The surgical microscope market is expected to record a CAGR of 10.89% over the forecast period, 2022-2027.

As per the World Health Organization (WHO), COVID-19 is infectious, and most people infected by the virus experience mild to moderate respiratory illness. Due to the high transmission rate of COVID-19, countries like the United States have suffered and are continuing to bear a significant burden on their economies and healthcare systems. The country has been in lockdown, suspended trade with other countries, and implemented travel restrictions, leading to a decline in the market capitalization of major companies worldwide. However, the situation has improved gradually with an increase in the vaccination rate. The delay of elective procedures due to COVID-19-related measures has adversely affected the surgical microscopes market, especially in 2020, as only urgent surgeries were allowed. Most cardiac procedures were canceled or postponed due to the diversion of resources toward the COVID-19 infected patients. However, with the increasing vaccination rates, the number of surgeries performed also increased, significantly impacting the market. Operating theaters were temporarily converted to respiratory support units in regions with a high disease burden. Postoperative recovery rooms and intermediate care units were used as care units outside regular intensive care to manage sick patients affected by COVID‐19. For instance, according to the study published in the British Journal of Surgery, in May 2020, based on a 12-week period of peak disruption to hospital services due to COVID-19, around 28.4 million elective surgeries worldwide were canceled or postponed, thus indicating the negative impact of COVID-19 on the market studied.

Certain factors driving the market include the increasing adoption of minimally invasive surgeries, the rising geriatric population and burden of chronic diseases, and technological advancements in surgical microscopes.

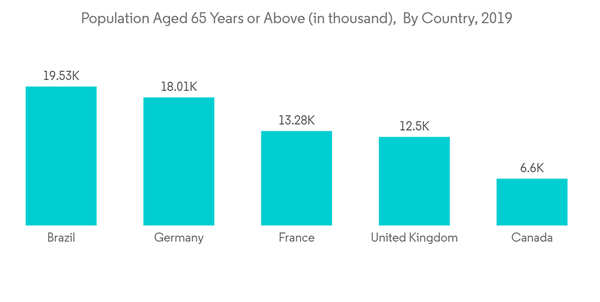

The global population is aging rapidly due to reduced birth rates and increasing life expectancy. For instance, according to the United Nations’ World Population Prospects for 2020, the number of people over 65 years may increase from 9.3% in 2020 to more than 16% by 2050. Hence, the prevalence of age-associated chronic diseases and subsequent surgical interventions increased, expanding the market.

Surgical microscopes have become a crucial tool for minimally invasive surgical procedures in dental surgery, otorhinolaryngology, neurosurgery, ophthalmic surgery, and cosmetic surgery. Technological advancements in the products have significantly improved vision, positioning, stability, sizing, and recording capabilities and helped in the integration of image-guided microscope systems for better outcomes.

A surgical microscope offers optimum lighting, 3D visualization, and magnification of deep surgical fields through small approaches. It also benefits surgeons by adjusting their posture while performing complicated and long procedures. These factors are anticipated to propel the market during the forecast period.

However, factors such as lack of skilled professionals and low acceptance due to high cost are likely to hamper the market’s growth over the forecast period.

The COVID-19 outbreak negatively impacted the gynecology and urological application segment. The pandemic has majorly impacted surgical services. As per the study titled “COVIDSurg Collaborative,” in May 2020, approximately 2.5 million benign urological surgeries were canceled due to the COVID-19 outbreak. However, as elective surgeries and emergency surgical procedures are resuming, the demand for surgical microscopes for urological and gynecology conditions may increase.

The applications of surgical microscopes are wide, among which gynecological and urological applications are the most common, as these practices include many procedures. As the prevalence of urological and gynecological conditions is increasing worldwide, the significance of surgical microscopes is also increasing. For instance, urinary tract infections (UTIs) are one of the most common microbial diseases affecting people of all ages. According to the study titled “Epidemiology of urological infections: a global burden,” World Journal of Urology, January 2020, about 150 million people get affected by community-acquired UTIs (CAUTIs). The rising prevalence of target disorders and the complexity of their treatment led to the adoption of advanced techniques involving surgical microscopes.

In gynecological and urological practices, microscopes are used for the detection of cancers, laser surgeries, and diagnostic procedures. The microscopes, like colonoscopy and endoscopy, give access to the inside of the bowel or colon and ease the surgery. Due to the increasing diseases associated with bowel movements, colonoscopy and endoscopy are widely used, which is expected to drive the overall market over the forecast period.

