1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

Table 1 Inclusions and Exclusions

1.3 Study Scope

Figure 1 Automotive Smart Antenna Market Segmentation

1.3.1 Regions Covered

1.3.2 Years Considered

1.4 Currency Considered

Table 2 Currency Exchange Rates

1.5 Unit Considered

1.6 Stakeholders

1.7 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 2 Automotive Smart Antenna Market: Research Design

Figure 3 Research Design Model

2.1.1 Secondary Data

2.1.1.1 List of Key Secondary Sources to Estimate Vehicle Production

2.1.1.2 List of Key Secondary Sources to Estimate Market Size

2.1.1.3 Key Data from Secondary Sources

2.1.2 Primary Data

Figure 4 Breakdown of Primary Interviews

2.1.2.1 Primary Participants

2.2 Market Size Estimation

Figure 5 Research Methodology: Hypothesis Building

2.2.1 Bottom-Up Approach

Figure 6 Automotive Smart Antenna Market Size Estimation: Bottom-Up Approach (Vehicle Type and Region)

2.2.2 Top-Down Approach

Figure 7 Automotive Smart Antenna Market Size Estimation: Top-Down Approach (Frequency and Component Type)

2.3 Data Triangulation

Figure 8 Data Triangulation

2.4 Factor Analysis

2.5 Research Assumptions

2.6 Research Limitations

2.7 Recession Impact Analysis

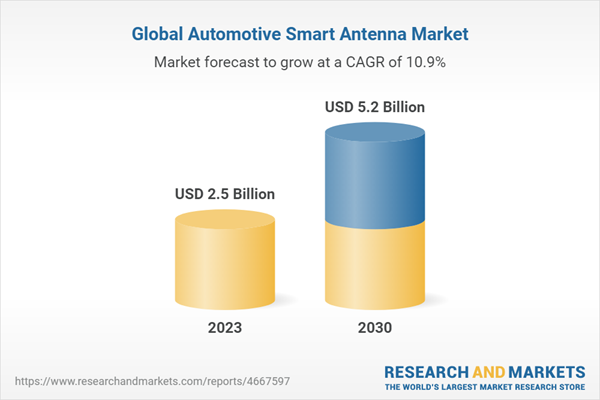

3 Executive Summary

3.1 Report Summary

Figure 9 Automotive Smart Antenna Market, by Vehicle Type, 2023 vs. 2030

4 Premium Insights

4.1 Attractive Opportunities for Players in Automotive Smart Antenna Market

Figure 10 Increase in Vehicle Production to Drive Market

4.2 Automotive Smart Antenna Market, by Frequency

Figure 11 Very High to be Largest Frequency Segment During Forecast Period

4.3 Automotive Smart Antenna Market, by Component

Figure 12 Transceiver to be Leading Component Type in 2030

4.4 Automotive Smart Antenna Market, by Type

Figure 13 Shark-Fin Antenna to Dominate Market in 2030

4.5 Automotive Smart Antenna Market, by Vehicle Type

Figure 14 Passenger Car to be Largest Vehicle Type for Automotive Smart Antenna During Forecast Period

4.6 Automotive Smart Antenna Market, by Electric Vehicle

Figure 15 BEV to Secure Leading Market Position During Forecast Period

4.7 Automotive Smart Antenna Market, by Region

Figure 16 Asia-Pacific to be Fastest-Growing Market During Forecast Period

5 Market Overview

5.1 Introduction

Figure 17 Evolution of Automotive Smart Antenna

5.2 Market Dynamics

Figure 18 Automotive Smart Antenna Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Growing Cellular Applications for Connected Vehicles

Figure 19 Average Download Speed, Country-Wise, 2022

5.2.1.2 Rising Demand for Safety Features in Vehicles

Table 3 US Department of Transportation's Fatality Analysis Reporting System (Fars)

5.2.1.3 Growing Use of Electrical/Electronic (E/E) Architecture

Figure 20 Evolution of E/E Vehicle Architecture

5.2.1.4 Increasing EV Sales

5.2.2 Restraints

5.2.2.1 Lack of Communication Infrastructure in Emerging Economies

5.2.3 Opportunities

5.2.3.1 New Revenue Opportunity in Autonomous Vehicle Ecosystem

Table 4 Autonomous Vehicle Regulations for Key Regions/Countries

Figure 21 Adas Market, by Level of Autonomy, 2022-2030 (‘000 Units)

