The first wave of the COVID-19 pandemic has disrupted almost all areas of healthcare services to some extent throughout the world. The negative impact of COVID-19 on patients with autoimmune disease diagnostics has also been recognized. According to an article published in October 2021 by Autoimmunity Reviews, a decrease in the number of autoantibody tests was observed in all European countries in the year 2020 compared to 2019. All autoantibody tests saw a 13% decrease, ranging from 1.4% in Switzerland to 25.5% in the United States (Greece). The decrease was most pronounced in all countries during the first wave of the pandemic (March-May 2020), with an overall decrease of 45.2% in those three months. The decrease was less pronounced (6.8%) in the second wave of the pandemic (October-December 2020). Thus, Covid-19 has a significant impact on the growth of the market.

The factors such as the growing burden of autoimmune disease and rising awareness about the diagnosis of disease coupled with technological advancement are propelling the growth of the market.

Increasing autoimmune disorders are expected to increase the autoimmune disease diagnostics market growth. More than 2.8 million people worldwide, including about 1 million in the United States, are currently living with multiple sclerosis, according to the Atlas of Multiple Sclerosis Report from 2020. Autoimmune illnesses are becoming more prevalent, which is a problem for European nations. The Multiple Sclerosis Trust estimates that there are 2.5 million people worldwide who have multiple sclerosis, with Europe having the highest prevalence in 2020. Women experience multiple sclerosis more frequently than males. Women experience multiple sclerosis more frequently than males. Rheumatoid arthritis affects two million people, while psoriasis, one of the most prevalent autoimmune disorders, is thought to impact between 2% and 3% of the general population. One major factor driving rising usage rates is the increased understanding of autoimmune disorders as a result of programs for research, education, support, and activism.

Moreover, the growing burden of autoimmune diseases in different parts of the world coupled with rising awareness about health and diseases creates the need for the diagnostics for early detection of diseases and thus drives the growth of the market. For instance, the American Autoimmune Related Disease Association (AARDA), which is committed to the eradication of autoimmune illnesses, the reduction of pain, and the socioeconomic impact of autoimmunity, designates the month of March each year as Autoimmune Disease Awareness Month (ADAM). The American Kidney Fund (AKF) launched a new patient-focused education and awareness campaign on lupus nephritis, a kidney condition caused by lupus, in February 2021. The AKF campaign gave lupus patients much-needed information they need regarding the symptoms, diagnosis, and treatment of lupus nephritis. The advertising for AKF was created using grant funding from GlaxoSmithKline plc. Similarly, in September 2021, Scipher Medicine entered a partnership with Ventegra Inc. The collaboration will allow Ventegra to provide its customers with access to Scipher's PrismRA liquid molecular signature test, which aids in determining the most targeted medicine for rheumatoid arthritis patients (RA). Thus, the abovementioned factors are expected to increase the market growth.

Thus, owing to the abovementioned factors, the market is expected to project growth over the forecast period. However, the slow turnaround time of results and need for multiple diagnostic tests, and high cost and reimbursement issues coupled with regulatory uncertainties may hamper the growth of the market.

Autoimmune Disease Diagnostics Market Trends

Rheumatoid Arthritis Segment is Expected to Hold a Major Market Share in the Autoimmune Disease Diagnostics Market

Rheumatoid arthritis (RA) is an autoimmune disease that mainly attacks the synovial tissues within the joints. The disease predominantly affects elderly patients. The aging population and technological advancements are also major factors driving the growth of the segment.Rheumatoid arthritis can be diagnosed using the ESR test, C-reactive protein test, rheumatoid factor test, cyclic citrullinated peptide (CCP) antibodies, antinuclear antibodies (ANA) test, and other imaging.

Rheumatoid arthritis is a common disease diagnosed in the elderly population, with the rise in the burden of the geriatric population risk of rheumatoid arthritis increases and thus drives the growth of the market. For instance, According to the World Population prospect, 2022, Globally, in 2022, there were 771 million people aged 65 years or over and is projected to reach 994 million by 2030 and 1.6 billion by 2050.

The launch of new products by the market players is contributing to the growth of the market. For instance, in June 2022, PEPperPrint GmbH introduce a novel biomarker set for the early diagnosis of rheumatoid arthritis (RA) at the 13th International Congress on Autoimmunity held in Athens, Greece. Such innovation for the early diagnosis of the disease is expected to propel the growth of the market.

Thus, owing to the abovementioned factors, the market segment is expected to project considerable growth over the forecast period.

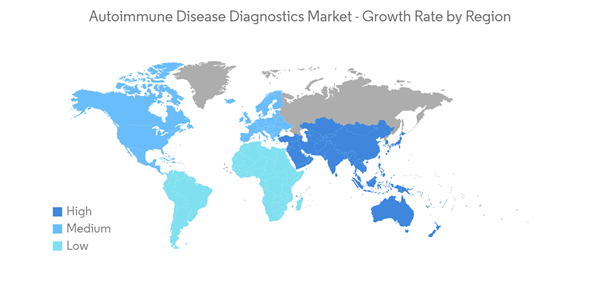

Asia-Pacific is the Fastest Growing Region in the Autoimmune Disease Diagnostics Market

Asia-Pacific is anticipated to exhibit extensive market growth over the forecast period, owing to the rising burden of autoimmune diseases and awareness of their diagnosis. Additionally, the strategic initiatives taken by the market players, increasing research, and developing healthcare infrastructure are also contributing to the growth of the market.According to an article published by Janssen Asia Pacific, a division of Johnson & Johnson Pte. Ltd., in June 2022, autoimmune, inflammatory, and pulmonary diseases, such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease, are on the rise in the Asia Pacific. The region already has the world's highest burden of chronic obstructive pulmonary disease (COPD), as well as the highest prevalence of systemic lupus erythematosus (SLE) in China and Southeast Asia. Hence, this will likely create demand for diagnostics in the coming years.

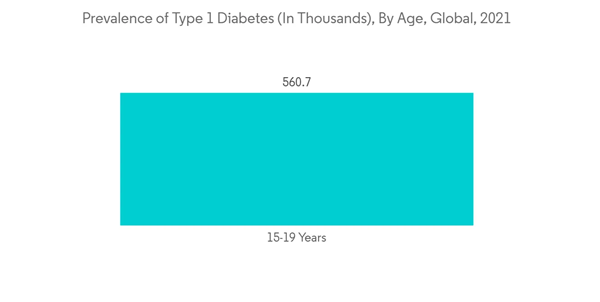

Furthermore, according to the International Diabetes Federation, Diabetes Altas, 2021 Edition, in Australia, there are 14,900 people aged 0-19 years living with Type 1 diabetes in 2021, and the incidence of type 1 diabetes was 1,500 in 2021. Such a high burden of disease creates the need for the proper diagnosis and treatment and thus drives the growth of the market.

The strategic initiatives taken by the market players are also contributing to the growth of the market. For instance, in June 2022, Avesthagen Limited entered into a four-year strategic alliance with Wipro Limited for commercializing its genetic testing portfolio in India. The portfolio includes genome panels offering highly specific, disease-centric analysis for conditions including cancers, neurodegenerative diseases, autoimmune disorders, and rare disease conditions. Such a partnership is expected to boost the growth of the market.

Thus, owing to the abovementioned factors, the studied market is expected to project growth in the Asia-Pacific region.

Autoimmune Disease Diagnostics Industry Overview

The autoimmune disease diagnostics Market is moderately competitive. The market comprises significant market players, and these players are focusing on R&D activities and effective growth strategies. Recently, a few diagnostic companies entered into strategic partnerships with hospitals. This trend is expected to continue over the next few years to meet the high volume of patient needs across different regions. Some of the companies currently dominating the market are Abbott Laboratories, Biomérieux, Trinity Biotech, Bio-rad Laboratories, and Thermo Fisher Scientific, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Biomerieux

- Bio-rad Laboratories

- Euroimmun AG

- F. Hoffmann-la Roche

- Inova Diagnostics Inc.

- Myriad Genetics

- Siemens Healthineers Inc.

- Thermo Fisher Scientific

- Trinity Biotech

- Grifols, S.A.

- Exagen Inc.

- DIAsource ImmunoAssays SA

- R-Biopharm AG