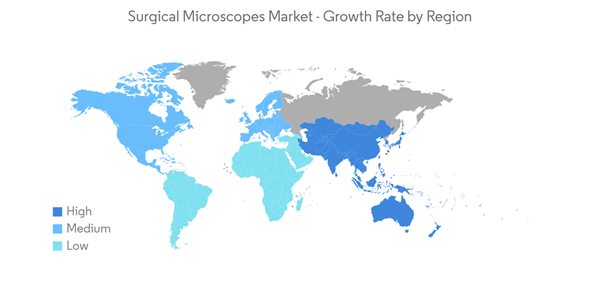

The market growth in the region is vastly attributed to the United States due to the availability of highly advanced equipment, the presence of sophisticated facilities, skilled neurosurgeons and cosmetic surgeons, the increasing number of surgical facilities, the preference for outpatient settings, and the supportive reimbursement framework for medical treatments.

The burden of chronic illnesses, like cancer, cardiovascular diseases (CVD), and neurological diseases, is huge in the United States (US). The Centers for Disease Control and Prevention (CDC) estimates that, between 2010 and 2020, the number of new cancer cases in the country may increase by 24% in men to more than 1 million cases per year and by about 21% in women to more than 900,000 cases per year. Thus, the rising prevalence of chronic disorders and the complexity of their treatment have led to the adoption of advanced techniques that involve the use of surgical microscopes.

The introduction of technologically advanced products is boosting the demand for surgical microscopes as they offer better illumination sources, are more precise, and provide options for customization and technology integration based on the complexity of the procedures. For instance, in September 2020, True Digital Surgery (TDS) and Aesculap Inc. launched Aesculap Aeos Robotic Digital Microscope in the United States. Thus, such technologically advanced product launches are expected to boost the regional market’s growth.

However, the rising number of COVID-19 cases may negatively impact the growth of the North American surgical microscopes market due to the affected supply chains of most companies. The usage of equipment like surgical microscopes was temporarily halted to curb the contamination of the virus through surgical equipment. However, as surgical instruments such as colonoscopes and endoscopes are essential components of surgical services, the impact is not expected to be long-term.

The surgical microscopes market is highly competitive and consists of several major players. Companies like Alcon, Alltion (Wuzhou) Co. Ltd, ARI Medical Technology Co. Ltd, Metall Zug (Haag-Streit), Danaher Corporation, Olympus Corporation, Seiler Instrument Inc., Takagi Seiko Co. Ltd, Topcon, and Carl Zeiss AG hold a substantial share in the market.

This product will be delivered within 2 business days.

As per the World Health Organization (WHO), COVID-19 is infectious, and most people infected by the virus experience mild to moderate respiratory illness. Due to the high transmission rate of COVID-19, countries like the United States have suffered and are continuing to bear a significant burden on their economies and healthcare systems. The country has been in lockdown, suspended trade with other countries, and implemented travel restrictions, leading to a decline in the market capitalization of major companies worldwide. However, the situation has improved gradually with an increase in the vaccination rate. The delay of elective procedures due to COVID-19-related measures has adversely affected the surgical microscopes market, especially in 2020, as only urgent surgeries were allowed. Most cardiac procedures were canceled or postponed due to the diversion of resources toward the COVID-19 infected patients. However, with the increasing vaccination rates, the number of surgeries performed also increased, significantly impacting the market. Operating theaters were temporarily converted to respiratory support units in regions with a high disease burden. Postoperative recovery rooms and intermediate care units were used as care units outside regular intensive care to manage sick patients affected by COVID‐19. For instance, according to the study published in the British Journal of Surgery, in May 2020, based on a 12-week period of peak disruption to hospital services due to COVID-19, around 28.4 million elective surgeries worldwide were canceled or postponed, thus indicating the negative impact of COVID-19 on the market studied.

Certain factors driving the market include the increasing adoption of minimally invasive surgeries, the rising geriatric population and burden of chronic diseases, and technological advancements in surgical microscopes.

The global population is aging rapidly due to reduced birth rates and increasing life expectancy. For instance, according to the United Nations’ World Population Prospects for 2020, the number of people over 65 years may increase from 9.3% in 2020 to more than 16% by 2050. Hence, the prevalence of age-associated chronic diseases and subsequent surgical interventions increased, expanding the market.

Surgical microscopes have become a crucial tool for minimally invasive surgical procedures in dental surgery, otorhinolaryngology, neurosurgery, ophthalmic surgery, and cosmetic surgery. Technological advancements in the products have significantly improved vision, positioning, stability, sizing, and recording capabilities and helped in the integration of image-guided microscope systems for better outcomes.