5.2.3.2 Significant Revenue Contribution by Premium Vehicle Sales

Table 5 Premium Vehicles Sold in 2022-2023 with Their Features

5.2.3.3 Increasing In-Car Entertainment Options

Table 6 Features Offered by OEMs for In-Vehicle Infotainment Systems, 2022-2023

5.2.3.4 New Revenue Stream by Key Players Using Data Monetization

Figure 22 Average Data Generated by Connected Car Feature

5.2.4 Challenges

5.2.4.1 Increase in Cybercrimes for Vehicles Equipped with Connected Car Features

Figure 23 Most Common Attack Vectors, 2019-2020

5.2.4.2 Interference with Metal Objects Reducing Reception Frequency Quality

5.3 Trends and Disruptions Impacting Customer Business

Figure 24 Trends and Disruptions Impacting Automotive Smart Antenna Market

5.4 Supply Chain Analysis

Figure 25 Supply Chain Analysis

Table 7 Role of Companies in Supply Chain

5.5 Pricing Analysis

5.5.1 Pricing Analysis for Automotive Smart Antenna

5.5.2 Average Selling Price Trend of Automotive Smart Antenna, by Type

Table 8 Average Selling Price Trend of Automotive Smart Antenna, by Type, 2022 (USD)

5.5.3 Average Selling Price Trend of Automotive Smart Antenna, by Region

Table 9 Average Selling Price Trend of Automotive Smart Antenna, by Region, 2022 (USD)

5.5.4 Automotive Conventional vs. Smart Antenna

Table 10 Examples of Automotive Conventional and Smart Antenna

5.6 Case Study Analysis

5.6.1 Mantaray: Future of Connected Cars

5.6.2 Virtual Signal Testing for Vehicle Antennas from Altair Engineering Inc.

5.6.3 Installing Tv in Vehicles from Rt-Rk LLC

5.7 Patent Analysis

Table 11 Innovations and Patents, 2021-2023

5.8 Trade Analysis

5.8.1 Import Data

Table 12 US: Import Data, by Country (%)

Table 13 Japan: Import Data, by Country (%)

Table 14 Germany: Import Data, by Country (%)

Table 15 UK: Import Data, by Country (%)

Table 16 Mexico: Import Data, by Country (%)

Table 17 France: Import Data, by Country (%)

5.8.2 Export Data

Table 18 China: Export Data, by Country (%)

Table 19 US: Export Data, by Country (%)

Table 20 Germany: Export Data, by Country (%)

Table 21 UK: Export Data, by Country (%)

Table 22 Hong Kong: Export Data, by Country (%)

5.9 Technology Analysis

5.9.1 Multi Millimeter-Wave (Mmwave) Technology

Figure 26 Worldwide Allocation of 60 Ghz Mmwave Spectrum

5.9.2 Conformal Antenna

5.9.3 5G Integrated Antenna

Figure 27 Evolution of Internet and Its Speed

5.9.4 Evolution of Smartphone for Automotive Smart Antenna

5.9.5 In-Vehicle Experience

5.9.6 IoT Technology Used in Smart Antenna

5.9.7 V2X Technology

Figure 28 V2X Technology

5.10 Ecosystem Mapping

Figure 29 Ecosystem Mapping

5.11 Tariff and Regulatory Landscape

5.11.1 Global

Table 23 Standards for Automotive Smart Antenna, by Country

5.11.2 Europe

Table 24 Europe: Specification Standards for Automotive Antenna

5.11.3 US

Table 25 US: Specification Standards for Automotive Antenna

5.11.4 Regulatory Bodies, Government Agencies, and Other Organizations

5.11.4.1 North America

Table 26 North America: Regulatory Bodies, Government Agencies, and Other Organizations

