HCIT Change Management services in the United Kingdom and boost the market's growth.Furthermore, local knowledge management of clinical decision support systems (CDSS) may require extensive processing power and storage capacity, which can result in high operating costs. In contrast, cloud-based applications are operated on remote servers, and executing them does not require a large amount of computational power or large storage space in the user's device.

Cloud-based applications do not depend on web browsers, which makes them inherently safer than web-based applications. In a cloud-based clinical decision support system, processing units are hosted on remote servers, which can be located in multiple data centers across the world, making them less vulnerable to cyberattacks. The increasing availability of cloud technology, owing to its benefit, is expected to drive the usage of cloud-based CDSS over the forecast period.

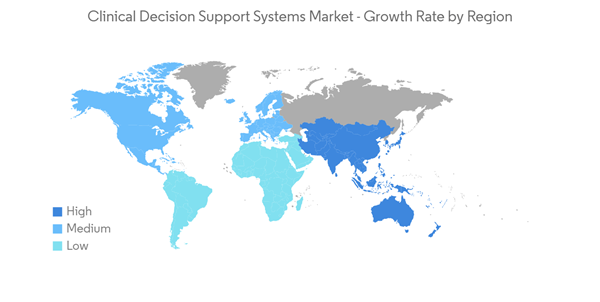

North America is Expected to Hold a Significant Share in the Market During the Forecast Period

The clinical decision support systems (CDSS) market in North America is driven due to the rise in the technological advancement in CDSS, the high awareness among patients, and rising investments in healthcare IT solutions in the region.Also, the increasing funding from the government in North America for supporting healthcare is an attributing factor to the growth of the market in the United States. For instance, the Congressional Budget Office,2021, published that in the past few decades, federal funding for the National Institute of Health (NIH) has totaled over USD 700 billion.

Additionally, the increasingly advanced product launches in this region by various market players are also expected to contribute to the growth of the market. For instance, in August 2021, First Databank, Inc launched the FDB CDS Analytics, during the 2021 HIMSS Global conference and exhibition in Las Vegas. The solution enables healthcare provider organizations to easily identify, monitor, and customize clinical decision support in their electronic health record.

Similarly, in June 2021, a Canadian Healthcare company Pathway which offers, evidence-based clinical support to providers, raised USD 1.3 million in its first round of financing. With this financing, the company aimed to enhance clinical decision support systems which eventually increase healthcare efficiency.

These factors such as increasing investments, CDSS launches, and high funding for healthcare, may fuel the growth of the CDSS market over the forecast period in North America.

CDSS Industry Overview

The clinical decision support systems market has the presence of well-diversified international, regional, and local players. However, some big international players dominate the market, owing to their brand image and market reach. The market is fragmented and competitive in nature. some of the major market players include Siemens Healthcare, Koninklijke Philips NV, IBM, Cerner Corporation, Change Healthcare and Others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cerner Corporation

- Epic Systems Corporation

- IBM

- Change Healthcare

- Medical Information Technology Inc.

- Koninklijke Philips NV

- Siemens Healthcare

- Allscripts Healthcare Solutions Inc.

- Wolters Kluwer NV

- Mckesson Corporation

- Zynx Health Inc.

- Elsevier

- NextGen Healthcare Inc.

- Agfa-Gevaert Group

- Athenahealth Inc.

- VisualDx