The Dehydrated Food Market size is estimated at USD 47.10 billion in 2024, and is expected to reach USD 65.34 billion by 2029, growing at a CAGR of 6.77% during the forecast period (2024-2029).

To maintain immunity, consumers are highly concerned about adding good protein content to their diet, which results in augmenting the sales of freeze-dried meat products, dairy products, and others that have more shelf-life together with similar nutrients than that fresh products. The applicability of the freeze-drying technology for heat-sensitive food products, an increase in freeze-dried pet food products, and the introduction of freeze-drying techniques into various food products for longer preservation and more convenient consumption are additional key market drivers.

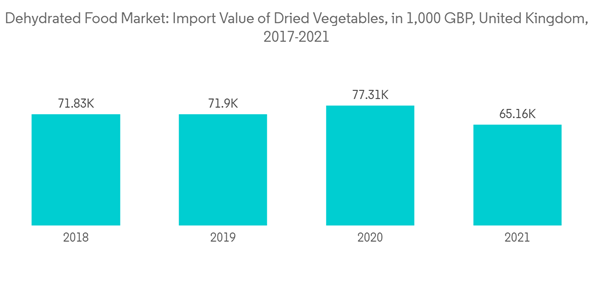

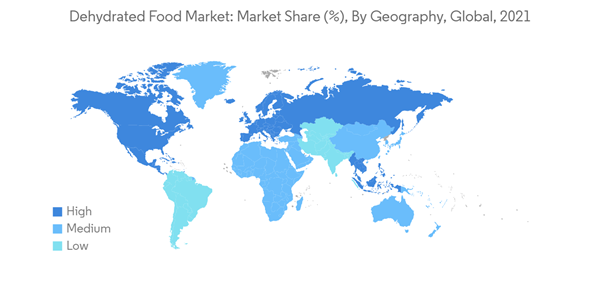

Furthermore, vegan and plant-based freeze-dried food products are witnessing an excessive demand amid changing consumer demands. This is primarily due to the prolonged shelf life of freeze-dried products, which can be purchased in larger quantities to tackle hectic work schedules, over fresh food products that require frequent buying in lesser amounts. According to UN Comtrade, in 2021, imports of slices, cut, whole, powdered vegetables, and other forms into the United Kingdom (UK) were valued at approximately GBP 65 million. The overall market is driven considerably, primarily by North American and European consumers owing to their higher purchasing power, thus, adding up to the value of the market studied. The other major factor expected to push the market is growing e-commerce in developing economies; now, consumers in developing economies have easy access to dehydrated food products within the comfort of their homes. Also, startups are listing their innovative products on online retail channels, which helps drive the sales of dehydrated foods across the globe.

In June 2021, Sow Good Inc. launched freeze-dried fruit and vegetable snacks and smoothies. The company claimed that the products featured shelf stability. The Irving, Texas-based firm aimed to reduce food waste with the new product range. By removing water from fruits and vegetables using freeze-drying technology, the brand created a product that retained more than 97% of the nutrients present in fresh food according to the company.

This product will be delivered within 2 business days.

To maintain immunity, consumers are highly concerned about adding good protein content to their diet, which results in augmenting the sales of freeze-dried meat products, dairy products, and others that have more shelf-life together with similar nutrients than that fresh products. The applicability of the freeze-drying technology for heat-sensitive food products, an increase in freeze-dried pet food products, and the introduction of freeze-drying techniques into various food products for longer preservation and more convenient consumption are additional key market drivers.

Furthermore, vegan and plant-based freeze-dried food products are witnessing an excessive demand amid changing consumer demands. This is primarily due to the prolonged shelf life of freeze-dried products, which can be purchased in larger quantities to tackle hectic work schedules, over fresh food products that require frequent buying in lesser amounts. According to UN Comtrade, in 2021, imports of slices, cut, whole, powdered vegetables, and other forms into the United Kingdom (UK) were valued at approximately GBP 65 million. The overall market is driven considerably, primarily by North American and European consumers owing to their higher purchasing power, thus, adding up to the value of the market studied. The other major factor expected to push the market is growing e-commerce in developing economies; now, consumers in developing economies have easy access to dehydrated food products within the comfort of their homes. Also, startups are listing their innovative products on online retail channels, which helps drive the sales of dehydrated foods across the globe.

Dehydrated Food Market Trends

Growing Demand for Convenient Processed Food Products

With the growing snacking culture among consumers, dried foods like chips, nuts, popcorn, and others are observing increased consumer demand, along with new players entering the market. Furthermore, the increased shelf-life of dehydrated and freeze-dried snack products adds to their popularity among consumers. Hence, different regions are witnessing a rise in the consumption and imports of dehydrated products. Busy lifestyles and the increased number of the working population are significant factors contributing to the demand for convenient products like- processed and packaged dried food items as they offer good taste, have preserved nutritional content, can be eaten on the go, and involves easy methods of preparation. With the growth in the number of travelers and tourists, camping, hiking, and other activities, there is an increased demand for packaged and processed foods manufactured with the help of dehydrating techniques.North America Holds a Significant Market Share

The increased consumption of meat and other animal-based products has been driving the market studied across North America. Additionally, in an effort to expand their market share, big-box stores like Target and Walmart are bulking up on freeze-dried food products. This has increased customer awareness of shelf-stable freeze-dried foods such as freeze-dried fruits and vegetables offered by various market players as well as the visibility of the items. The location of British Columbia in the disaster-prone zone for earthquakes is prompting many providers of emergency survival foods, such as Total Prepare Canada Inc., to provide freeze-dried foods, like meats, fruits, and vegetables, as emergency food to victims across the country. The National Health Services of Mexico has permitted the import of freeze-dried foods, such as seafood, for consumption, if they are pest and disease-free, which in turn, has increased the scope of international brands and the availability of freeze-dried meat in the country.In June 2021, Sow Good Inc. launched freeze-dried fruit and vegetable snacks and smoothies. The company claimed that the products featured shelf stability. The Irving, Texas-based firm aimed to reduce food waste with the new product range. By removing water from fruits and vegetables using freeze-drying technology, the brand created a product that retained more than 97% of the nutrients present in fresh food according to the company.

Dehydrated Food Industry Overview

The market studied is highly competitive due to the presence of global and regional players. Production innovation and partnership are the most preferred key strategies, as key players are trying to meet the demand and withstand the competition in the market. Additionally, expansion is one of the critical strategies that global players are adopting to gain competitiveness. Major players competing in the market include Van Drunen Farms, European Freeze Dry, Mercer Foods, LLC, Tong Garden Co. Ltd., and Crispy Green Inc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Van Drunen Farms

- European Freeze Dry

- Mercer Foods, LLC

- Ajinomoto Co. Inc.

- Harmony House Foods Inc.

- Mother Earth Products

- Tong Garden Co. Ltd.

- Nutristore Canada

- Augason Farms

- Nim's Fruit Crisps Limited.