The escalating demographic of the elderly is driving a significant uptick in the demand for surgical interventions, highlighting the pivotal role of hemostatic agents within modern healthcare. As individuals age, they become more susceptible to a range of chronic conditions necessitating surgical correction to restore or improve functional capacity. This includes procedures such as orthopedic joint replacements and more complex cardiovascular and gastrointestinal surgeries. Aging is associated with physiological changes, including diminished tissue resilience and an elevated propensity for hemorrhage.

Consequently, the judicious application of hemostatic agents is critical for optimizing surgical outcomes in geriatric patients. With the global aging population on the rise, the demand for hemostatic products is projected to escalate correspondingly, underscoring their essential contribution to addressing the intricate surgical care requirements of older adults. Nonetheless, the prohibitive costs of advanced hemostatic technologies coupled with limited accessibility in resource-constrained environments may pose challenges to their broader implementation.

Combination hemostats segment accounted for the highest growth rate in the hemostats market, by type, during the study period.

The hemostats market is bifurcated into oxidized regenerated cellulose-based hemostats, thrombin-based hemostats, combination hemostats, gelatin-based hemostats, collagen-based hemostats, and other hemostats on the basis of type. The market for hemostatic agents is experiencing rapid growth due to the superior efficacy of combination hemostats compared to monotherapy products.These advanced hemostatic agents operate through multiple mechanisms, which enhance their ability to control surgical hemorrhage effectively. Key benefits associated with these combination products include decreased intraoperative blood loss, expedited and reliable hemostasis, reduced convalescence times, and a lower frequency of transfusion requirements. Furthermore, the implementation of combination hemostats has been linked to improved patient outcomes, such as shortened hospital stays and faster recovery trajectories.

Sponge hemostats segment accounted for the highest growth rate in the hemostats market, by formulation, during the forecast period.

The global hemostats market is bifurcated into matrix & gel hemostats, sheet & pad hemostats, sponge hemostats, and powder hemostats. The sponge hemostats segment is experiencing the most rapid growth due to an increasing reliance on sponge-based formulations among surgeons and healthcare professionals, attributed to several key advantages. These hemostatic sponges are highly absorbent, user-friendly, and conform well to irregular wound geometries, making them applicable to a wide range of surgical procedures.They facilitate prompt hemostasis, mitigate the risk of postoperative bleeding, and are frequently available in ready-to-use formats, eliminating the need for prior preparation. Furthermore, most sponge hemostats are bioresorbable, which removes the necessity for subsequent removal and minimizes potential complications. Recent advancements in material science have led to the development of sponge hemostats with enhanced biocompatibility and antimicrobial properties, further solidifying their clinical preference. These innovations not only improve the safety profile but also optimize their effectiveness in various surgical contexts.

By application, the orthopedic surgery segment accounted for the largest share of the hemostats market in 2024.

The hemostats market has been segmented into orthopedic surgery, general surgery, neurological surgery, cardiovascular surgery, gynecological surgery, reconstructive surgery, and other surgical applications, based on application. In 2024, the orthopedic surgery segment dominated the hemostats market, a trend driven by a rising prevalence of lifestyle-related conditions such as arthritis, osteoporosis, and obesity, which often lead to musculoskeletal complications requiring surgical intervention. The demographic shift towards an aging population, which is more susceptible to degenerative bone and joint disorders, also significantly contributes to the increased demand for orthopedic surgical procedures.Moreover, the escalating incidence of sports-related injuries and traumatic fractures necessitates a more substantial number of surgical interventions where precise hemostatic control is crucial. The growing preference for minimally invasive orthopedic techniques, which prioritize effective hemostasis without compromising clinical outcomes, further fuels market demand. Additionally, improved healthcare accessibility in emerging markets, coupled with the availability of advanced hemostatic agents, is facilitating the broader adoption of these products in orthopedic surgical practices.

By region, the Asia Pacific was the fastest-growing region in the hemostats market in 2024.

