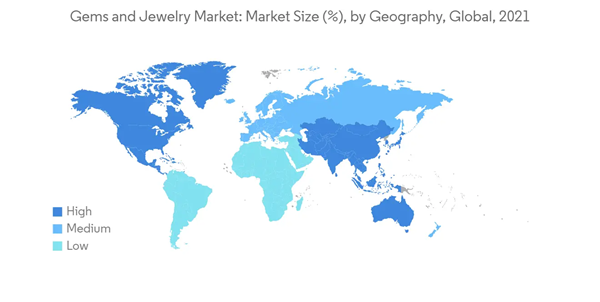

A soaring middle-income level of consumers within developing countries as well as the rising purchasing power of these consumers, alongside a growing fashion trend around the globe, have been significant contributors to the increase in demand for gems and jewelry around the world. In the same way that the gold industry anticipates high demand for gold, the diamond industry expects high demand for diamonds as well. This is primarily due to the growing middle class that is emerging in the country. As a result, major players are investing and expanding their retail outlets across the globe. As emerging markets like India, China, Brazil, and other developing markets are showing encouraging prospects, international players are beginning to move into the region in order to tap into the rising market demand in these countries.

Additionally, the increase in cross-cultural designs is one of the latest trends gaining popularity in the gem and jewelry market. The demand for jewelry inspired by Italian, European, and Egyptian cultures is expected to drive the market studied over the forecast period. The rise in urbanization has resulted in changing consumer behavior related to accessories, switching from wearing more pieces of jewelry to keeping it minimal and sophisticated while maintaining the style statement. Such evolving factors have led to a substantial demand for single-stone stud earrings, pendants, and rings.

Gems & Jewelry Market Trends

Rising Demand for Gems & Jewellery Owing to the Emerging Middle Class

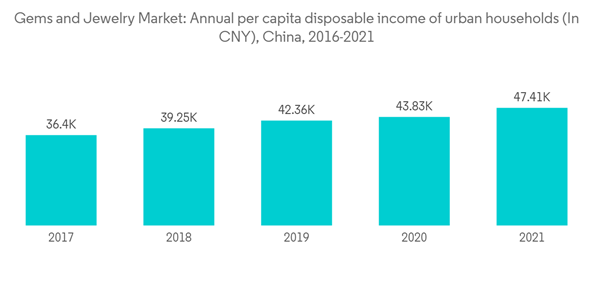

With the steady growth of the global economy and the increase in disposable income and spending power of the population, the demand for luxury goods such as gems and jewelry is increasing dramatically, which is a major factor contributing to the growth of the global economy. As well as that, different cultures around the world follow different customs regarding the adoption of ornaments. Accordingly, the emergence of new gift exchange practices during festivals and the shift in consumer preferences towards celebration gifts and gifts for their friends and families are also driving the growth of the gem and jewelry market in the five years to come. During the next five years, the gems and jewelry market is expected to steadily expand as a result of the increasing demand for branded jewelry products among the middle-class group of consumers and the assurance of the authenticity and purity of luxury metals and gems in jewelry.In middle-class and upper-middle-class families, luxury materials such as gold and silver are viewed as symbols of wealth and prestige. Modern jewelry designs and materials such as platinum, white gold, rose gold, etc. are among the things that are used in jewelry making today. As a result, they are quickly becoming accepted in the market, mostly by working women looking for lighter, more comfortable jewelry. According to the Gems Jewellery Export Promotion Council, India's export of modern materials jewelry has increased dramatically. The export of polished lab-grown diamonds grew by 211%, platinum jewelry grew by 180%, silver jewelry grew by 61%, and studded gold jewelry grew by 60% in 2021 over 2020.

Asia-Pacific is the Largest Market

In Asia-Pacific, the gems and jewelry market is witnessing changes in consumer preferences due to the adoption of the Western lifestyle. Consumers are demanding new designs and varieties in jewelry, and branded jewelers are able to fulfill their changing demands better than the local, unorganized players. Moreover, an increase in per capita income has led to an increase in sales of jewelry in countries like India, where jewelry is considered a status symbol. Luxury jewelry, especially gold jewelry, is witnessing an increase in demand in the country. The strong performance of the real jewelry segment is expected to drive the Asian jewelry market.Manufacturers of gems and jewelry in the region are more focused on developing new and innovative designs to fulfill the changing needs and demands of consumers by using advanced technologies, such as computer-aided design (CAD) and rapid prototyping (RP), that play a vital role in incorporating 3D printing in jewelry. Additionally, gems & jewelry manufacturers are developing and updating their e-commerce platforms with the aim of increasing sales of gems & jewelry to consumers via e-commerce platforms in order to increase their profits. For instance, in December 2022, in an effort to elevate jewelry shopping experiences, Perfect Corp., a Taiwan-based company, developed high-precision real-time live AR and AI-powered virtual try-on technology that allows customers to experience 3D necklaces in real time.

Gems & Jewelry Market Competitor Analysis

The gems and jewelry market is highly competitive with the presence of key players such as LVMH, Buccellati, Pandora Jewelry LLC, Chow Tai Fook Jewelry Company Limited, the Swatch Group AG, Tata Sons Private Ltd., De Beers Jewellers US Inc., Signet Jewelers, Richemont, and Swarovski Crystal Online AG. Key players are focusing on online distribution channels for the online marketing and branding of their products to expand their geographical reach and increase their customer base. Leading manufacturers in the gems and jewelry market are focusing on leveraging the opportunities posed by the emerging markets of Asia-Pacific, like China and India, to expand their revenue base because of the rising income levels and their religious traditions, as they consider giving jewelry ornaments as auspicious. The key brands are embarking on innovation and new product developments infused with the latest technology to provide a luxury feel and perfect craftsmanship to their product offerings.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- LVMH Group

- PANDORA JEWELRY LLC

- Richemont SA

- The Swatch Group AG

- Chow Tai Fook Jewelry Company Limited

- Tata Sons Private Ltd

- De Beers Jewellers US Inc.

- Swarovski Crystal Online AG

- Signet Jewelers

- Chow Tai Fook Jewellery Company Limited