5.11.4.2 Europe

Table 27 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

5.11.4.3 Asia-Pacific

Table 28 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

5.12 Key Stakeholders and Buying Criteria

5.12.1 Buying Criteria

Figure 30 Key Buying Criteria for Automotive Smart Antenna

Table 29 Key Buying Criteria for Automotive Smart Antenna

5.12.2 Key Stakeholders

Table 30 Influence of Stakeholders on Buying Process of Automotive Smart Antenna

5.13 Key Conferences and Events in 2024

Table 31 Key Conferences and Events, 2024

5.14 Supplier Analysis

Table 32 Smart Antenna Supplier Analysis, 2021-2023

6 Automotive Smart Antenna Market, by Component Type

6.1 Introduction

6.1.1 Primary Insights

Figure 31 Automotive Smart Antenna Market, by Component, 2023 vs. 2030 (USD Million)

Table 33 Automotive Smart Antenna Market, by Component, 2018-2022 (USD Million)

Table 34 Automotive Smart Antenna Market, by Component, 2023-2030 (USD Million)

6.2 Transceiver

6.2.1 Increasing Demand for Connected Cars to Drive Market

Table 35 Transceiver: Automotive Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 36 Transceiver: Automotive Smart Antenna Market, by Region, 2023-2030 (USD Million)

6.3 Electronic Control Unit (Ecu)

6.3.1 Smaller Size with Increased Processing Speed to Drive Market

Table 37 Ecu: Automotive Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 38 Ecu: Automotive Smart Antenna Market, by Region, 2023-2030 (USD Million)

6.4 Others

Table 39 Others: Automotive Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 40 Others: Automotive Smart Antenna Market, by Region, 2023-2030 (USD Million)

7 Automotive Smart Antenna Market, by Frequency

7.1 Introduction

Table 41 Automotive Smart Antenna: Frequency Usage Plan for Vehicle Applications

Table 42 Automotive Smart Antenna: Operational Data

7.1.1 Primary Insights

Figure 32 Automotive Smart Antenna Market, by Frequency, 2023 vs. 2030 (USD Million)

Table 43 Automotive Smart Antenna Market, by Frequency, 2018-2022 (‘000 Units)

Table 44 Automotive Smart Antenna Market, by Frequency, 2023-2030 (’000 Units)

Table 45 Automotive Smart Antenna Market, by Frequency, 2018-2022 (USD Million)

Table 46 Automotive Smart Antenna Market, by Frequency, 2023-2030 (USD Million)

7.2 High

7.2.1 Keyless Entry System with Advanced Features to Drive Market

Table 47 High Frequency: Automotive Smart Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 48 High Frequency: Automotive Smart Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 49 High Frequency: Automotive Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 50 High Frequency: Automotive Smart Antenna Market, by Region, 2023-2030 (USD Million)

7.3 Very High

7.3.1 Increase in Sales of SUV Vehicles to Drive Market

Table 51 Very High Frequency: Automotive Smart Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 52 Very High Frequency: Automotive Smart Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 53 Very High Frequency: Automotive Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 54 Very High Frequency: Automotive Smart Antenna Market, by Region, 2023-2030 (USD Million)

7.4 Ultra High

7.4.1 Increase in Sales of Luxury Vehicles to Drive Market

Table 55 Ultra High Frequency: Automotive Smart Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 56 Ultra High Frequency: Automotive Smart Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 57 Ultra High Frequency: Automotive Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 58 Ultra High Frequency: Automotive Smart Antenna Market, by Region, 2023-2030 (USD Million)

8 Automotive Smart Antenna Market, by Sales Channel

8.1 Introduction

8.1.1 Primary Insights

8.2 OEMs

8.3 Aftermarket

Table 59 Key Companies Offering Automotive Smart Antenna in Aftermarket

9 Automotive Smart Antenna Market, by Type

9.1 Introduction

9.1.1 Primary Insights

Figure 33 Automotive Smart Antenna Market, by Type, 2023 vs. 2030 (USD Million)

Table 60 Automotive Smart Antenna Market, by Type, 2018-2022 (‘000 Units)

Table 61 Automotive Smart Antenna Market, by Type, 2023-2030 (’000 Units)

Table 62 Automotive Smart Antenna Market, by Type, 2018-2022 (USD Million)

Table 63 Automotive Smart Antenna Market, by Type, 2023-2030 (USD Million)

9.2 Shark-Fin

9.2.1 Consumer Preference for Advanced Features to Drive Market

Table 64 Vehicles Offered with Shark-Fin Antennas, 2022-2024

Table 65 Shark-Fin Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 66 Shark-Fin Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 67 Shark-Fin Antenna Market, by Region, 2018-2022 (USD Million)

Table 68 Shark-Fin Antenna Market, by Region, 2023-2030 (USD Million)

9.3 Fixed Mast

9.3.1 Cost-Effectiveness and Simple Design to Drive Market

Table 69 Fixed Mast Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 70 Fixed Mast Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 71 Fixed Mast Antenna Market, by Region, 2018-2022 (USD Million)

Table 72 Fixed Mast Antenna Market, by Region, 2023-2030 (USD Million)

10 Automotive Smart Antenna Market, by Vehicle Type

10.1 Introduction

10.1.1 Primary Insights

Figure 34 Automotive Smart Antenna Market, by Vehicle Type, 2023 vs. 2030 (USD Million)

Table 73 Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 74 Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (’000 Units)

Table 75 Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 76 Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

10.2 Passenger Car (Pc)

10.2.1 Rapid Growth of Telecom Infrastructure to Drive Market

Table 77 Passenger Car Smart Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 78 Passenger Car Smart Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 79 Passenger Car Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 80 Passenger Car Smart Antenna Market, by Region, 2023-2030 (USD Million)

10.3 Light Commercial Vehicle (Lcv)

10.3.1 Advanced Telematics and Data Exchange to Drive Market

Table 81 Lcv Smart Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 82 Lcv Smart Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 83 Lcv Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 84 Lcv Smart Antenna Market, by Region, 2023-2030 (USD Million)

10.4 Heavy Commercial Vehicle (Hcv)

10.4.1 Data-Driven Logistics and Predictive Maintenance to Drive Market

Table 85 Hcv Smart Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 86 Hcv Smart Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 87 Hcv Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 88 Hcv Smart Antenna Market, by Region, 2023-2030 (USD Million)

11 Automotive Smart Antenna Market, by Electric Vehicle

11.1 Introduction

11.1.1 Primary Insights

Figure 35 Automotive Smart Antenna Market, by Electric Vehicle, 2023 vs. 2030 (USD Million)

Table 89 Automotive Smart Antenna Market, by Electric Vehicle, 2018-2022 (‘000 Units)

Table 90 Automotive Smart Antenna Market, by Electric Vehicle, 2023-2030 (’000 Units)

Table 91 Automotive Smart Antenna Market, by Electric Vehicle, 2018-2022 (USD Million)

Table 92 Automotive Smart Antenna Market, by Electric Vehicle, 2023-2030 (USD Million)

11.2 Battery Electric Vehicle (BEV)

11.2.1 Increase in Adoption of Strict Emissions Norms to Drive Market

Table 93 BEV Smart Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 94 BEV Smart Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 95 BEV Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 96 BEV Smart Antenna Market, by Region, 2023-2030 (USD Million)

11.3 Plug-In Hybrid Electric Vehicle (PHEV)

11.3.1 Greater Range Than HEVs to Drive Market

Table 97 PHEV Smart Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 98 PHEV Smart Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 99 PHEV Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 100 PHEV Smart Antenna Market, by Region, 2023-2030 (USD Million)

11.4 Fuel Cell Electric Vehicle (Fcev)

11.4.1 Stringent Emission Regulations to Drive Market

Table 101 Fcev Smart Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 102 Fcev Smart Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 103 Fcev Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 104 Fcev Smart Antenna Market, by Region, 2023-2030 (USD Million)

12 Automotive Smart Antenna Market, by Region

12.1 Introduction

12.1.1 Primary Insights

Figure 36 Automotive Smart Antenna Market, by Region, 2023 vs. 2030 (USD Million)

Table 105 Automotive Smart Antenna Market, by Region, 2018-2022 (‘000 Units)

Table 106 Automotive Smart Antenna Market, by Region, 2023-2030 (‘000 Units)

Table 107 Automotive Smart Antenna Market, by Region, 2018-2022 (USD Million)

Table 108 Automotive Smart Antenna Market, by Region, 2023-2030 (USD Million)

12.2 Asia-Pacific

12.2.1 Recession Impact

Figure 37 Asia-Pacific: Automotive Smart Antenna Market Snapshot

Figure 38 Asia-Pacific: Automotive Smart Antenna Market, by Country, 2023 vs. 2030 (USD Million)

