An electric motor is a device that converts electrical energy into mechanical energy, enabling the conversion of electrical power into physical motion. It operates on the principle of electromagnetism, where the interaction between electric currents and magnetic fields results in the generation of mechanical force. The key components of an electric motor include a stator and a rotor. The stator is the stationary part, typically made up of coils or windings, which produce a magnetic field when an electric current passes through them. The rotor, on the other hand, is the rotating part, often composed of permanent magnets or electromagnets. When an electric current flows through the stator windings, it creates a magnetic field that interacts with the magnetic field of the rotor, causing the rotor to spin.

As industries and consumers seek to reduce energy consumption and minimize their carbon footprint, there is a growing demand for energy-efficient solutions. Electric motors, compared to traditional combustion engines, are known for their higher efficiency and lower energy losses. The pursuit of sustainability and energy conservation has led to a rise in the adoption of electric motors in various applications, including electric vehicles, industrial machinery, and home appliances. Additionally, the global push for cleaner transportation alternatives has led to a rapid increase in the adoption of electric vehicles. Electric motors serve as the primary propulsion system in EVs, making them a critical component in the automotive sector's electrification efforts. Other than this, the ongoing industrial automation trend, driven by the need for increased productivity and precision, has escalated the demand for electric motors. Motors are essential components in robotics and automated machinery, enabling precise control and motion in manufacturing and logistics processes. As industries seek to enhance efficiency and reduce human intervention, the sales of electric motors in automation is set to accelerate. Besides this, with advancements in production processes and economies of scale, the cost of electric motors has become increasingly competitive compared to traditional alternatives. This cost-effectiveness has been instrumental in convincing businesses and consumers to shift towards electric motors in different applications, from industrial pumps and fans to household appliances. Moreover, governments worldwide are implementing stringent regulations and providing incentives to promote the adoption of electric vehicles and energy-efficient technologies. These policies aim to reduce greenhouse gas emissions and combat climate change. Subsidies, tax benefits, and stricter emission norms have significantly boosted the electric motor market's growth and encouraged manufacturers to develop innovative and eco-friendly motor solutions.

Electric Motor Market Trends/Drivers

Increasing Emphasis on Energy Efficiency

Electric motors have emerged as a crucial component in addressing these concerns due to their higher efficiency and reduced energy losses compared to conventional combustion engines. The efficiency of an electric motor can exceed 90%, while internal combustion engines typically have efficiencies below 40%. In industrial applications, the drive for energy efficiency has led to the widespread adoption of electric motors in pumps, compressors, and other machinery. By using energy-efficient electric motors, businesses can lower their operational costs and minimize their environmental impact. Moreover, governments and regulatory bodies often encourage the use of energy-efficient motors through incentives and efficiency standards.Government Initiatives and Regulations

Several countries have set ambitious goals to reduce greenhouse gas emissions and combat climate change, prompting the implementation of policies that promote the adoption of energy-efficient technologies, including electric motors. Various incentive programs, tax credits, and subsidies are offered to manufacturers and consumers to encourage the production and purchase of electric vehicles and energy-efficient appliances. These incentives not only create a demand pull for electric motors but also incentivize manufacturers to invest in research and development to produce more efficient and environmentally friendly motor technologies. Furthermore, emission norms and regulations on vehicle manufacturers have become more stringent, necessitating a shift towards electric mobility. As a result, automotive manufacturers are increasingly incorporating electric motors into their product portfolios, further driving the market.Rising Demand for Electric Vehicles (EVs)

Electric motors serve as the primary propulsion system in EVs, and the demand for these motors has soared in tandem with the rise in electric vehicle adoption. Advancements in battery technology, resulting in improved energy storage and longer driving ranges, have made EVs more practical and appealing to consumers. The increased availability of charging infrastructure has further allayed concerns about range anxiety, boosting consumer confidence in electric vehicles. Governments and policymakers have played a pivotal role in accelerating the adoption of electric vehicles through a combination of financial incentives, subsidies, and regulatory support. As electric vehicles become more mainstream, the demand for electric motors used in EVs is expected to witness exponential growth, transforming the automotive industry and contributing significantly to the expansion of the electric motor market.Electric Motor Industry Segmentation

This report provides an analysis of the key trends in each segment of the global electric motor market report, along with forecasts at the global and regional levels from 2025-2033. The report has categorized the market based on motor type, voltage, rated power, magnet type, weight, speed and application.Breakup by Motor Type

- AC Motor

- Induction AC Motor

- Synchronous AC Motor

- DC Motor

- Brushed DC Motor

- Brushless DC Motor

- Others

The report has provided a detailed breakup and analysis of the market based on the motor type. This includes AC motor (induction AC motor and synchronous AC motor), DC motor (brushed DC motor and brushless DC motor), and others. According to the report, AC motors represented the largest segment.

