Hockey is an outdoor sport that is played by many countries. Rising interest and participation rates in outdoor sports like field hockey, increasing government initiatives to encourage participation in field hockey, and increasing televised coverage of international hockey events are some of the key factors driving the market growth. Moreover, children are taking more interest in field hockey as they are following the sports players. According to Sports England data from 2021, 3.4% of children participated in hockey in 2021. Increasing government measures to encourage participation in field hockey and expanded broadcast coverage of international hockey games are driving the field hockey equipment market growth globally.

The growing adoption of online shopping by consumers and the rising number of grassroots programs in schools, colleges, and clubs are major factors driving the sales of field hockey equipment globally. Women are also becoming more active in field hockey sports. The governments of various countries are arranging sports competitions and events for women's and men's hockey. For instance, FIH Hockey Women's Nation's Cup was set in December 2022 in Spain. Other countries like India, Korea, Japan, Ireland, and Italy also participated in the event. The easy availability of counterfeit products is restraining the growth of the field hockey equipment market. Over the medium term, the growing interest of people in this sport and innovations in products is expected to drive the market.

Field Hockey Equipment Market Trends

Rising Interest and Participation Rate in Field Hockey

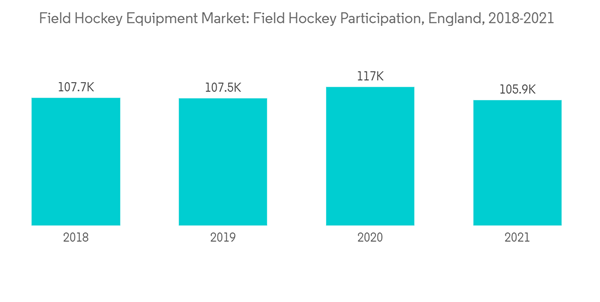

Several sports, like cricket and football, across the United Kingdom increased people’s interest. However, Hockey has recently gained popularity due to rising interest in the sport as it attracted people’s attention. England Hockey conducted workshops and trained over 100 coaches to deliver sessions to players during the year. In August 2021, Great Britain women's hockey team won the bronze medal in Tokyo Olympics. The interest in hockey is evident, and England Hockey is working hard to increase the sport's profile. Due to increasing interest and the support of government initiatives, the popularity of field hockey sport will increase further during the forecast period. For instance, in August 2022, the Canadian government is dedicated to fostering stronger, healthier communities across the country. To support community-based organized sports, the Parliamentary Secretary to the Ministers of Health and Sport stated that Field Hockey Canada, as a national-level organization, will receive USD 56,323.4 from the Community Sport for All Initiative in 2022-23. Field Hockey Canada will start an open registration process for its "Stick Together" project in the fall. Community organizations across Canada can apply for funding to provide field hockey to those who would otherwise be unable to participate.Additionally, field hockey is one of the most physically demanding sports thanks to the stance and strength required of hockey players. This has become a key driving factor for the Field Hockey Equipment Market. Several new players are getting interested in the sport due to its utility as an exercise.

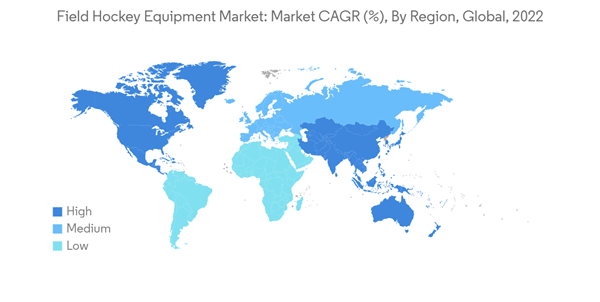

Asia-Pacific Registers the Highest Growth Rate

Asia-Pacific is the fastest-growing region in the overall field hockey equipment market. China, Australia, India, Pakistan, and South Korea are the top contributing countries in the region. These countries started hosting many international-level field hockey tournaments, thus boosting the popularity of and demand for field hockey equipment. For instance, according to the Asian Hockey Federation, the Women's Asia Cup was held from January 21 to 28, 2022, at the Sultan Qaboos Complex in Muscat, Oman. India hosted the Hockey Men's Junior World Cup tournament in December 2021. Bangladesh hosted the Hero Asian Champions Trophy in December 2021.In addition, there is a rise in the women’s participation rate and government initiatives, which boost the demand for field hockey equipment in the region. For instance, in December 2021, Bajaj Allianz General Insurance announced the launch of the Care4Hockey campaign with Rani Rampal, Indian Women's Hockey Captain, to promote field hockey recognition in India. Additionally, in March 2021, the Indian hockey team received a significant boost due to the Indian government's Target Olympic Podium Scheme, which would provide a monthly stipend of INR 50,000 (USD 671.24) to the core group players of both the men's and women's teams.

Field Hockey Equipment Industry Overview

The Field Hockey Equipment Market is highly fragmented and comprises many local and international competitors. There is intense competition between the key vendors, leading to the introduction of newer field hockey equipment. Notably, the top market players were engaged in expansions, product innovations, mergers and acquisitions, and partnerships. Moreover, players are consistently advancing their technologies to deliver equipment that provides a high-end experience to consumers.To provide innovative and advanced equipment to customers, companies are heavily investing in R&D activities. Major key players are Adidas AG, Gryphon Hockey, Grays of Cambridge (International) Ltd, Wm T. Burnett & Co. Inc. (STX), and Dita Hockey. Players are focusing on social media platforms and online distribution channels for online marketing and branding of their products to attract more customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adidas AG

- Grays of Cambridge (International) Ltd

- Gryphon Hockey Ltd

- Osaka World

- Mazon Hockey

- OBO

- Ritual Hockey

- Princess Sportsgear

- Atlas Hockey

- Brabo Hockey

- Dita Hockey

- STX