Table 109 Asia-Pacific: Automotive Smart Antenna Market, by Country, 2018-2022 (‘000 Units)

Table 110 Asia-Pacific: Automotive Smart Antenna Market, by Country, 2023-2030 (‘000 Units)

Table 111 Asia-Pacific: Automotive Smart Antenna Market, by Country, 2018-2022 (USD Million)

Table 112 Asia-Pacific: Automotive Smart Antenna Market, by Country, 2023-2030 (USD Million)

12.2.2 China

12.2.2.1 Increasing Production of Mid-Segment and Premium Cars to Drive Market

Table 113 China: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 114 China: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 115 China: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 116 China: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.2.3 Japan

12.2.3.1 Increase in Popularity of Compact Cars to Drive Market

Table 117 Japan: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 118 Japan: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 119 Japan: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 120 Japan: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.2.4 South Korea

12.2.4.1 Growing Demand for Passenger Cars to Drive Market

Table 121 South Korea: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 122 South Korea: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 123 South Korea: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 124 South Korea: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.2.5 India

12.2.5.1 Increase in Sales of SUVs with Adas Features to Drive Market

Table 125 India: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 126 India: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 127 India: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 128 India: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.2.6 Rest of Asia-Pacific

Table 129 Rest of Asia-Pacific: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 130 Rest of Asia-Pacific: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 131 Rest of Asia-Pacific: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 132 Rest of Asia-Pacific: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.3 Europe

12.3.1 Recession Impact

Table 133 Europe: Automotive Smart Antenna Market, by Country, 2018-2022 (‘000 Units)

Table 134 Europe: Automotive Smart Antenna Market, by Country, 2023-2030 (‘000 Units)

Table 135 Europe: Automotive Smart Antenna Market, by Country, 2018-2022 (USD Million)

Table 136 Europe: Automotive Smart Antenna Market, by Country, 2023-2030 (USD Million)

12.3.2 Germany

12.3.2.1 OEMs Offering Premium Cars to Drive Market

Table 137 Germany: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 138 Germany: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 139 Germany: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 140 Germany: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.3.3 France

12.3.3.1 Rise in Focus on Road Safety to Drive Market

Table 141 France: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 142 France: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 143 France: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 144 France: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.3.4 UK

12.3.4.1 Consumer Preference for Luxury Vehicles to Drive Market

Table 145 UK: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 146 UK: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 147 UK: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 148 UK: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.3.5 Spain

12.3.5.1 Increasing Popularity of Connected Car Features to Drive Market

Table 149 Spain: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 150 Spain: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 151 Spain: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 152 Spain: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.3.6 Italy

12.3.6.1 Demand for Advanced Traffic Information Systems to Drive Market

Table 153 Italy: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 154 Italy: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 155 Italy: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 156 Italy: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.3.7 Rest of Europe

Table 157 Rest of Europe: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 158 Rest of Europe: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 159 Rest of Europe: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 160 Rest of Europe: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.4 North America

12.4.1 Recession Impact

Figure 39 North America: Automotive Smart Antenna Market Snapshot

Figure 40 North America: Automotive Smart Antenna Market, by Country, 2023 vs. 2030 (USD Million)

Table 161 North America: Automotive Smart Antenna Market, by Country, 2018-2022 (‘000 Units)

Table 162 North America: Automotive Smart Antenna Market, by Country, 2023-2030 (‘000 Units)

Table 163 North America: Automotive Smart Antenna Market, by Country, 2018-2022 (USD Million)

Table 164 North America: Automotive Smart Antenna Market, by Country, 2023-2030 (USD Million)

12.4.2 US

12.4.2.1 In-Car Infotainment Systems as Options in Low- to Mid-Segment Vehicles to Drive Market

Table 165 US: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (’000 Units)

Table 166 US: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 167 US: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 168 US: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.4.3 Canada

12.4.3.1 Government Regulations for Driver Safety to Drive Market

Table 169 Canada: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 170 Canada: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 171 Canada: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 172 Canada: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.4.4 Mexico

