Key Highlights

- Agrochemicals are essential for crop protection and increased yield during the pre-harvest stage. Utilizing crop protection agents wisely promotes sustainable farm management and provides socioeconomic advantages to address the challenges of feeding a population that is always expanding. Therefore, farmers use agrochemicals to fuel the market for sustainable development of agricultural production in the country.

- The fertilizer segment is the largest agrochemical market in the country due to the technical and scientific advancements that have made fertilizers more efficient in recent years and have helped farmers maximize fertilizers' benefits while reducing risks. For instance, slow-release fertilizers and controlled-release fertilizers are widely used in broad-acre crops like maize, wheat, cotton, etc. In Pakistan, fertilizer usage is influenced by location, water availability, costs, and the timely availability of various products.

- Insect pests are the major cause of crop damage, yield, and quality reduction in Pakistan. The pest problem in the country has increased with the introduction of high-yielding and fertilizer-responsive varieties, which prove susceptible to various pests.

- The adoption of sustainable farming technologies, increasing adoption of biobased agrochemicals, government subsidies, and the need for increased land productivity are some of the major factors driving the market growth in the country.

Pakistan Agrochemicals Market Trends

Need for Increased Land Productivity

- The focus of the agricultural sector is to increase productivity and food security in the country. However, the country's agricultural productivity has fluctuated over the years compared to neighboring regional economies. Cereal crops require many agrochemicals in the country, particularly wheat, rice, and maize. Wheat is one of the major crops cultivated in the country, whose area under cultivation was increased from 8.8 million ha in 2018 to 9.2 million ha in 2021. The increase in the area under cultivation drives the demand for agrochemicals in the country during the forecast period.

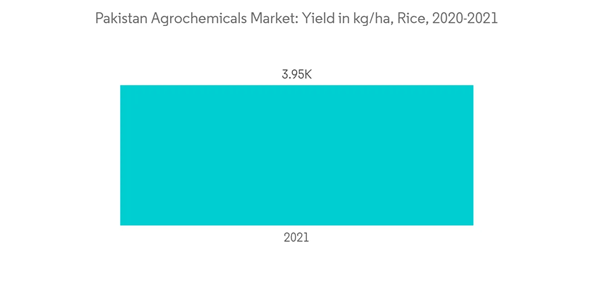

- The use of agrochemicals increases productivity which drives the market. For instance, rice productivity increased from 2,562.9 kg/ha in 2018 to 3,953.2 kg/ha in 2021.

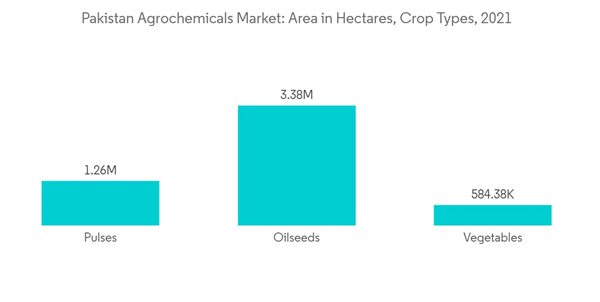

- In the case of vegetable crops, both herbicides and insecticides are used to protect major crops such as tomatoes, onions, chilis, peppers, etc., as they are the primary vegetables produced in the country. The pesticides are effective in combating pests and increasing the yield of the crops. The share of the application of agrochemical products on fruit crops is anticipated to increase. It is anticipated that the agrochemicals market in Pakistan will continue to grow in the coming years, majorly due to the growing population, increasing focus on food security, increased investment in research and development, the need to enhance land productivity, and an increase in farming income.

Grains and Cereals Dominate the Market

- As per studies, cereal crops, especially wheat, rice, and maize, have contributed the highest to the overall agrochemical demand. Maximum demand for agrochemical products, such as pesticides, is generated by cereal crop growers in the country.

- According to the Food and Agriculture Organization, in 2021, the country showed an increase in the cultivation and production of grains and cereals, which accounted for most of the country's production. In 2018, the total cereal production in the country was reported to be 39.7 million metric tons which will increase to 52.4 million metric tons in 2021. This is anticipated to drive the demand for agrochemical products over the forecast period.

- Wheat, Pakistan's largest crop in area sown, is grown under different agroecological zones. In irrigated areas, wheat is planted after cotton, rice, and sugarcane, while in rainfed areas, wheat is grown at the same time as maize and millet. Also, there is a heavy demand for animal protein sources in the country, and the demand for feed for poultry and cattle has driven maize farmers to expand cultivation.

- The shift of farmers away from cultivating cotton to cultivating rice during the Kharif/summer season is also significant, and cotton is attributed to multiple problems like a low-quality seed, pest problems, harsh climatic conditions, and lower profitability associated with Pakistan's cotton crop. All these factors drive the demand for agrochemicals for grains and cereal production.

Pakistan Agrochemicals Industry Overview

The Pakistani agrochemical market is consolidated, with major players such as Bayer AG, Syngenta, BASF SE, Evyol Group, and FMC Corporation. The market is anticipated to be more consolidated in the future, as the major players are expanding and investing in their businesses by adopting various strategies, such as mergers and acquisitions, expansions, partnerships, and product launches. The companies will majorly be seen as expanding and diversifying their crop protection chemical businesses by launching products with new ingredients.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.