The global hemostats market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is poised for significant growth in the hemostats market over the forecast period, primarily driven by robust GDP growth and rising disposable incomes in emerging economies. These economic dynamics are facilitating increased healthcare expenditure among broader demographics.The demand for sophisticated surgical products, such as hemostats, is escalating due to a surge in surgical procedures, a higher prevalence of chronic diseases, and the ongoing modernization of healthcare infrastructures. Moreover, the market is propelled by the increasing integration of advanced medical technologies, extending even into rural areas. The rapid expansion of healthcare facilities, particularly hospitals and clinics in China and India, combined with government initiatives to enhance disease management awareness, are critical contributors to this growth. Additionally, the significant uptick in healthcare spending across numerous Asian nations has bolstered the purchasing power of healthcare providers, thereby expediting the adoption of innovative hemostatic agents within the region.

The break-up of the profile of primary participants in the hemostats market:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, Director-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America - 6%, and Middle East & Africa - 4%

Research Coverage

The report analyzes the hemostats market, estimating the market size and potential for future growth across various segments, including end users, regions, applications, type, and formulation. Additionally, the report features a competitive analysis of the key players in the market, detailing their company profiles, product offerings, recent developments, and key market strategies.Reasons to Buy the Report

The report provides valuable insights for market leaders and new entrants in the hemostats industry, offering approximate revenue figures for the overall market and its subsegments. It assists stakeholders in understanding the competitive landscape, enabling them to position their businesses better and develop effective go-to-market strategies. Additionally, the report highlights key market drivers, restraints, challenges, and opportunities, helping stakeholders gauge the current state of the market.This report provides insights into the following pointers:

- Analysis of key drivers (growing volume of surgical procedures performed, rising focus on R&D, and increasing emphasis on effective blood loss management in patients during surgeries), restraints (side effects and allergic reactions associated with hemostats), opportunities (increasing growth opportunities in emerging economies), and challenges (stringent regulatory framework, dearth of skilled personnel for effective use of hemostats, and high cost of hemostats) influencing the growth of the hemostats market.

- Market Penetration: It provides detailed information on the product portfolios that major players in the global hemostats market offer. The report covers various segments: end user, region, application, type, and formulation.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global hemostats market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the hemostats market across varied regions.

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global hemostats market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global hemostats market.

Table of Contents

Companies Mentioned

- Johnson & Johnson Services, Inc.

- Baxter

- Pfizer Inc.

- B. Braun SE

- Becton, Dickinson and Company (Bd)

- Teleflex Incorporated

- Medtronic PLC

- Hemostasis, LLC

- Stryker

- Integra Lifesciences

- Advanced Medical Solutions Group PLC

- Samyang Corporation

- Marine Polymer Technologies, Inc.

- Gelita Medical

- Dilon Technologies

- Betatech Medical

- Meril Life Sciences Pvt. Ltd.

- Biocer Development GmbH

- Unilene

- Katsan Medical Devices

- Tricol Biomedical

- 3-D Matrix Medical Technology

- Hemostat Medical GmbH

- Celox Medical Ltd.

- Altaylar Medical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 262 |

| Published | July 2025 |

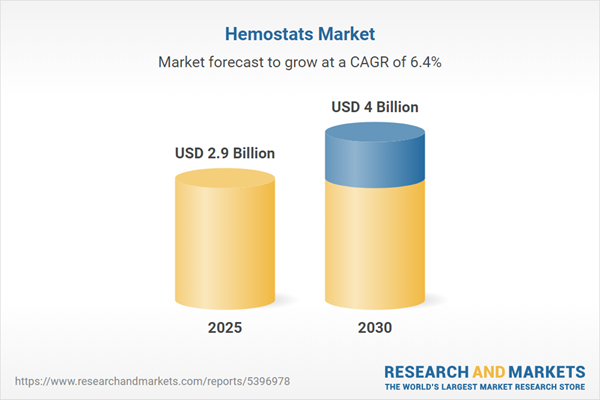

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 4 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |