Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Manufacturers are focusing on fuel-efficient and durable models with enhanced payload capacity, aligning with the rising demand from sectors such as road construction, waste management, and quarrying. Electrification of tipper trucks and adoption of hybrid variants are emerging as long-term opportunities, catering to sustainability targets and reducing total cost of ownership. Smart fleet management solutions, real-time diagnostics, and predictive maintenance features are being deployed to improve operational efficiency.

Market Drivers

Infrastructure Development and Urbanization

Ongoing infrastructure development and accelerated urbanization are significantly fueling the demand for tipper trucks across industries. As road construction, metro rail expansion, housing developments, and industrial corridors increase, the need for efficient material transport vehicles has risen sharply. Tipper trucks are widely used to transport aggregates, debris, and raw construction material in large quantities, offering a critical link in project timelines and logistics. The push toward urban expansion requires timely removal of excavated material and consistent delivery of concrete, sand, and gravel, which enhances the utilization rate of tipper trucks.Governments and private sectors are investing in high-value civil projects, driving sustained procurement of medium and heavy-duty dump trucks. Tipper trucks offer reliability and load-handling flexibility across uneven terrain, making them indispensable in large-scale site operations. With urban planning involving smart city development and expansion of public infrastructure like airports, railways, and highways, the relevance of tipper trucks in supporting rapid material movement continues to grow.

For instance, in 2024, the European Commission awarded a record $7.6 billion USD (converted from €7 billion) under the Connecting Europe Facility (CEF) to 134 strategic transport projects, with 80% of the funding directed toward rail infrastructure and 83% aligned with EU climate goals. Key investments include cross-border rail links like Rail Baltica, Lyon-Turin, and Fehmarnbelt tunnel, maritime port electrification, inland waterway upgrades, road safety enhancements, and expansion of EU-Ukraine Solidarity Lanes. This marks the largest call in the CEF Transport programme and supports the revised TEN-T Regulation.

Key Market Challenges

High Capital and Operating Costs

One of the major challenges affecting the tipper truck market is the high initial investment and operational cost associated with these vehicles. Procuring a new tipper truck requires significant upfront expenditure, particularly for medium and heavy-duty models designed for industrial use. Beyond purchase cost, operators must consider insurance, licensing, taxes, and periodic inspection fees.Fuel expenses represent a substantial ongoing cost, especially in long-haul and high-load operations. While advancements in engine technology have improved fuel economy, volatile fuel prices continue to strain fleet budgets. Maintenance is another critical cost driver, as tipper trucks operate in harsh environments involving dust, heavy loads, and difficult terrain. Components such as hydraulic systems, tires, brakes, and suspension require frequent inspection and replacement, increasing the total cost of ownership.

Key Market Trends

Electrification of Medium and Heavy-Duty Tippers

The shift toward electrification is becoming a key trend in the tipper truck industry, particularly among medium and heavy-duty models. As the industry moves to align with sustainability goals, several manufacturers are developing electric tipper trucks that offer zero-emission operation and lower noise levels. These vehicles are particularly well-suited for urban construction, waste management, and short-haul industrial use, where operating ranges can be limited, and emissions restrictions are tight. Battery technology has advanced significantly, offering better energy density, faster charging, and longer lifespans, making electric tipper trucks more viable than before.Companies are piloting electric fleets in specific applications to gather performance data, reduce operating costs, and align with green procurement mandates. Fleet operators stand to benefit from reduced fuel expenses, lower maintenance needs due to fewer moving parts, and exemption from certain tolls or environmental taxes. For instance, In Q1 2024, zero-emission heavy-duty vehicle (HDV) sales in the EU-27 surged despite a 9% drop in total HDV sales compared to Q1 2023. Germany led ZEV HDV adoption, accounting for 40% of sales. Zero-emission heavy trucks exceeded a 1% market share, light and medium ZEV trucks rose to over 8% (up from 6%), and ZEV buses reached 12% (up from under 5%). Of the 86,000 HDVs sold, Germany, France, and Italy together made up 57% of sales, each showing year-on-year growth. Mercedes-Benz led the brand rankings with a 22% share, followed by MAN (15%), Scania (13%), Iveco (13%), and others, with the top seven brands capturing 90% of the market.

Key Market Players

- AB Volvo

- Tata Motors Limited

- Caterpillar Inc.

- OJSC Belaz

- Hitachi Construction Machinery Co. Ltd.

- MAN Truck & Bus AG

- BEML Limited

- Komatsu Limited

- Scania AB

- FAW Trucks Qingdao Automobile Co., Ltd

Report Scope:

In this report, the Europe & CIS Tipper Truck Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe & CIS Tipper Truck Market, By Vehicle Type:

- Small (Less than 30 Tons)

- Medium (31 Tons - 70 Tons)

- Large (Above 70 Tons)

Europe & CIS Tipper Truck Market, By Size:

- 6-Wheeler Rigid Tipper

- 4-Wheeler Rigid Tipper

- 8-Wheler Rigid Tipper

- Articulated Wheeler Rigid Tipper

Europe & CIS Tipper Truck Market, By Application:

- Construction

- Mining

- Others

Europe & CIS Tipper Truck Market, By Country:

- Germany

- Russia

- France

- Spain

- Italy

- United Kingdom

- Poland

- Rest of Europe & CIS

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe & CIS Tipper Truck Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AB Volvo

- Tata Motors Limited

- Caterpillar Inc.

- OJSC Belaz

- Hitachi Construction Machinery Co. Ltd.

- MAN Truck & Bus AG

- BEML Limited

- Komatsu Limited

- Scania AB

- FAW Trucks Qingdao Automobile Co., Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | July 2025 |

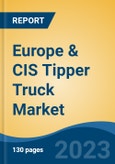

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.59 Billion |

| Forecasted Market Value ( USD | $ 15.72 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Europe, Russia |

| No. of Companies Mentioned | 10 |