Dry shampoo, with its unique selling point of extracting oil from the scalp without water, will be one of the critical factors that will drive the market's growth, propelled by fast-paced lifestyles and hectic work hours, and the propensity of living in highly polluted cities. With experts opining that regular washing of hair can cause damage to the hair, consumers are increasingly inclined toward natural and organic cosmetic products. Hence, there is a shift of consumers towards natural dry shampoo. Additionally, moderate to severe water shortages across developing regions augment dry shampoo's popularity, creating lucrative opportunities for key stakeholders. Also, the rising consumer preference for waterless products is fueling the global market.

Furthermore, along with the increasing demand for the product in supermarkets and hypermarkets and increasing internet penetration, the online market for purchasing personal care products, including shampoos, has seen rapid growth globally in the last 3-4 years. This category has attracted a few vertical specialists like Amazon, Walmart, Carrefour, etc. They are riding on increasing e-retailing growth and vying for a significant pie in online personal care products. Also, expanding the influence of digital beauty bloggers and providing exposure to new and niche brands is also supporting market growth worldwide.

Dry Shampoo Market Trends

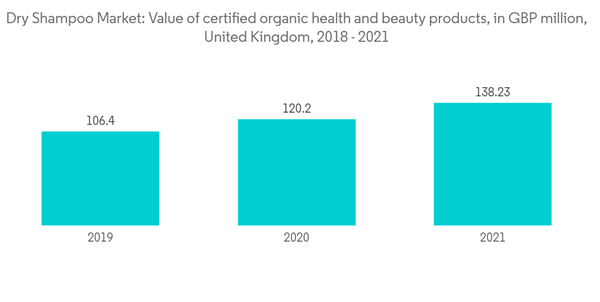

Organic/Natural formulations are Becoming Mainstream

With rising awareness about the side effects of chemical formulations and evolving consumer needs for shampoo products comprising natural ingredients, manufacturers are expanding their product portfolios and placing themselves in a highly competitive shampoo market. Shampoos with natural, silicone-free, paraben-free, and sulfate-free formulas with 80-100% naturally-derived ingredients are trending in the market. Consumer awareness about products and services and their benefits through digital media and other sources boost the segment's growth. Herbal and Ayurveda's global reach is pushed by Indians migrating to foreign countries and creating a promising market for traditional personal care products. The export rate of ayurvedic and herbal products increased significantly in recent years, affecting the global herbal market's growth. According to the Department of Commerce (India), the sales generated by exporting ayurvedic products accounted for USD 539.87 million in 2021, indicating a 26% increase compared to 2020. Thus, the market studied is expected to witness high demand in the international market.Dry shampoos are pioneering research in herbal ingredients. Various global players are strategically investing in sustainable development. New products have been launched after improving their environmental profile with high biodegradability levels, thus providing a jumpstart. For instance, In February 2022, Klorane, a genuine brand in European pharmacies, rolled out a new formulation for National Dry Shampoo Day. The brand launched its new Volumizing Dry Shampoo with Organic Flax which incorporates seven 100% natural, oil-absorbing, plant-based cleansing powders.

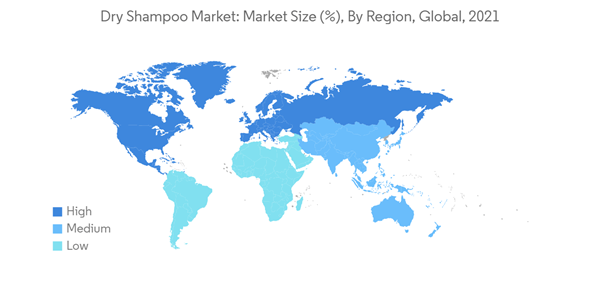

Asia-Pacific is the Fastest-Growing Market

The beauty and personal care industry in the Asia-Pacific region is witnessing tremendous growth due to an increasing number of beauty-conscious consumers, particularly in China, Japan, Thailand, and South Korea. The hair care regime is an important aspect of their everyday life. For example, the Chinese population considers shampoos an essential hair care product to keep the moisture balance of the hair. Additionally, in China, the demand for anti-hair fall shampoo is growing rapidly, mainly attributable to the high-pressure life and increasing pollution levels. Moreover, substantial growth in disposable income, rising living standards, the fast-paced life of consumers, and various advancements such as anti-hair fall and anti-dandruff dry shampoos, are factors expected to confer a boost to the growth of the dry shampoo market during the forecast period. Furthermore, the rapid adoption of 2-in-1 shampoos and conditioners, intended to clear the scalp and make hair soft and silky, across the Asia-Pacific region is expected to fuel the overall market.Dry Shampoo Industry Overview

The dry shampoo market faces high competition, with the majority of market share being held by leading players, including Procter & Gamble, Church & Dwight UK Ltd., Henkel AG & Co. KGaA, L'Oréal Paris, BBLUNT, MacAndrews & Forbes Incorporated, Coty Inc., PHILOSOPHY INC, and Unilever. The key players focus on product development, online distribution channels, strategic expansions, advertisement, and branding of their products to expand their geographic reach and consumer base. The leading companies are also investing heavily in R&D to ensure high-quality products. Launching new products and strategic expansions to untapped geographies are the preferred strategies of players operating in the market. Leading manufacturers in the dry shampoo market are focusing on leveraging the opportunities posed by the emerging markets of Asia-Pacific, such as India, to expand their revenue base.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Church & Dwight Co., Inc.

- Unilever

- Procter & Gamble

- L'Oreal S.A.

- BBLUNT

- MacAndrews & Forbes (Revlon)

- Henkel AG & Co. KGaA

- Kao Corporation

- Coty Inc.

- Philosophy, Inc.