Chapter 1. Excavator Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Excavator Market: Executive Summary

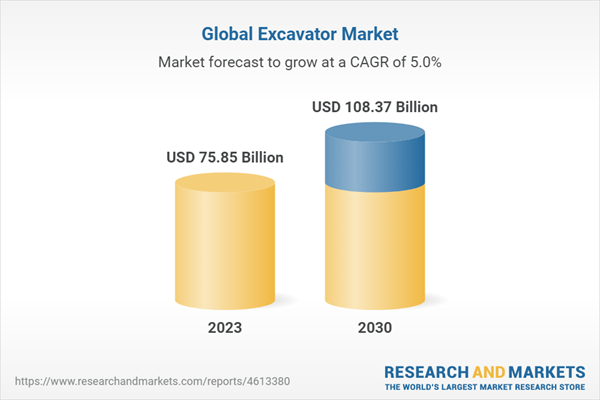

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Excavators Market: Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million)

3.3. Industry Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Drivers Analysis

3.4.1.1. Increasing investments in the construction industry

3.4.1.2. Growing technological advancements

3.4.2. Market Restraints Analysis

3.4.2.1. Fluctuating prices of raw materials

3.4.3. Industry Opportunities

3.4.3.1. Rapid advancements in battery technology

3.5. Excavators Market Analysis Tools

3.5.1. Porter’s Analysis

3.5.1.1. Bargaining power of the suppliers

3.5.1.2. Bargaining power of the buyers

3.5.1.3. Threats of substitution

3.5.1.4. Threats from new entrants

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Economic and Social Landscape

3.5.2.3. Technological landscape

3.5.2.4. Environmental Landscape

3.5.2.5. Legal Landscape

Chapter 4. Excavator Market: Vehicle Weight Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Excavator Market: Vehicle Weight Movement Analysis, USD Million, 2023 & 2030

4.3. < 10

4.3.1. < 10 Excavator Market Revenue Estimates and Forecasts, 2018-2030 (USD Million)

4.4. 11 to 45

4.4.1. 11 to 45 Excavator Market Revenue Estimates and Forecasts, 2018-2030 (USD Million)

4.5. 46>

4.5.1. 46> Excavator Market Revenue Estimates and Forecasts, 2018-2030 (USD Million)

Chapter 5. Excavator Market: Engine Capacity Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Excavator Market: Engine Capacity Movement Analysis, USD Million, 2023 & 2030

5.3. Up to 250 HP

5.3.1. Up to 250 HP Excavator Market Revenue Estimates and Forecasts, 2018-2030 (USD Million)

5.4. 250-500 HP

5.4.1. 250-500 HP Excavator Market Revenue Estimates and Forecasts, 2018-2030 (USD Million)

5.5. More than 500 HP

5.5.1. More than 500 HP Excavator Market Revenue Estimates and Forecasts, 2018-2030 (USD Million)

Chapter 6. Excavator Market: Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Excavator Market: Type Movement Analysis, USD Million, 2023 & 2030

6.3. Wheel

6.3.1. Wheel Excavator Market Revenue Estimates and Forecasts, 2018-2030 (USD Million)

6.4. Crawler

6.4.1. Crawler Excavator Market Revenue Estimates and Forecasts, 2018-2030 (USD Million)

Chapter 7. Excavator Market: Drive Type Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Excavator Market: Drive Type Movement Analysis, USD Million, 2023 & 2030

