In 2020, COVID-19 severely impacted industry growth due to decreased aircraft production and raw materials shortage. However, the growing aerospace industry post-pandemic is expected to increase thermal spray coatings consumption.

Key Highlights

- The extensive usage of thermal spray coatings in the aerospace sector increased usage in medical devices, and the rising popularity of thermal spray ceramic coatings primarily drives the market’s growth.

- Stringent government regulations for thermal spray coatings and issues regarding process reliability and consistency will likely restrain the market growth.

- The increasing applications in the oil and gas industry, advancements in spraying technology, and recycling of thermal spray processing materials are expected to provide numerous opportunities for the manufacturers in the market studied.

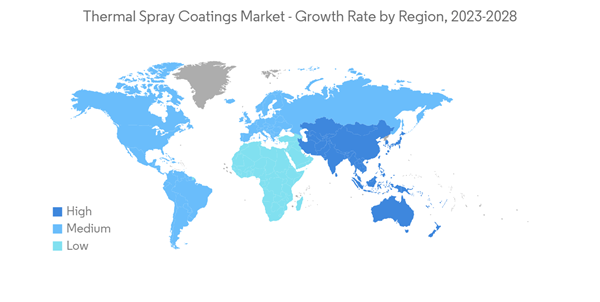

- North America dominated the global spray coatings market due to increased application in the aerospace industry and medical devices.

Thermal Spray Coatings Market Trends

Increasing Demand from the Aerospace Industry

- In the aerospace sector, thermal spray coatings are extensively used as protective coatings to protect aircraft components and repair old ones. The usage of thermal spray coatings for aircraft gas turbines provides various advantages, such as better corrosion resistance, resistance from contaminants, improved thermal efficiency, reduced emissions of nitrogen oxide (NOX), actuation systems, and to provide high thermal resistance, and increased component life.

- Thermal sprays are primarily employed for various purposes in jet engine components, such as crankshafts, piston rings, cylinders, valves, etc. In addition to these, they are also applied in the landing gear coating (bearings and axles inside the landing gear) to withstand the forces during landing and take-off.

- Most superalloy materials used to manufacture aircraft components and equipment possess good oxidation characteristics but are not corrosion and erosion resistant. Aviation components are subjected to harsh environments, exceptionally high heat, pressures, and abrasive chemicals. Thermal spray coatings significantly protect expensive engine components by extending the component life and improving performance.

- Thermal spray coatings, such as zirconium oxide, aluminum bronze, and cobalt-molybdenum, are used for coating purposes in rocket combustion chambers, compressor air seals, and high-pressure nozzles, respectively. In addition, chromium cobalt, aluminum oxide, and chromium carbide coatings are employed in turbine air seals, fuel nozzles, and turbine vanes. High-velocity oxy-fuel (HVOF) spray and plasma spray processes are the majorly used processes in this sector.

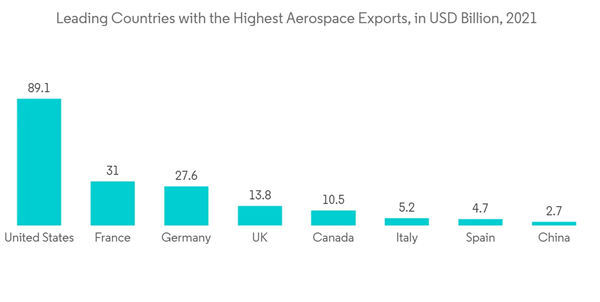

- In 2021, the United States contributed some USD 89.1 billion in aerospace exports, making it the leading country in aerospace exports. The country is home to some of the leading manufacturers in the aerospace sector, including Boeing and Lockheed Martin. As of 2021, six of the 12 leading aerospace and defense companies are based in the United States.

- Asia-Pacific and the Middle East & African regions are expected to witness rapid expansion in the aviation sector, owing to rising consumer incomes and investments in transportation infrastructure shortly.

- Asia-Pacific airlines registered substantial international growth four months in a row, reaching a year-on-year recovery rate of 453.3% in May, a significant increase from 103.5% in January 2022.

- Moreover, in 2021, the production value in the aerospace manufacturing industry was estimated to amount to approximately JPY 1.48 trillion (USD 13.96 billion), down from around JPY 1.61 trillion (USD 15.19 billion) in the previous fiscal year.

- All the factors mentioned above are expected to boost the consumption of thermal spray coatings in the aerospace industry during the forecast period.

North America to Dominate the Market

- North America represented the largest regional market for global thermal spray coatings. The United States is expected to remain the region's primary market for thermal spray coatings, owing to the increasing demand for improved performance at competitive costs and meeting all the regulations and industry standards.

