Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

These advanced composites play a crucial role in the manufacturing of high-performance supercars and aircraft parts, such as engine nacelles, wings, elaborators, floor beams, ailerons, rudders, landing gear doors, and various other components. Their exceptional strength combined with reduced weight significantly enhances operational efficiency. By employing advanced manufacturing processes, multiple components are blended to create advanced composite materials (ACM) that possess high specific strength and stiffness. Compared to the traditional composite materials commonly used in reinforced concrete, structures made from advanced composites are lightweight and exhibit exceptional strength.

The Advanced Composites Market is expected to experience substantial growth due to increasing demand in the automotive and aerospace industries. These industries value advanced composites for their outstanding technical properties, including high strength, stiffness, fatigue resistance, and abrasion resistance. The adoption of advanced composites is driven by the need for high-performance components in supercars and aircraft, as they provide excellent strength while reducing overall weight. The rapid pace of urbanization and improved lifestyle will contribute to an increase in the number of airline passengers, accompanied by reduced airfare prices. For instance, it is projected that global air traffic will grow by over 5% by 2025.

In 2022, global aircraft deliveries reached 1,239 units, marking a 19.1% increase from 2021. Most of these deliveries, along with new orders for 2023, consist of next-generation narrow-body jets primarily destined for airlines in Asia Pacific, Europe, and North America, the top three passenger markets. However, aircraft manufacturers have noted ongoing supply chain disruptions, which are expected to delay production and future deliveries.dditionally, the automotive industry will play a significant role in the growth of the Advanced Composites Market, especially in countries like China, Japan, and the United States. Automobile manufacturers are increasingly incorporating polymer composites into their vehicles as part of their initiatives to enhance performance and efficiency.

The utilization of advanced composites presents a promising future in various industries, driven by their exceptional properties and the continuous efforts of manufacturers to innovate and improve their products.

Key Market Drivers

Growing Demand of Advanced Composites in Transportation Industry

Advanced composites, often referred to as high-performance composites, are engineered materials made by combining high-strength fibers such as carbon or glass with polymer resins. These materials exhibit exceptional mechanical properties, including a superior strength-to-weight ratio, excellent corrosion resistance, and enhanced durability. These characteristics make advanced composites highly suitable for a wide range of applications across the transportation sector.In recent years, the transportation industry has increasingly adopted advanced composites to meet the growing demand for lighter, more fuel-efficient, and environmentally sustainable vehicles. By integrating these materials into vehicle structures - such as frames, body panels, interiors, and propulsion systems - manufacturers can significantly reduce overall weight, resulting in improved fuel economy and lower emissions. Unlike conventional materials like steel or aluminum, advanced composites offer better resistance to wear and corrosion, reducing maintenance requirements and extending the operational life of vehicles, which ultimately leads to long-term cost savings.

Beyond automotive applications, the use of advanced composites is expanding into aerospace, marine, and rail industries. Their lightweight and high-performance characteristics are particularly beneficial in sectors where weight reduction directly contributes to energy efficiency and payload optimization. As a result, demand for advanced composites continues to grow globally. In response to this trend, manufacturers are heavily investing in research and development to produce new composite formulations that cater to specific industry needs. These efforts are focused not only on performance but also on improving manufacturing efficiency and cost-effectiveness.

The broader shift toward sustainable transportation solutions has further accelerated the adoption of advanced composites. As environmental regulations tighten and industries pursue net-zero goals, these materials are seen as a key enabler of cleaner, more efficient mobility systems. The global demand for transport is expected to grow significantly over the next three decades, with passenger transport set to nearly triple by 2050, increasing from 44 trillion to 122 trillion passenger-kilometres.

Freight demand is also projected to experience similar growth. This surge in demand presents opportunities for advanced composites, which are increasingly being used to address the industry's need for lighter, more fuel-efficient vehicles. Advanced composites offer exceptional strength, durability, and corrosion resistance, making them ideal for the transportation sector. As manufacturers continue to prioritize sustainability and fuel efficiency, advanced composites will play a critical role in the development of next-generation transportation solutions, driving growth in aerospace, automotive, and rail industries.

Advanced composites represent a transformative opportunity for the transportation industry. Their continued evolution is expected to play a central role in shaping the future of mobility across multiple modes of transport.

Key Market Challenges

Volatility in Price of Raw Materials

Advanced composites, also known as composite materials, are a class of high-performance materials that are created by combining strong fibers, such as carbon fibers, with polymer resins. These materials possess exceptional mechanical properties, including a high strength-to-weight ratio and resistance to corrosion. As a result, they are increasingly being utilized across a wide range of industries and applications, including aerospace, automotive, and construction. The production process of advanced composites relies on several key raw materials, such as carbon fibers, epoxy resins, and thermoplastic polymers. These raw materials play a crucial role in determining the quality and performance of the final composite product. However, the prices of these raw materials can be subject to significant fluctuations due to various factors, including changes in supply and demand dynamics, geopolitical tensions, natural disasters, and regulatory policies.The price volatility of these raw materials presents a significant challenge for manufacturers operating in the advanced composites market. To ensure smooth operations and maintain profitability, manufacturers often need to carefully plan their production schedules and budgets well in advance. However, sudden, and unpredictable changes in raw material prices can disrupt these plans, leading to increased production costs and reduced profit margins. This inherent uncertainty regarding raw material prices can complicate the pricing strategies of manufacturers. While they strive to remain competitive in the market, they must also ensure that their products are priced adequately to cover costs and maintain profitability. Failure to strike this delicate balance can potentially impact their market share and overall competitiveness.

