The global aviation sector has faced unmatched challenges due to the COVID-19 pandemic. The restrictions from the government led to supply chain disruptions, reduced demand for aircraft parts, and production halt from aircraft OEMs. The aviation sector has witnessed a strong recovery after the pandemic due to increased air passengers and a relaxation in travel restrictions.

Factors like the increasing number of orders for new aircraft and the need to increase the aircraft production rate are likely to create a demand for aircraft fasteners. Growing air traffic worldwide, rising aircraft modernization programs, and increasing spending on procuring new aircraft are driving market growth. Furthermore, rising investments by the airlines in interior cabin products to enhance passengers' experience are expected to boost market growth in the coming years.

In the global market forecast report for 2022, Airbus projected that there would be demand for 39,490 new passengers and freighter aircraft over the next 20 years. Out of the 39,490 aircraft, the OEM predicts that 31,620 or 80% will be typically single-aisle, and 7,870 will be typically widebody. Thus, increasing demand for new aircraft is expected to create demand for aerospace fasteners.

Aerospace Fasteners Market Trends

Commercial Aircraft Segment Will Showcase Remarkable Growth During the Forecasts Period

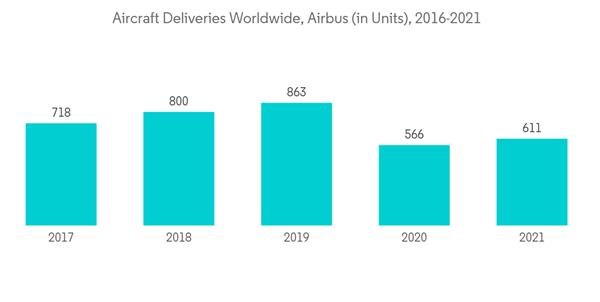

Commercial aircraft are projected to show significant growth during the forecast period. There are more than one million fasteners used in commercial aircraft. The rising number of air travelers, growing expenditure on aircraft upgradation contracts, and increasing commercial aircraft deliveries are driving the market growth. The International Air Transport Association (IATA) projected that the overall number of air passengers will reach 4 billion by 2024. Furthermore, the Federal Aviation Administration forecasted that the number of United States airline passengers will reach 1.28 billion by 2038.Global aircraft original equipment manufacturers (OEMs) such as Airbus, Boeing, Embraer, Bombardier, and others have received increasing aircraft orders after the COVID-19 pandemic. In 2021, Airbus delivered 611 commercial aircraft to 88 customers, while Boeing delivered 340 commercial aircraft. Thus, the growing number of commercial aircraft deliveries and new orders for aircraft OEMs create demand for aerospace fasteners, driving the market's growth.

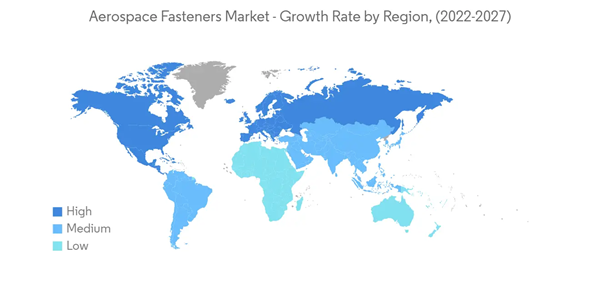

Asia-Pacific is Expected to Show Highest Growth During the Forecast Period

Asia-Pacific is estimated to show remarkable growth during the forecast period. The growth is due to rising cargo traffic, a growing number of airports, and increasing expenditure on the aviation sector from emerging economies, such as China and India. The rapid expansion of the aviation sector and growing urbanization are expected to create further demand for new aircraft, driving the market growth.For instance, in February 2020, the Indian government announced that 100 new airports would be built by 2024. Also, the IATA report stated that China would surpass the United States and become the largest aviation market. In contrast, India will surpass the United Kingdom to become the third-largest aviation market in 2024.

Additionally, growing expenditure on the procurement of military aircraft from India and China is expected to boost the market growth. The Indian Air Force is planning to procure 114 fighter jets, out of which 96 will be built in India under the Atmanirbhar scheme. In August 2021, Raghu Vamsi, an Indian aircraft component manufacturing company, signed a contract with Boeing to supply critical aviation components. The company manufactures aerospace fasteners, gears, sheet metal fabrication, and others. Hence, the rising demand for aerospace fasteners due to the growing demand for new aircraft is expected to propel the market growth across the Asia Pacific region.

Aerospace Fasteners Market Competitor Analysis

The aerospace fasteners market is moderately consolidated in nature. It is characterized by a few suppliers providing various types of aerospace fasteners. Some prominent aerospace fasteners market players are Stanley Black & Decker Inc., LISI Aerospace, Arconic, Precision Castparts Corp., 3V Fasteners, and others.With the growing competition in the industry, manufacturers of aerospace fasteners are focusing on developing lightweight aircraft components and introducing advanced technologies such as 3D printing. For instance, in October 2021, LISI Aerospace introduced Markforged Composite 3D printers to optimize the faster manufacturing of high-quality fasteners for the aerospace sector.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3V Fasteners Company Inc. (Consolidated Aerospace Manufacturing LLC)

- Arconic Inc.

- B&B Specialties Inc.

- LISI Aerospace

- KLX Aerospace (Boeing)

- BUFAB

- TriMas

- Berkshire Hathaway Inc. (Precision Castparts Corp.)

- NAFCO

- TFI Aerospace

- FSL Aerospace

- Stanley Black & Decker Inc.