The COVID-19 pandemic negatively impacted the market in 2020. However, the market reached pre-pandemic levels and is expected to grow steadily in the coming years.

Key Highlights

- Over the short term, the primary factor driving the market's growth is the increasing demand for polymer production. The surge in the use of rubber oils is also likely to augment the demand for process oils in the coming years.

- However, declining usage of PAH and DAE due to stringent regulations is likely to hinder the market's growth during the studied period.

- Nevertheless, research in bio-based rubber process oils and the accelerating demand for process oils in electric vehicles can soon be the factors behind growth opportunities for the global market.

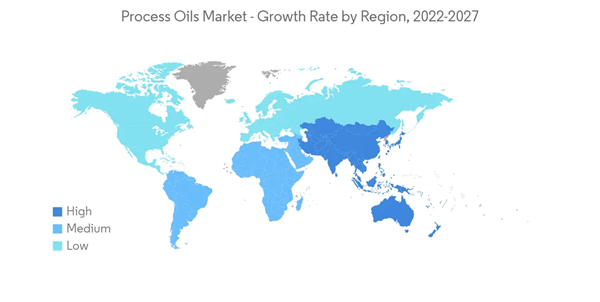

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Process Oils Market Trends

Rubber Applications to Dominate the Market

- Rubber process oil is manufactured using petroleum after the more volatile petrol, and heating oil fractions are separated using the distillation process.

- Both natural and synthetic process oils are commercially used in producing several rubber products, including rubber bands, toys, and tires.

- They are also used in the mixing process for rubber compounds as they increase the dispersion of fillers and enhance the flow characteristics of the mixture.

- The expansion of the global rubber industry is promoting the use of rubber process oils across various application industries. Some typical rubber applications include tires, construction materials, white goods, biomedical, and textiles.

- China is the largest tire-producing country in the world. According to the National Bureau of Statistics of China, tire production in China in 2021 was 902.46 million units, an increase of around 95 million units compared to 2020.

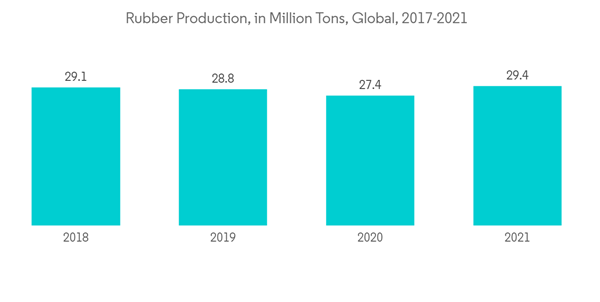

- According to Malaysian Rubber Council, the global rubber production in the first half of 2022 was around 13.9 million metric tons, with a decline of 1.5% from the corresponding period of the previous year, where about 14.1 million metric tons were produced.

- Based on the factors above, the rubber oil application for process oils is expected to dominate the market.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is an area of immense potential due to the extensive demand for textiles and personal care products in countries such as India and China.

- China continued to be the biggest textile and apparel exporter in the world since 1994. The country dominates the global low-to-medium-end market by mainly engaging in OEM manufacturing and processing. At the same time, the European Union continues to dominate the global upmarket and high-quality textiles.

- According to OICA, automotive production in China in 2021 was at 26.08 million units, with a 3% growth from 25.22 million units in 2020. It is anticipated to positively impact the process oil market during the forecast period.

- Presently, the penetration of personal care products in India is comparatively low compared to developed and other developing economies.

- However, the improving economic environment and the increasing purchasing power of the Indian population are expected to increase the adoption of personal care products in the country.

- According to NIPFA India, the Indian beauty and personal care industry is currently worth USD 26.8 billion and is anticipated to grow to USD 37.2 billion over the next three years. The growth of the Indian market is expected to boost the development of the process oil market during the studied period.

- According to OICA, the automotive industry in India observed a growth of 30% in 2021 and produced around 4.39 million units. Rapid growth in the Automotive sector would positively impact the studied market.

- Due to the factors above, the market for process oils in the Asia-Pacific region is expected to dominate the global market during the forecast period.

Process Oils Industry Overview

The process oils market is partially consolidated in nature. Some of the major players in the market are Chevron Corporation, ExxonMobil Corporation, HP Lubricants, Royal Dutch Shell Plc, and Total.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Rising Polymer Production

4.2 Restraints

4.2.1 Declining Automotive Sector

4.2.2 Declining Usage of PAH and DAE due to Stringent Regulations

4.3 Industry Value Chain Analysis

4.4 Porters Five Force Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

5.1 Type

5.1.1 Aromatic

5.1.2 Paraffinic

5.1.3 Naphthenic

5.2 Application

5.2.1 Rubber

5.2.2 Polymers

5.2.3 Personal Care

5.2.4 Textile

5.2.5 Other Applications

5.3 Geography

5.3.1 Asia-Pacific

5.3.1.1 China

5.3.1.2 India

5.3.1.3 Japan

5.3.1.4 South Korea

5.3.1.5 Rest of Asia-Pacific

5.3.2 North America

5.3.2.1 United States

5.3.2.2 Canada

5.3.2.3 Mexico

5.3.3 Europe

5.3.3.1 Germany

5.3.3.2 United Kingdom

5.3.3.3 Italy

5.3.3.4 France

5.3.3.5 Rest of Europe

5.3.4 South America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.4.3 Rest of South America

5.3.5 Middle-East and Africa

5.3.5.1 Saudi Arabia

5.3.5.2 South Africa

5.3.5.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share(%)**/ Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Chevron Corporation

6.4.2 Ergon Inc.

6.4.3 Exxon Mobil Corporation

6.4.4 HollyFrontier Refining & Marketing LLC

6.4.5 HP Lubricants

6.4.6 Idemitsu Kosan Co. Ltd

6.4.7 LUKOIL

6.4.8 Nynas AB

6.4.9 ORGKHIM Biochemical Holding

6.4.10 Panama Petrochem Ltd

6.4.11 PetroChina

6.4.12 PETRONAS Lubricants International

6.4.13 Phillips 66 Company

6.4.14 Repsol

6.4.15 Royal Dutch Shell PLC

6.4.16 ENEOS Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Research in Bio-based Rubber Process Oils

7.2 Rising Demand for Process Oils in Electric Vehicles

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Chevron Corporation

- Ergon Inc.

- Exxon Mobil Corporation

- HollyFrontier Refining & Marketing LLC

- HP Lubricants

- Idemitsu Kosan Co. Ltd

- LUKOIL

- Nynas AB

- ORGKHIM Biochemical Holding

- Panama Petrochem Ltd

- PetroChina

- PETRONAS Lubricants International

- Phillips 66 Company

- Repsol

- Royal Dutch Shell PLC

- ENEOS Corporation