7.3. Electric

7.3.1. Electric Excavator Market Revenue Estimates and Forecasts, 2018-2030 (USD Million)

7.4. ICE

7.4.1. ICE Excavator Market Revenue Estimates and Forecasts, 2018-2030 (USD Million)

Chapter 8. Excavator Market: Regional Estimates & Trend Analysis

8.1. Excavator Market Share, by Region, 2023 & 2030, USD Million

8.2. North America

8.2.1. North America Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.2.2. U.S.

8.2.2.1. U.S. Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.2.3. Canada

8.2.3.1. Canada Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.3. Europe

8.3.1. Europe Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.3.2. U.K.

8.3.2.1. U.K. Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.3.3. Germany

8.3.3.1. Germany Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.3.4. France

8.3.4.1. France Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.4. Asia-Pacific

8.4.1. Asia-Pacific Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.4.2. China

8.4.2.1. China Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.4.3. Japan

8.4.3.1. Japan Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.4.4. India

8.4.4.1. India Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.4.5. South Korea

8.4.5.1. South Korea Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.4.6. Australia

8.4.6.1. Australia Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.5. Latin America

8.5.1. Latin America Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.5.2. Brazil

8.5.2.1. Brazil Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.5.3. Mexico

8.5.3.1. Mexico Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.6. Middle East and Africa

8.6.1. Middle East and Africa Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.6.2. Saudi Arabia

8.6.2.1. Saudi Arabia Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.6.3. UAE

8.6.3.1. UAE Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

8.6.4. South Africa

8.6.4.1. South Africa Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Positioning

9.4. Company Market Share Analysis

9.5. Company Heat Map Analysis

9.6. Strategy Mapping

9.6.1. Expansion

9.6.2. Mergers & Acquisition

9.6.3. Partnerships & Collaborations

9.6.4. New Product Launches

9.6.5. Research And Development

9.7. Company Profiles

9.7.1. Caterpillar Inc.

9.7.1.1. Participant’s Overview

9.7.1.2. Financial Performance

9.7.1.3. Product Benchmarking

9.7.1.4. Recent Developments

9.7.2. CNH Industrial N.V.

9.7.2.1. Participant’s Overview

9.7.2.2. Financial Performance

9.7.2.3. Product Benchmarking

9.7.2.4. Recent Developments

9.7.3. Doosan Corporation

9.7.3.1. Participant’s Overview

9.7.3.2. Financial Performance

9.7.3.3. Product Benchmarking

9.7.3.4. Recent Developments

9.7.4. Escorts Kubota Limited

9.7.4.1. Participant’s Overview

9.7.4.2. Financial Performance

9.7.4.3. Product Benchmarking

9.7.4.4. Recent Developments

9.7.5. Hitachi Construction Machinery Co., Ltd.

9.7.5.1. Participant’s Overview

9.7.5.2. Financial Performance

9.7.5.3. Product Benchmarking

9.7.5.4. Recent Developments

9.7.6. Hyundai Construction Equipment Co., Ltd.

9.7.6.1. Participant’s Overview

9.7.6.2. Financial Performance

9.7.6.3. Product Benchmarking

9.7.6.4. Recent Developments

9.7.7. J C Bamford Excavators Ltd.

9.7.7.1. Participant’s Overview

9.7.7.2. Financial Performance

9.7.7.3. Product Benchmarking

9.7.7.4. Recent Developments

9.7.8. Deere & Company

9.7.8.1. Participant’s Overview

9.7.8.2. Financial Performance

9.7.8.3. Product Benchmarking

9.7.8.4. Recent Developments

9.7.9. Kobelco Construction Machinery Co. Ltd.

9.7.9.1. Participant’s Overview

9.7.9.2. Financial Performance

9.7.9.3. Product Benchmarking

9.7.9.4. Recent Developments

9.7.10. Komatsu Ltd.

9.7.10.1. Participant’s Overview

9.7.10.2. Financial Performance

9.7.10.3. Product Benchmarking

9.7.10.4. Recent Developments

9.7.11. Liebherr-International AG

9.7.11.1. Participant’s Overview

9.7.11.2. Financial Performance

9.7.11.3. Product Benchmarking

9.7.11.4. Recent Developments

9.7.12. Manitou Group

9.7.12.1. Participant’s Overview

9.7.12.2. Financial Performance

9.7.12.3. Product Benchmarking

9.7.12.4. Recent Developments

9.7.13. HIDROMEK

9.7.13.1. Participant’s Overview

9.7.13.2. Financial Performance

9.7.13.3. Product Benchmarking

9.7.13.4. Recent Developments

9.7.14. Sany Heavy Industry Co., Ltd.

9.7.14.1. Participant’s Overview

9.7.14.2. Financial Performance

9.7.14.3. Product Benchmarking

9.7.14.4. Recent Developments

9.7.15. Sumitomo Heavy Industries, Ltd.

9.7.15.1. Participant’s Overview

9.7.15.2. Financial Performance

9.7.15.3. Product Benchmarking

9.7.15.4. Recent Developments

9.7.16. Mitsubishi Heavy Industries - VST Diesel Engines Pvt Ltd.

9.7.16.1. Participant’s Overview

9.7.16.2. Financial Performance

9.7.16.3. Product Benchmarking

9.7.16.4. Recent Developments

9.7.17. Terex Corporation