- The United States is one of the world's largest producers of the automotive industry. The country's automotive production recorded robust growth in 2021 after the pandemic. In 2021, automotive production stood at 9.17 million units 2021, a 4% growth from the previous year.

- Additionally, strong exports of aerospace components to countries such as France, China, and Germany, along with robust consumer spending in the United States, are driving the manufacturing activities in the aerospace industry.

- According to the Federal Aviation Administration (FAA), the total commercial aircraft fleet is expected to reach 8,270 by 2037 from 5,791 in 2021, owing to the growth in air cargo. Also, the US mainliner carrier fleet is expected to grow to 54 aircraft per year due to the existing fleet getting older.

- The Canadian aerospace industry contributed around USD 24 billion to the country's GDP in 2021. The Canadian aerospace industry exports over 75% of its products to over 190 countries across six continents.

- Such factors above, in turn, increase the demand for thermal spray coatings in the region during the forecast period.

Thermal Spray Coatings Industry Overview

The global thermal spray coatings market is fragmented, with intense competition among the top players to capture a significant global market share. Most market leaders are vertically integrated, with a broad product portfolio of materials and equipment that is part of the overall thermal spray coatings market. Major players in the market include OC Oerlikon Management AG, Praxair S.T. Technologies Inc. (Linde PLC), Chromalloy Gas Turbine LLC, Kennametal Inc., and TOCALO Co. Ltd, among others (not in any particular order).Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Increased Usage of Thermal Spray Coatings in Medical Devices

4.1.2 Rising Popularity of Thermal Spray Ceramic Coatings

4.1.3 Growing Application in Aerospace Industry

4.2 Restraints

4.2.1 Issues Regarding Process Reliability and Consistency

4.2.2 Stringent Government Regulations for Thermal Spray Coatings

4.3 Industry Value-chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Powder Coating Materials

5.1.1 Ceramic Oxides

5.1.2 Carbides

5.1.3 Metals

5.1.4 Polymers and Other Powder Coating Materials

5.2 Process

5.2.1 Combustion

5.2.2 Electric Energy

5.3 End-user Industry

5.3.1 Aerospace

5.3.2 Industrial Gas Turbines

5.3.3 Automotive

5.3.4 Electronics

5.3.5 Medical Devices

5.3.6 Energy and Power

5.3.7 Oil and Gas

5.3.8 Other End-user Industries

5.4 Geography

5.4.1 Asia-Pacific

5.4.1.1 China

5.4.1.2 India

5.4.1.3 Japan

5.4.1.4 South Korea

5.4.1.5 Australia & New Zealand

5.4.1.6 Rest of Asia-Pacific

5.4.2 North America

5.4.2.1 United States

5.4.2.2 Canada

5.4.2.3 Mexico

5.4.3 Europe

5.4.3.1 Germany

5.4.3.2 United Kingdom

5.4.3.3 Italy

5.4.3.4 France

5.4.3.5 Rest of Europe

5.4.4 South America

5.4.4.1 Brazil

5.4.4.2 Argentina

5.4.4.3 Rest of South America

5.4.5 Middle East and Africa

5.4.5.1 Saudi Arabia

5.4.5.2 South Africa

5.4.5.3 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%)**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 APS Materials Inc.

6.4.2 ASB Industries Inc.

6.4.3 Bodycote PLC

6.4.4 Chromalloy Gas Turbine LLC

6.4.5 Chromalloy Gas Turbine LLC

6.4.6 Eurocoating SpA

6.4.7 FM Industries Inc.

6.4.8 FW Gartner Thermal Spraying (Curtis-Wright)

6.4.9 Kennametal Inc.

6.4.10 Oerlikon Metco

6.4.11 Praxair S.T. Technology, Inc.

6.4.12 The Fisher Barton Group (Thermal Spray Technologies)

6.4.13 Thermion

6.4.14 TOCALO Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Increasing Applications in the Oil and Gas Industry

7.2 Advancements in Spraying Technology (Cold Spray Process)

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- APS Materials Inc.

- ASB Industries Inc.

- Bodycote PLC

- Chromalloy Gas Turbine LLC

- Chromalloy Gas Turbine LLC

- Eurocoating SpA

- FM Industries Inc.

- FW Gartner Thermal Spraying (Curtis-Wright)

- Kennametal Inc.

- Oerlikon Metco

- Praxair S.T. Technology, Inc.

- The Fisher Barton Group (Thermal Spray Technologies)

- Thermion

- TOCALO Co. Ltd