12.4.4.1 Increase in Demand for Trucks to Drive Market

Table 173 Mexico: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 174 Mexico: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 175 Mexico: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 176 Mexico: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.5 Rest of the World (RoW)

Figure 41 RoW: Automotive Smart Antenna Market, by Country, 2023-2030 (USD Million)

Table 177 RoW: Automotive Smart Antenna Market, by Country, 2018-2022 (‘000 Units)

Table 178 RoW: Automotive Smart Antenna Market, by Country, 2023-2030 (‘000 Units)

Table 179 RoW: Automotive Smart Antenna Market, by Country, 2018-2022 (USD Million)

Table 180 RoW: Automotive Smart Antenna Market, by Country, 2023-2030 (USD Million)

12.5.1 Brazil

12.5.1.1 Rise in Sales of Ethanol-based Vehicles to Drive Market

Table 181 Brazil: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 182 Brazil: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 183 Brazil: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 184 Brazil: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.5.2 Iran

12.5.2.1 Innovations in Smart Antenna Technology to Drive Market

Table 185 Iran: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 186 Iran: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 187 Iran: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 188 Iran: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

12.5.3 Other Countries

Table 189 Other Countries: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (‘000 Units)

Table 190 Other Countries: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (‘000 Units)

Table 191 Other Countries: Automotive Smart Antenna Market, by Vehicle Type, 2018-2022 (USD Million)

Table 192 Other Countries: Automotive Smart Antenna Market, by Vehicle Type, 2023-2030 (USD Million)

13 Competitive Landscape

13.1 Overview

13.2 Revenue Analysis of Top Listed/Public Players

Figure 42 Revenue Analysis of Top Listed/Public Players, 2020-2022

13.3 Key Players’ Strategies/Right to Win, 2021-2023

Table 193 Strategies Adopted by Key Players from 2021 to 2023

13.4 Automotive Smart Antenna Market Share Analysis, 2022

Table 194 Degree of Competition, 2022

Figure 43 Automotive Smart Antenna Market Share, 2022

13.5 Company Evaluation Matrix

13.5.1 Stars

13.5.2 Emerging Leaders

13.5.3 Pervasive Players

13.5.4 Participants

Figure 44 Automotive Smart Antenna Market: Company Evaluation Matrix, 2022

13.5.5 Company Footprint

Table 195 Automotive Smart Antenna Market: Company Product Footprint, 2022

Table 196 Automotive Smart Antenna Market: Company Vehicle Type Footprint, 2022

Table 197 Automotive Smart Antenna Market: Company Region Footprint, 2022

13.6 Competitive Scenario

13.6.1 Product Developments

Table 198 Product Developments, 2022-2023

13.6.2 Deals

Table 199 Deals, 2021-2023

14 Company Profiles

14.1 Key Players

(Business Overview, Products/Services/Solutions Offered, Analyst's View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

14.1.1 Continental AG

Table 200 Continental AG: Company Overview

Figure 45 Continental AG: Company Snapshot

Table 201 Continental AG: Products Offered

Table 202 Continental AG: Deals

14.1.2 Denso Corporation

Table 203 Denso Corporation: Company Overview

Figure 46 Denso Corporation: Company Snapshot

Table 204 Denso Corporation: Products Offered

Table 205 Denso Corporation: Product Developments

Table 206 Denso Corporation: Deals

14.1.3 Forvia

Table 207 Forvia: Company Overview

Figure 47 Forvia: Company Snapshot

Table 208 Forvia: Products Offered

Table 209 Forvia: Deals

14.1.4 Te Connectivity

Table 210 Te Connectivity: Company Overview

Figure 48 Te Connectivity: Company Snapshot

Table 211 Te Connectivity: Products Offered

Table 212 Te Connectivity: Product Developments

Table 213 Te Connectivity: Deals

14.1.5 Ficosa Internacional SA

Table 214 Ficosa Internacional SA: Company Overview

Figure 49 Ficosa Internacional SA: Company Snapshot

Figure 50 Ficosa Internacional SA: Integrated Service Capabilities Within Vehicle