Breakup by Voltage

- Low Voltage Electric Motors

- Medium Voltage Electric Motors

- High Voltage Electric Motors

A detailed breakup and analysis of the market based on the voltage has also been provided in the report. This includes low voltage electric motor, medium voltage electric motors, and high voltage electric motors According to the report, low voltage accounted for the largest market share.

Breakup by Rated Power

- Fractional Horsepower Motors

- Fractional Horsepower (< 1/8) Motors

- Fractional Horsepower (1/8 - 1/2) Motors

- Fractional Horsepower (1/2 - 1) Motors

- Integral Horsepower Motors

- Integral Horsepower (1 - 5) Motors

- Integral Horsepower (10 - 50) Motors

- Integral Horsepower (50 - 100) Motors

- Integral Horsepower (>100) Motors

The report has provided a detailed breakup and analysis of the market based on the fractional horsepower. This includes fractional horsepower motors [fractional horsepower (< 1/8) motors, fractional horsepower (1/8 - 1/2) motors, and fractional horsepower (1/2 - 1) motors] and integrated horsepower motors (integral horsepower (1 - 5) motors, integral horsepower (10 - 50) motors, integral horsepower (50 - 100) motors, and integral horsepower (>100) motors). According to the report, fractional horsepower represented the largest segment.

Breakup by Magnet Type

- Ferrite

- Neodymium (NdFeB)

- Samarium Cobalt (SmCo5 and Sm2Co17)

A detailed breakup and analysis of the market based on the magnet type has also been provided in the report. This includes ferrite, neodymium (NdFeB), and samarium cobalt (SmCo5 and Sm2Co17). According to the report, ferrite accounted for the largest market share.

Breakup by Weight

- Low Weight Motors

- Medium Weight Motors

- High Weight Motors

The report has provided a detailed breakup and analysis of the market based on the weight. This includes low weight motors, medium weight motors, and high weight motors). According to the report, fractional horsepower represented the largest segment.

Breakup by Speed

- Ultra-High-Speed Motors

- High-Speed Motors

- Medium Speed Motors

- Low Speed Motors

A detailed breakup and analysis of the market based on the speed has also been provided in the report. This includes ultra-high-speed motors, high-speed motors, medium-speed motors, and low speed motors. According to the report, ferrite accounted for the largest market share.

Breakup by Application

- Industrial Machinery

- HVAC

- Transportation

- Household Appliances

- Motor Vehicles

- Aerospace

- Marine

- Robotics

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes industrial machinery, HVAC, transportation, household appliances, motor vehicles, aerospace, marine, robotics, and others. According to the report, industrial machinery represented the largest segment.

Breakup by Region

- Asia-Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, Middle East and Africa, Latin America. According to the report, Asia Pacific was the largest market for electric motors.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABB Group

- Siemens AG

- WEG SA

- TECO

- Regal Beloit Corporation

- Nidec Corporation

Key Questions Answered in This Report

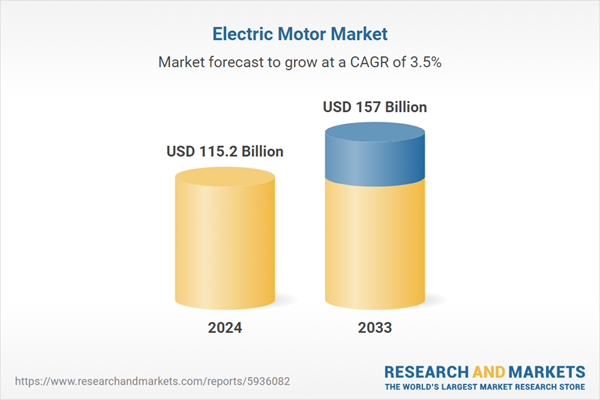

1. What was the size of the global electric motor market in 2024?2. What is the expected growth rate of the global electric motor market during 2025-2033?

3. What are the key factors driving the global electric motor market?

4. What has been the impact of COVID-19 on the global electric motor market?

5. What is the breakup of the global electric motor market based on the motor type?

6. What is the breakup of the global electric motor market based on the voltage?

7. What is the breakup of the global electric motor market based on the rated power?

8. What is the breakup of the global electric motor market based on the magnet type?

9. What is the breakup of the global electric motor market based on the weight?

10. What is the breakup of the global electric motor market based on the speed?

11. What is the breakup of the global electric motor market based on the application?

12. What are the key regions in the global electric motor market?

13. Who are the key players/companies in the global electric motor market?

Table of Contents

Companies Mentioned

- ABB Group

- Siemens Ag

- WEG SA

- TECO

- Regal Beloit Corporation

- Nidec Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 115.2 Billion |

| Forecasted Market Value ( USD | $ 157 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |