Certain factors that are driving the market growth include increased awareness about the potential benefits of targeted alpha therapy and the growing number of patients with cardiac and cancer ailments.

The global pandemic of COVID-19 is predicted to have an impact on the alpha emitters market. Consequently, the reduced contact with physicians in outpatient consultations in the initial period of the pandemic resulted in a decreased number of patients being referred to nuclear medicine for diagnosis and treatment; this effect being less prominent for oncological patients. During the COVID-19 outbreak, according to a survey published in the PMC Journal in September 2020, a total of 434 responses from 72 countries confirmed a significant reduction in nuclear medicine procedures; more than 50% in diagnostic and 40% in therapeutic procedures. However, as the population has begun to cope with the pandemic, the need for cancer care is expected to boost, which is expected to significantly impact the market.

An increase in awareness of the potential benefits of the targeted alpha emitter and a high number of patients with various types of cancers such as ovarian cancer, pancreatic cancer, lymphoma, and melanoma are likely to boost the market growth. In addition, increasing the use of targeted anticancer or alpha therapy (TAT) in the treatment of cancer and alpha particles has an advantage in targeted therapy because of their exceptionally high cell-killing ability. For instance, according to the International Agency for Research on Cancer (IARC), by 2040, the global burden is projected to increase to 27.5 million active cancer incidents and 16.3 million cancer deaths primarily due to population growth and aging. About 70% of deaths from cancer occur in low- and middle-income countries. Thus, the rising cases of cancer and cardiovascular diseases are expected to surge the demand for radiopharmaceuticals for the treatment of these diseases.

Companies are now increasingly aware of the potential benefits of targeted therapies to treat several chronic ailments. Radioimmunotherapy with short-ranged, high-efficiency α-particles is a striking and promising treatment approach. α-particles have an advantage in targeted therapy due to their exceptionally high cell-killing ability.

However, regulatory requirements pose a hurdle to translational research and clinical investigations. For instance, in the United States, all pharmacologic agents, including diagnostic radiopharmaceuticals and radio therapeutics, undergo regulatory oversight by the FDA. Similarly, radiopharmaceuticals face additional scrutiny and undergo unique regulatory and approval pathways across the world.

Alpha Emitter Market Trends

Medical Application in Ovarian Cancer is Expected to Observe the Highest Growth Rate Over the Forecast Period

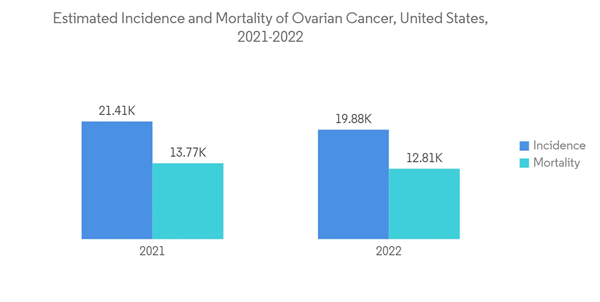

The ovarian cancer segment in the alpha emitter market is expected to witness the highest CAGR by the end of the forecast period.The growth rate is attributed to an increasing number of new diagnosis cases. According to the American Cancer Society, ovarian cancer is the fifth most common cause of cancer-related death among women in the United States. It was estimated that about 21,410 women would receive a new diagnosis of ovarian cancer, while about 13,770 women would die from ovarian cancer in 2021. A recent Phase I clinical trial involving At-211-MX35 F (ab) showed significant efficacy, as therapeutic doses reached their targets in patients with ovarian cancer.

The major market players are focused on developing advanced radionuclides for the management of different types of ovarian cancer. For instance, in January 2021, Soricimed Biopharma Inc. and Orano Med agreed to focus on the development of a novel Peptide Receptor Radionuclide Therapy to treat solid tumor cancers. The companies use Orano Med's unique radioactive alpha emitter, lead-212 (212Pb), conjugated or linked to Soricimed's TRPV6 cancer receptor-targeting peptides to investigate the use of this novel approach in cancer treatment.

Ovarian cancer uses radioimmunotherapy as a locally injected adjuvant therapy. Trials have evaluated the practice of complete abdominal or moving-strip external-beam radiotherapy (EBRT) or non-specific IP radiotherapy, with colloid preparations of Au-198 or P-32 as adjuvant therapies. The adoption of targeted alpha therapy with higher LET and shorter wavelengths has been promising in the treatment process. This trend is expected to gain traction in the future.

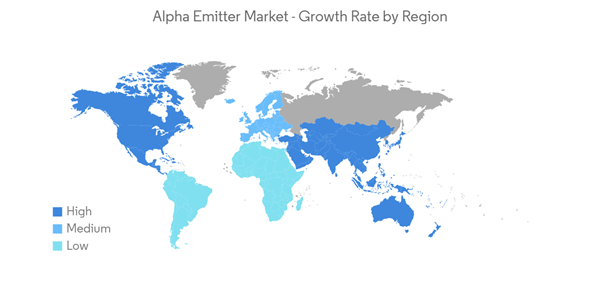

North America Dominates the Market, and It is Expected to do the Same During the Forecast Period

Currently, North America dominates the alpha emitter market, and it is expected to continue its stronghold for a few more years due to the increase in cancer and cardiological diseases, which is the major driving factor for the market growth in the region. For instance, the diffusing alpha-emitter radiation therapy, Alpha DaRT, was found to elicit complete responses (CRs) per RECIST v1.1 criteria in 10 patients with malignant skin and soft tissue cancers in a trial. According to Sofer, Alpha Tau Medical Ltd is closer to launching a multi-center pivotal trial for skin cancer in the United States. This trial is being planned for launch in 2022.In the United States, cancer is one of the most prevalent forms of cancer. As per the estimates of the American Cancer Society, in 2021, an estimated 1,898,160 new cases of cancer were diagnosed in the United States, and 608,570 people died from the disease. This number is likely to increase insignificantly in the future, which is driving the growth of the oncology segment in the United States, thereby propelling the alpha emitter market.

Moreover, according to the GLOBOCAN 2020 report, the number of new cancer cases was 274,364 in 2020, including prostate cancer 29,972, breast cancer 28,026, lung Cancer 25,574, colorectal cancer 25,510, bladder cancer 9,350, and other cancers 155,932. The rising prevalence of cancer is making it imperative for healthcare professionals across Canada to increase radiotherapy utilization for cancer treatment. This is directly affecting the growth of the alpha emitter market in the country.

Alpha Emitter Industry Overview

The alpha emitter market is less competitive and consists of very few major players. Companies like IBA Radiopharma Solutions, Bayer AG, Alpha Tau Medical Ltd, Actinium Pharmaceutical Inc., Telix Pharmaceuticals Ltd, RadioMedix Inc., and Fusion Pharmaceuticals hold a substantial share in the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Actinium Pharmaceutical Inc.

- Alpha Tau Medical Ltd

- Bayer AG

- Fusion Pharmaceuticals

- IBA Radiopharma Solutions

- RadioMedix Inc.

- Telix Pharmaceuticals Ltd