A surgical microscope offers optimum lighting, 3D visualization, and magnification of deep surgical fields through small approaches. It also benefits surgeons by adjusting their posture while performing complicated and long procedures. These factors are anticipated to propel the market during the forecast period.

However, factors such as lack of skilled professionals and low acceptance due to high cost are likely to hamper the market’s growth over the forecast period.

Key Market Trends

The Gynecology and Urology Segment is Expected to Hold a Significant Market Share

The COVID-19 outbreak negatively impacted the gynecology and urological application segment. The pandemic has majorly impacted surgical services. As per the study titled “COVIDSurg Collaborative,” in May 2020, approximately 2.5 million benign urological surgeries were canceled due to the COVID-19 outbreak. However, as elective surgeries and emergency surgical procedures are resuming, the demand for surgical microscopes for urological and gynecology conditions may increase.

The applications of surgical microscopes are wide, among which gynecological and urological applications are the most common, as these practices include many procedures. As the prevalence of urological and gynecological conditions is increasing worldwide, the significance of surgical microscopes is also increasing. For instance, urinary tract infections (UTIs) are one of the most common microbial diseases affecting people of all ages. According to the study titled “Epidemiology of urological infections: a global burden,” World Journal of Urology, January 2020, about 150 million people get affected by community-acquired UTIs (CAUTIs). The rising prevalence of target disorders and the complexity of their treatment led to the adoption of advanced techniques involving surgical microscopes.

In gynecological and urological practices, microscopes are used for the detection of cancers, laser surgeries, and diagnostic procedures. The microscopes, like colonoscopy and endoscopy, give access to the inside of the bowel or colon and ease the surgery. Due to the increasing diseases associated with bowel movements, colonoscopy and endoscopy are widely used, which is expected to drive the overall market over the forecast period.

North America is Expected to Dominate the Market Over the Forecast Period

The market growth in the region is vastly attributed to the United States due to the availability of highly advanced equipment, the presence of sophisticated facilities, skilled neurosurgeons and cosmetic surgeons, the increasing number of surgical facilities, the preference for outpatient settings, and the supportive reimbursement framework for medical treatments.

The burden of chronic illnesses, like cancer, cardiovascular diseases (CVD), and neurological diseases, is huge in the United States (US). The Centers for Disease Control and Prevention (CDC) estimates that, between 2010 and 2020, the number of new cancer cases in the country may increase by 24% in men to more than 1 million cases per year and by about 21% in women to more than 900,000 cases per year. Thus, the rising prevalence of chronic disorders and the complexity of their treatment have led to the adoption of advanced techniques that involve the use of surgical microscopes.

The introduction of technologically advanced products is boosting the demand for surgical microscopes as they offer better illumination sources, are more precise, and provide options for customization and technology integration based on the complexity of the procedures. For instance, in September 2020, True Digital Surgery (TDS) and Aesculap Inc. launched Aesculap Aeos Robotic Digital Microscope in the United States. Thus, such technologically advanced product launches are expected to boost the regional market’s growth.

However, the rising number of COVID-19 cases may negatively impact the growth of the North American surgical microscopes market due to the affected supply chains of most companies. The usage of equipment like surgical microscopes was temporarily halted to curb the contamination of the virus through surgical equipment. However, as surgical instruments such as colonoscopes and endoscopes are essential components of surgical services, the impact is not expected to be long-term.

Competitive Landscape

The surgical microscopes market is highly competitive and consists of several major players. Companies like Alcon, Alltion (Wuzhou) Co. Ltd, ARI Medical Technology Co. Ltd, Metall Zug (Haag-Streit), Danaher Corporation, Olympus Corporation, Seiler Instrument Inc., Takagi Seiko Co. Ltd, Topcon, and Carl Zeiss AG hold a substantial share in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION (Market Size by Value - USD million)

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alcon Inc.

- Alltion (Wuzhou) Co. Ltd

- ARI Medical Technology Co. Ltd

- ATMOS MedizinTechnik GmbH & Co. KG

- Avante Health Solutions

- Carl Zeiss AG

- HAAG-STREIT Surgical GmbH

- Danaher Corporation (Leica Microsystems)

- Metall Zug Group (Haag-Streit)

- Olympus Corporation

- Optofine Instruments Pvt. Ltd

- Seiler Instrument Inc.

- Synaptive Medical

- Takagi Seiko Co. Ltd

- Topcon Corporation