Given these challenges, manufacturers in the advanced composites industry must closely monitor the market dynamics, establish strong supplier relationships, and implement effective risk management strategies to mitigate the impact of price volatility. By doing so, they can navigate these complexities and maintain their position in a highly competitive market landscape.

Key Market Trends

Advancements in Manufacturing Technologies

As the demand for advanced composites continues to grow, there is an increasing need for efficient, scalable, and cost-effective manufacturing technologies that can meet these demands. In recent years, significant advancements have been made in this area, with the development of new techniques and processes aimed at improving the production of advanced composites. One notable advancement in this field is the use of automated fiber placement (AFP) and automated tape laying (ATL) technologies. These cutting-edge methods allow for the precise placement of composite materials, resulting in improved product quality and reduced waste. By precisely controlling the arrangement of fibers, manufacturers can enhance the strength and durability of composite structures, making them ideal for a wide range of applications.Another emerging trend in the advanced composites sector is additive manufacturing, commonly known as 3D printing. This innovative technology enables the creation of complex, custom-designed composite parts with minimal waste. By building up the material layer by layer, manufacturers can achieve intricate geometries and optimize the use of materials, leading to greater design flexibility and reduced production costs.

This opens up new possibilities for the use of advanced composites in industries such as aerospace, automotive, and healthcare. Advancements in curing technologies, such as out-of-autoclave (OOA) curing and microwave curing, are revolutionizing the efficiency and quality of composite production. OOA curing eliminates the need for expensive autoclave equipment, reducing manufacturing costs and increasing production capacity. Microwave curing, on the other hand, offers faster curing times and improved material properties, enhancing the overall performance of composite products.

These remarkable advancements in manufacturing technologies are not only transforming the advanced composites market but also driving innovation within the sector. As manufacturers continue to adopt and refine these technologies, we can expect to witness the emergence of new composite materials and applications. This will further expand the possibilities for utilizing advanced composites in diverse industries, unlocking new levels of performance, sustainability, and cost-effectiveness.The continuous development and integration of advanced manufacturing technologies are propelling the advanced composites industry to new heights. These advancements are enabling manufacturers to produce higher-quality products more efficiently and at a lower cost, democratizing the use of advanced composites across various sectors. As technology continues to evolve, we can anticipate even more groundbreaking discoveries and applications in the field of advanced composites.

Key Market Players

- Toray Industries, Inc.

- Koninklijke Ten Cate NV

- Teijin Limited

- Hexcel Corporation

- SGL Carbon Corp

- Cytec Industries Inc

- Owens Corning

- E. I. Dupont De Nemours and Company

- Huntsman Corporation

- Momentive Performance Materials Inc.

Report Scope:

In this report, the Global Advanced Composites Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Advanced Composites Market, By Fiber Type:

- S-Glass Composite

- Aramid Fiber Composite

- Carbon Fiber Composite

- Others

Advanced Composites Market, By Manufacturing Process:

- Hand Lay Process

- Injection Molding

- Compression Molding

- Pultrusion

- Others

Advanced Composites Market, By End User:

- Transportation

- Aerospace

- Electricals & Electronics

- Others

Advanced Composites Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Advanced Composites Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Toray Industries, Inc.

- Koninklijke Ten Cate NV

- Teijin Limited

- Hexcel Corporation

- SGL Carbon Corp

- Cytec Industries Inc

- Owens Corning

- E. I. Dupont De Nemours and Company

- Huntsman Corporation

- Momentive Performance Materials Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2025 |

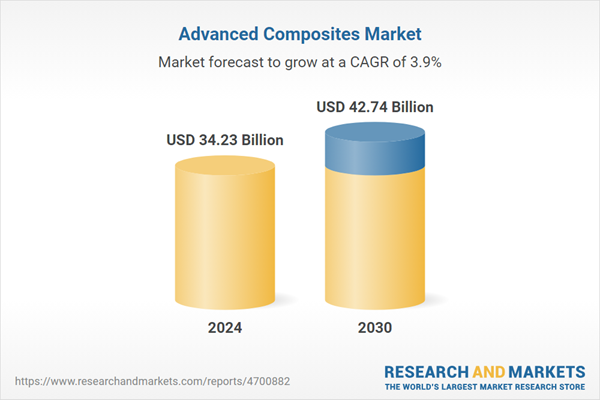

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.23 Billion |

| Forecasted Market Value ( USD | $ 42.74 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |