Key Highlights

- Numerous consumers in the United Arab Emirates are inclined towards online delivery channels, and they purchase food and beverage products through online mediums. This, in turn, resulted in several retailers expanding their online footprints to retain consumers and maintain their market share. This maintained the demand for daily essentials, including frozen desserts, while respecting the social distancing norms imposed by the government.

- For instance, in October 2020, Waitrose & Partners launched a new online shopping site in the United Arab Emirates, called Waitrose.ae, to retail 15,000 products, including frozen food products, to consumers in Dubai and Abu Dhabi.

- Furthermore, United Arab Emirates is inhospitable to most agriculture due to its arid climate and nominal rainfall, and thus, it relies heavily on imports of food and other products from other nations across the globe. The fast-changing consumer preferences for the ever-rising need for convenience due to busy lifestyles propel the demand for frozen food products.

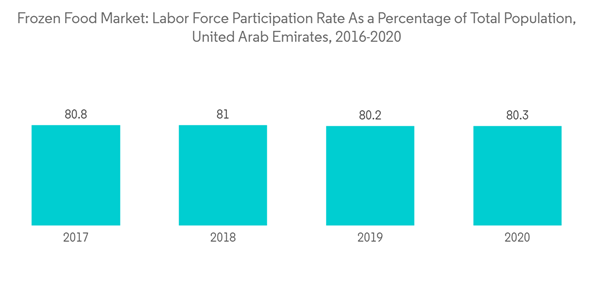

- Attributed to a high number of foreign and expatriate workers, United Arab Emirates is witnessing significant demand for seafood and halal seafood products, which further represents considerable potential in the frozen food products market in the United Arab Emirates.

UAE Frozen Food Market Trends

Escalating Demand for Ready-to-Eat and Convenience Food Products

- Consumers in the United Arab Emirates are looking for convenience food products such as ready-to-eat products and meals. The research and development leading to innovation in food products via new and innovative frozen food technologies are propelling market demand. Frozen meals are enticing to consumers due to their hectic lifestyles, which do not permit them to invest much time in cooking, but they require food products with high nutritional content. In addition to this, the wider availability of convenience food products via different sales channels, such as both online and offline availability, is attracting consumers towards them.

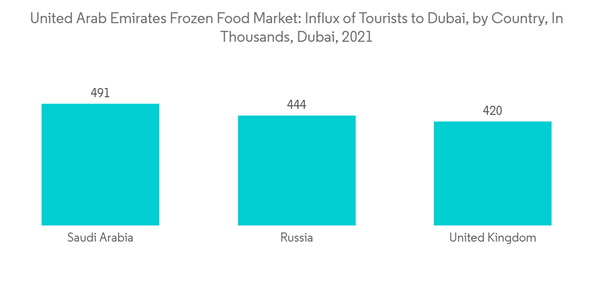

- Also, the demand for packaged food products is rising in the United Arab Emirates, attributed to rising urbanization and a high percentage of tourists and expatriates. For instance, According to Dubai's Department of Economy and Tourism (DET), Between January and December 2021, Dubai hosted 7.28 million international overnight visitors, a 32% year-on-year (YoY) growth. The rise in consumers (including both residents and tourists) is fuelling demand for processed, canned, frozen, and ready-to-eat food products.

- The new-age consumers in the country (especially millennials) are sophisticated when it comes to their food shopping and eating habits; they spend on high-quality and healthy food. Most food and beverage chains continue to innovate and experiment with multiple product offerings and models to cater to this growing consumer segment.

Frozen Ready Meals is the Fastest Growing Segment

- Frozen ready meals are those meals that are precooked and packaged and then frozen for further sale in the market. The frozen-ready meals are more appealing to consumers as they are a convenient alternative to cooking, thereby enhancing their use by the working population.

- Working people have to spend less time on cooking and thereby increasingly prefer frozen food products or precooked meals such as meatballs, veg meals, etc. Additionally, there is a high demand from customers for frozen food products that have been halal-certified. Prominent players such as Ta'moosh are offering frozen gourmet ready-to-eat halal dishes to maintain a significant share in the UAE market.

- Thus, all the above-mentioned factors are supporting the demand for frozen and convenience food products in the United Arab Emirates.

UAE Frozen Food Industry Overview

The United Arab Emirates frozen food market is highly competitive and fragmented, with several players selling frozen and shelf-stable food products via several distribution channels present across the country. Thus, market players are adopting strategies such as expansions, product innovations, partnerships, and mergers and acquisitions to achieve a competitive advantage and sustain in the market for a longer period. Some of the prominent players in the market include General Mills Inc., IFFCO, Al Kabeer Group, Al Islami Foods, etc. These players will embark on innovations and market expansions to increase their range of products and widen their consumer base.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- JBS S.A.

- BRF S.A.

- Sidco Foods Trading LLC

- Al Islami Foods

- Al Kabeer Group ME

- General Mills, Inc.

- European Sea Food LLC

- Americana Group

- IFFCO Group

- Unilever PLC

- Mars, Incorporated