Chocolate consumption is rising in South Korea as consumers are shifting towards small luxuries and high-quality products, thereby propelling the growth of premium chocolate brands. Consumers following these trends are willing to purchase premium-priced chocolate with quality ingredients, high cacao content, and minimal artificial additives. Additionally, there is an inclination toward a healthier lifestyle, which has been driving the consumption of sugar-free and dark chocolate. Also, consumers are preferring organic, vegan, and gluten-free chocolates, which is expected to be one of the key factors boosting the growth of the market in the coming years.

In South Korea, people give chocolates or other sweet snacks on various occasions. Increased demand for premium chocolate brands and boxed assortments is the key factor driving the chocolate market across the country. Among chocolate consumers in Korea, 92% of consumers consumed milk chocolate, 7% consumed dark chocolate, and only 1% consumed white chocolate, as per an article published by the Korean Nutrition Society and the Korean Society of Community Nutrition in the year 2020. Innovation in product packaging and chocolate with toys is gaining popularity among adults as well. Growing demand for imported chocolate owing to premium varieties is further accelerating overall sales. These factors are thus promoting the demand and growth of the chocolate market in South Korea over recent years.

South Korea Chocolate Market Trends

Rising Demand for Premium Chocolates

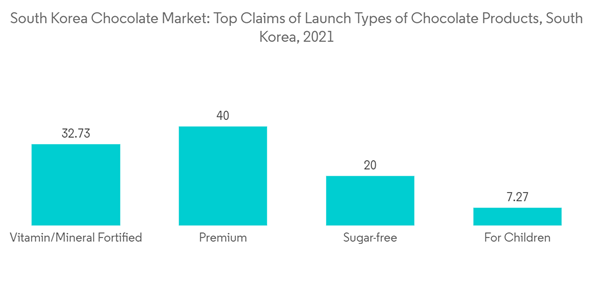

Chocolate consumption in South Korea has become more diverse with chocolate-making classes to handmade chocolate, an increase in imported chocolates, and a rising preference for premium chocolates. South Korean consumers consider imported and premium chocolate products with great regard. Consumers also prefer premium chocolate, chocolate bars, and products with high cocoa content. For instance; as per the Government of Canada, premium chocolates accounted for nearly 40% of new product launches in South Korea in the year 2021.Consumers in South Korea enjoy premium chocolates and prefer expensive boxed chocolates, especially for gift-giving, which are available across high-end stores in the country. Korean consumers enjoy premium chocolate as an alternative to luxurious desserts, giving rise to the expansion of more premium international brands in the country. Presently, global premium chocolate brands such as “Pierre Ledent”, “GODIVA”, “haut dessert”, “La Maison du Chocolat” and “ROYCE” have established their exclusive stores in Seoul.

Furthermore, the tradition of gift-giving chocolates on occasions such as Christmas, Valentine's Day, White Day, etc. has been fuelling the demand for premium chocolates by South Korean consumers. Moreover, the passion for chocolates in South Korea is symbolized by the Choco Pie which is made up of two small layers of cake filled with marshmallows and coated in chocolate, supporting demand. Therefore, all the above-mentioned factors support the demand and growth of the chocolate market in South Korea.

Modern Sales Channels Boosting the Market Sales

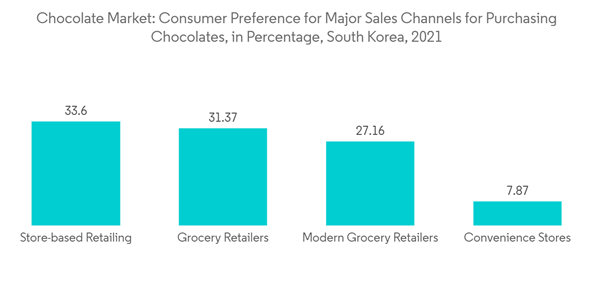

South Korean consumers majorly prefer convenience stores, grocery stores, and supermarkets/hypermarkets for the purchase of chocolates. This is majorly attributed to the convenience factor, ease of searching, billing, a wide selection of products, and discounts and promotions that fueled the retail chocolate sale. Convenience stores and supermarkets are growing at a steady rate given the product promotions, easy accessibility factors, and such stores running a variety of specially packaged products targetting specific celebratory days. For instance; as per the Government of Canada, the majority of confectionery in South Korea is distributed through store-based retailing (93.5%) versus non-store retailing (6.5%) in the year 2021.However, sales via online retail stores are surging and recording an impressive growth rate. Consumers these days actively search for new chocolate products and brands which allows them to get personalized recommendations online to help find new flavors and products. These factors are thus propelling the consumption of chocolates via online retail stores. The growing popularity of premium and artisanal chocolate is one of the primary drivers of the South Korean chocolate market. South Korean consumers have become more sophisticated in their preferences, and they are seeking higher-quality chocolate products manufactured with natural and organic ingredients. As a result, a plethora of artisanal chocolate companies have evolved in South Korea, and these products are frequently promoted via social media platforms and online markets.

South Korea Chocolate Industry Overview

The Chocolate market in South Korea is competitive with the presence of regional and international brands. Prominent market players emphasize mergers and acquisitions, product launches, partnerships, etc. as strategic approaches to boost their brand presence among consumers. Some major players in the South Korea Chocolate market include Lotte Co. Ltd., Ferrero Group, Crown Confectionery Co. Ltd., Meiji Holdings Co. Ltd, and Orion Confectionery Co, Ltd, among others. Companies have been advertising their products through celebrity endorsement, community bulletin boards, and local newspaper advertising, to create brand awareness, and increase their sales in the country. Also, major players in the market studied have been building an appetite for higher priced chocolates among young consumers, by increasing the accessibility and innovative productsAdditional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Crown Confectionery Co., Ltd.

- The Hershey Company

- Orion Confectionery Co, Ltd.

- Mars, Incorporated

- Ferrero International S.A.

- Lotte Corporation

- Meiji Holdings Co. Ltd

- Perfetti Van Melle Group

- Mondelēz International, Inc.

- Loacker USA Inc.