9.7.17.1. Participant’s Overview

9.7.17.2. Financial Performance

9.7.17.3. Product Benchmarking

9.7.17.4. Recent Developments

9.7.18. Volvo Construction Equipment AB

9.7.18.1. Participant’s Overview

9.7.18.2. Financial Performance

9.7.18.3. Product Benchmarking

9.7.18.4. Recent Developments

List of Tables

Table 1 Global Excavator Market, 2018-2030 (USD Million)

Table 2 Global Excavator Market, By Vehicle Weight, 2018-2030 (USD Million)

Table 3 Global Excavator Market, By Engine Capacity, 2018-2030 (USD Million)

Table 4 Global Excavator Market, By Type, 2018-2030 (USD Million)

Table 5 Global Excavator Market, By Drive Type, 2018-2030 (USD Million)

Table 6 > 10 Vehicle Weight Market By Region, 2018-2030 (USD Million)

Table 7 11 to 45 Vehicle Weight Market By Region, 2018-2030 (USD Million)

Table 8 46 >Vehicle Weight Market by Region, 2018-2030 (USD Million)

Table 9 Up To 250 HP Engine Capacity Market by Region, 2018-2030 (USD Million)

Table 10 250 - 500 HP Engine Capacity Market by Region, 2018-2030 (USD Million)

Table 11 More than 500 HP Engine Capacity Market By Region, 2018-2030 (USD Million)

Table 12 Wheel Excavator Market by Region, 2018-2030 (USD Million)

Table 13 Crawler Excavator Market by Region, 2018-2030 (USD Million)

Table 14 Electric Drive Market by Region, 2018-2030 (USD Million)

Table 15 Ice Drive Market by Region, 2018-2030 (USD Million)

Table 16 North America Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 17 North America Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 18 North America Excavator Market, By Type 2018-2030 (USD Million)

Table 19 North America Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 20 U.S. Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 21 U.S. Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 22 U.S. Excavator Market, By Type 2018-2030 (USD Million)

Table 23 U.S. Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 24 Canada Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 25 Canada Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 26 Canada Excavator Market, By Type 2018-2030 (USD Million)

Table 27 Canada Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 28 Europe Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 29 Europe Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 30 Europe Excavator Market, By Type 2018-2030 (USD Million)

Table 31 Europe Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 32 U.K. Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 33 U.K. Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 34 U.K. Excavator Market, By Type 2018-2030 (USD Million)

Table 35 U.K. Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 36 Germany Excavator Market, By Vehicle Weight 2018-2030(USD Million)

Table 37 Germany Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 38 Germany Excavator Market, By Type 2018-2030(USD Million)

Table 39 Germany Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 40 Asia-Pacific Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 41 Asia-Pacific Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 42 Asia-Pacific Excavator Market, By Type 2018-2030 (USD Million)

Table 43 Asia-Pacific Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 44 China Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 45 China Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 46 China Excavator Market, By Type 2018-2030 (USD Million)

Table 47 China Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 48 Japan Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 49 Japan Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 50 Japan Excavator Market, By Type 2018-2030 (USD Million)

Table 51 Japan Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 52 India Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 53 India Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 54 India Excavator Market, By Type 2018-2030 (USD Million)

Table 55 India Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 56 Latin America Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 57 Latin America Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 58 Latin America Excavator Market, By Type 2018-2030 (USD Million)

Table 59 Latin America Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 60 Brazil Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 61 Brazil Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 62 Brazil Excavator Market, By Type 2018-2030 (USD Million)

Table 63 Brazil Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 64 Mexico Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 65 Mexico Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 66 Mexico Excavator Market, By Type 2018-2030 (USD Million)

Table 67 Mexico Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 68 MEA Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 69 MEA Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 70 MEA Excavator Market, By Type 2018-2030 (USD Million)

