Continued Innovation in Women’s Contraceptive Health

With the increasing demand, awareness, and preference for reliable alternatives, companies are looking forward to offering safe, effective, and long-term contraceptive options to meet the evolving needs of women worldwide, leading to notable advancements and product launches.EnilloRing: Expanding Contraceptive Choices

In October 2023, Xiromed LLC introduced EnilloRing (etonogestrel/ethinyl estradiol vaginal ring), a generic alternative to NuvaRing. This product offers long-lasting contraceptive protection and marks an important expansion of Xiromed’s extensive range of women's health medications, which also feature oral contraceptives and transdermal gels.Rob Spina, CEO of Xiromed, highlighted the impact of this launch:

Manufactured at Laboratorios Leon Pharma SAU in Leon, Spain, EnilloRing underscores Xiromed’s dedication to leveraging cutting-edge technologies as part of Insud Pharma’s commitment to advancing women’s health solutions.U.S. Contraceptive Market Report Segmentation

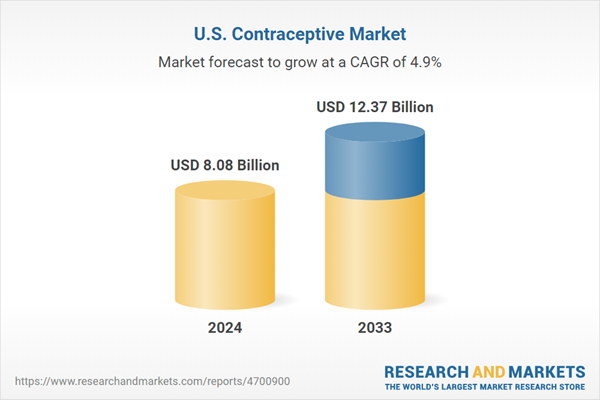

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, the analyst has segmented the U.S. contraceptive market report based on product.Product Outlook (Revenue, USD Billion, 2021-2033)

- Pills

- Intrauterine Devices (IUD)

- Condoms

- Vaginal Ring

- Subdermal Implants

- Injectable

- Others

Why You Should Buy This Report

- Comprehensive Market Analysis: Gain detailed insights into the market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

Report Deliverables

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this U.S. Contraceptive market report include:- Church & Dwight Co., Inc.

- Reckitt Benckiser Group Plc

- Organon Group of Companies

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- The Cooper Companies, Inc.

- Mayer Laboratories Inc

- Agile Therapeutics

- Mayne Pharma Group Limited.

- Bayer AG

- Afaxys, Inc.

- AbbVie

- Gedeon Richter

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | October 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 8.08 Billion |

| Forecasted Market Value ( USD | $ 12.37 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | United States |

| No. of Companies Mentioned | 14 |