Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Environmental sustainability is becoming a crucial consideration, prompting interest in low-emission and energy-efficient tractors. Manufacturers are introducing models with improved fuel efficiency and exploring hybrid and electric variants to align with environmental standards. Government support through grants and rebates is also encouraging investments in new machinery. These incentives are enabling small and mid-size farmers to access modern tractors and boost overall mechanization across farming sectors including dairy, grain, and horticulture.

The market faces certain limitations such as rising input costs, unpredictable commodity prices, and weather-related risks that affect purchasing power. Supply chain disruptions, particularly in the availability of parts and skilled service technicians, pose operational challenges. As reported by the Tractor and Machinery Association of Australia (TMA), tractor sales in Australia reached 13,800 units in 2023, showing a 5% decline from 2022 due to high inventory saturation and global supply chain normalization.

Despite these hurdles, the sector is expected to benefit from technological upgrades, evolving business models such as equipment leasing, and growing interest in autonomous machinery. These developments are helping to maintain momentum in the Australian tractor market and set the stage for gradual growth from 2026 to 2030.

Market Drivers

Rising Agricultural Mechanization

As manual labor becomes scarce and expensive, the reliance on mechanized farming has increased significantly in Australia. Farmers are turning to tractors to perform a wide range of agricultural tasks from tilling and plowing to seeding and harvesting with greater efficiency. Mechanization improves productivity per acre and enables timely field operations, which is critical in a country where weather patterns are unpredictable and labor shortages are common.The need to cover large farming areas quickly and cost-effectively makes tractors indispensable. Small and medium-sized farms are also beginning to invest in compact and mid-range tractors to replace animal-driven or outdated manual methods. Mechanization not only reduces labor dependency but also enhances output quality, supporting the broader goals of food security and sustainable production. This driver is pushing steady demand for technologically equipped and versatile tractors across all scales of farming.

Key Market Challenges

High Initial Investment Costs

The upfront cost of purchasing a tractor remains a major barrier, particularly for small and medium-sized farmers. Even basic models involve significant capital expenditure, which can be prohibitive without external financing or government subsidies. Tractors equipped with modern technologies such as GPS, telematics, or autonomous functionality are priced even higher, placing them out of reach for many.Limited access to affordable credit further compounds the issue, especially in rural or remote regions. Despite long-term savings from efficiency and fuel economy, the initial price point dissuades many farmers from upgrading older equipment. Unfavorable commodity price cycles or unpredictable weather patterns can also lead farmers to delay capital purchases. These cost pressures restrict market penetration and slow the pace of technological adoption. Addressing this challenge will require broader financial solutions, flexible payment plans, or leasing models to improve affordability and drive faster market expansion.

Key Market Trends

Integration of Precision Farming Technologies

Farmers across Australia are increasingly integrating precision agriculture tools into their tractor operations to improve yield, efficiency, and cost management. Tractors equipped with GPS guidance, variable rate technology, and auto-steering systems help optimize fieldwork, minimize input waste, and reduce fuel consumption. The growing availability of data analytics platforms enables farmers to monitor soil conditions, planting patterns, and machinery performance in real-time.This shift is supported by the demand for more data-driven decision-making in agriculture, especially in managing large tracts of land. As farming operations scale up, precision farming tools enhance consistency and reduce labor dependence. Manufacturers are embedding sensors and connectivity features directly into tractors, making them more intelligent and responsive. This trend is reshaping how equipment is used, encouraging a shift from traditional mechanical use toward connected, smart farming solutions that enhance productivity and sustainability.

Key Market Players

- AGCO Corporation (Massey Ferguson and Fendt)

- CLAAS KGaA mbH

- CNH Industrial (Case IH and New Holland)

- Deutz-Fahr

- Iseki & Co., Ltd.

- John Deere

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- SAME (SAME Deutz-Fahr Group)

- TAFE - Tractors and Farm Equipment Limited

Report Scope:

In this report, the Australia Tractor Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Australia Tractor Market, By Engine Power:

- Less than 30 HP

- 31-50 HP

- 51-80 HP

- Above 80 HP

Australia Tractor Market, By Application:

- Row Crop Tractors

- Orchard Tractors

- Others

Australia Tractor Market, By Drive:

- Two-Wheel Drive

- Four-Wheel Drive

Australia Tractor Market, By Region:

- New South Wales

- Victoria & Tasmania

- Queensland

- Western Australia

- Northern Territory & Southern Australia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Australia Tractor Market.Available Customizations:

Australia Tractor Market report with the given market data, TechSci Research, offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- AGCO Corporation (Massey Ferguson and Fendt)

- CLAAS KGaA mbH

- CNH Industrial (Case IH and New Holland)

- Deutz-Fahr

- Iseki & Co., Ltd.

- John Deere

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- SAME (SAME Deutz-Fahr Group)

- TAFE – Tractors and Farm Equipment Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | August 2025 |

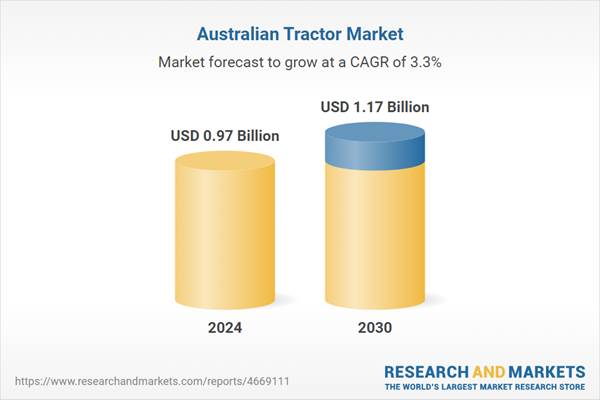

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.97 Billion |

| Forecasted Market Value ( USD | $ 1.17 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 10 |