Table 71 MEA Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 72 UAE Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 73 UAE Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 74 UAE Excavator Market, By Type 2018-2030 (USD Million)

Table 75 UAE Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 76 Saudi Arabia Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 77 Saudi Arabia Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 78 Saudi Arabia Excavator Market, By Type 2018-2030 (USD Million)

Table 79 Saudi Arabia Excavator Market, By Drive Type 2018-2030 (USD Million)

Table 80 South Africa Excavator Market, By Vehicle Weight 2018-2030 (USD Million)

Table 81 South Africa Excavator Market, By Engine Capacity 2018-2030 (USD Million)

Table 82 South Africa Excavator Market, By Type 2018-2030 (USD Million)

Table 83 South Africa Excavator Market, By Drive Type 2018-2030 (USD Million)

List of Figures

Fig. 1 Market Segmentation & Scope

Fig. 2 Information Procurement

Fig. 3 Primary Research Pattern

Fig. 4 Primary Research Process

Fig. 5 Market Formulation and Data Visualization

Fig. 6 Industry Snapshot

Fig. 7 Excavator Market Size and Growth Prospects, 2018-2030 (USD Million)

Fig. 8 Excavator Market Value Chain Analysis

Fig. 9 Excavator Market Penetration & Growth Prospect Mapping (Key Opportunity Prioritized)

Fig. 10 Industry Analysis-Porter’s Five Forces

Fig. 11 PEST Analysis

Fig. 12 Excavator Market, by Vehicle Weight, Key Takeaways (USD Million)

Fig. 13 Vehicle Weight Type Movement Analysis & Market Share, 2023 & 2030

Fig. 14 < 10 Movement Analysis & Market Share, 2023 & 2030

Fig. 15 11 to 45 Movement Analysis & Market Share, 2023 & 2030

Fig. 16 46> Movement Analysis & Market Share, 2023 & 2030

Fig. 17 Excavator Market, by Engine Capacity, Key Takeaways (USD Million)

Fig. 18 Up to 250 HP Excavator Market, by Engine Capacity, Key Takeaways (USD Million)

Fig. 19 250-500 HP Excavator Market, by Engine Capacity, Key Takeaways (USD Million)

Fig. 20 More than 500 HP Excavator Market, by Engine Capacity, Key Takeaways (USD Million)

Fig. 21 Excavator Market, by Type, Key Takeaways (USD Million)

Fig. 22 Type Movement Analysis & Market Share, 2023 & 2030

Fig. 23 Wheel Excavator Movement Analysis & Market Share, 2023 & 2030

Fig. 24 Crawler Excavator Movement Analysis & Market Share, 2023 & 2030

Fig. 25 Excavator Market, by Drive Type, Key Takeaways (USD Million)

Fig. 26 Drive Type Movement Analysis & Market Share, 2023 & 2030

Fig. 27 ICE Movement Analysis & Market Share, 2023 & 2030

Fig. 28 Electric Movement Analysis & Market Share, 2023 & 2030

Fig. 29 Regional market size estimates & forecasts, 2018-2030(USD Million)

Fig. 30 North America Excavator Market Outlook and Market Share by Country, 2023 & 2030 (USD Million)

Fig. 31 U.S. Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 32 Canada Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 33 Europe Excavator Market Outlook and Market Share by Country, 2023 & 2030 (USD Million)

Fig. 34 U.K. Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 35 Germany Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 36 France Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 37 Asia-Pacific Excavator Market Outlook and Market Share by Country, 2023 & 2030 (USD Million)

Fig. 38 China Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 39 India Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 40 Japan Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 41 South Korea Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 42 Australia Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 43 Latin America Excavator Market Outlook and Market Share by Country, 2023 & 2030 (USD Million)

Fig. 44 Brazil Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 45 Mexico Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 46 Middle East & Africa Excavator Market Outlook and Market Share by Country, 2023 & 2030 (USD Million)

Fig. 47 UAE Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 48 Saudi Arabia Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 49 South Africa Excavator Market Estimates and Forecasts, 2018-2030 (USD Million)

Fig. 50 Key Company Share Analysis, 2023