Figure 51 Ficosa Internacional SA: Antenna Locations Within Vehicle

Table 215 Ficosa Internacional SA: Products Offered

14.1.6 Harada Industry Co. Ltd.

Table 216 Harada Industry Co. Ltd.: Company Overview

Figure 52 Harada Industry Co. Ltd.: Company Snapshot

Table 217 Harada Industry Co. Ltd.: Products Offered

14.1.7 Kathrein Solutions GmbH

Table 218 Kathrein Solutions GmbH: Company Overview

Table 219 Kathrein Solutions GmbH: Products Offered

14.1.8 Robert Bosch GmbH

Table 220 Robert Bosch GmbH: Company Overview

Figure 53 Robert Bosch GmbH: Company Snapshot

Table 221 Robert Bosch GmbH: Products Offered

Table 222 Robert Bosch GmbH: Deals

14.1.9 Laird Connectivity

Table 223 Laird Connectivity: Company Overview

Table 224 Laird Connectivity: Products Offered

14.1.10 Yokowo Co. Ltd.

Table 225 Yokowo Co. Ltd.: Company Overview

Figure 54 Yokowo Co. Ltd.: Company Snapshot

Table 226 Yokowo Co. Ltd.: Products Offered

*Business Overview, Products/Services/Solutions Offered, Analyst's View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments Might Not be Captured in Case of Unlisted Companies

14.2 Other Players

14.2.1 Schaffner Holding AG

Table 227 Schaffner Holding AG: Company Overview

14.2.2 Hirschmann Car Communication GmbH

Table 228 Hirschmann Car Communication GmbH: Company Overview

14.2.3 Harman International

Table 229 Harman International: Company Overview

14.2.4 Taoglas Ltd.

Table 230 Taoglas Ltd.: Company Overview

14.2.5 Airgain

Table 231 Airgain: Company Overview

14.2.6 Inpaq Technology Co. Ltd.

Table 232 Inpaq Technology Co. Ltd.: Company Overview

14.2.7 Anokiwave, Inc.

Table 233 Anokiwave, Inc.: Company Overview

14.2.8 Calearo Antenne Spa

Table 234 Calearo Antenne Spa: Company Overview

14.2.9 Antenova Ltd.

Table 235 Antenova Ltd.: Company Overview

14.2.10 Yageo Group

Table 236 Yageo Group: Company Overview

15 Recommendations

15.1 Asia-Pacific to Dominate Automotive Smart Antenna Market

15.2 Conformal Antennas for Future Applications: Key Focus Area

15.3 V2X for Future Applications: Key Focus Area

15.4 Conclusion

16 Appendix

16.1 Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledgestore: The Subscription Portal

16.4 Customization Options

16.4.1 Automotive Smart Antenna Market, by Frequency and Country

16.4.1.1 Asia-Pacific

16.4.1.1.1 China

16.4.1.1.2 India

16.4.1.1.3 Japan

16.4.1.1.4 South Korea

16.4.1.1.5 Rest of Asia-Pacific

16.4.1.2 Europe

16.4.1.2.1 Germany

16.4.1.2.2 France

16.4.1.2.3 UK

16.4.1.2.4 Spain

16.4.1.2.5 Italy

16.4.1.2.6 Rest of Europe

16.4.1.3 North America

16.4.1.3.1 US

16.4.1.3.2 Canada

16.4.1.3.3 Mexico

16.4.1.4 RoW

16.4.1.4.1 Brazil

16.4.1.4.2 Iran

16.4.1.4.3 Others

16.4.2 Automotive Smart Antenna Market, by Type and Country

16.4.2.1 Asia-Pacific

16.4.2.1.1 China

16.4.2.1.2 India

16.4.2.1.3 Japan

16.4.2.1.4 South Korea

16.4.2.1.5 Rest of Asia-Pacific

16.4.2.2 Europe

16.4.2.2.1 Germany

16.4.2.2.2 France

16.4.2.2.3 UK

16.4.2.2.4 Spain

16.4.2.2.5 Italy

16.4.2.2.6 Rest of Europe

16.4.2.3 North America

16.4.2.3.1 US

16.4.2.3.2 Canada

16.4.2.3.3 Mexico

16.4.2.4 RoW

16.4.2.4.1 Brazil

16.4.2.4.2 Iran

16.4.2.4.3 Others

16.4.3 Detailed Analysis and Profiling of Additional Market Players (Up to 3)